Publication date

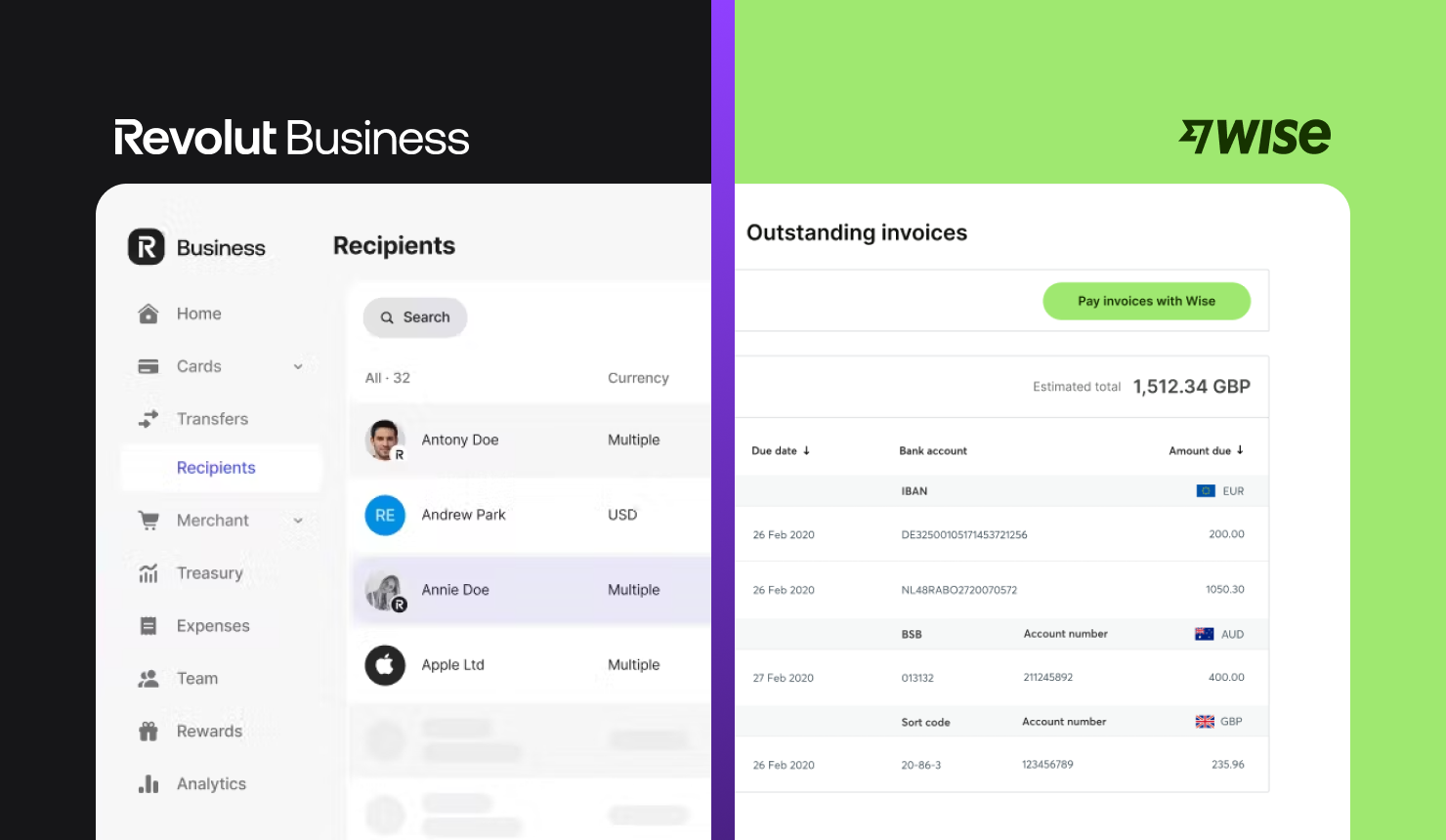

Chances are you've heard of Wise and Revolut and are considering at least one of these two solutions to manage your international payment needs.

But here's the thing: While there are a lot of similarities between these cross-border payment providers, they take quite different approaches to the tools they provide — and those differences could be a big deal depending on the size of your business.

And just because they're two of the more well-known brands, doesn't mean they're the best fit for your business and volume of international transactions.

So, let’s break down how Wise and Revolut stack up for growing businesses, explore when each provider might be best for your needs and shed some light on when you should consider an alternative to Wise and Revolut.

What you get with Wise

Starting out as TransferWise in 2011, Wise is a fintech company that specialises in international money transfers and multi-currency accounts.

Wise keeps things pretty simple — it’s all about helping individuals, freelancers, digital nomads and smaller businesses move money internationally without the usual headaches that come with traditional banks.

Opening a multi-currency business account with Wise lets you hold and send funds in 40+ currencies with no monthly subscription fees. You get local bank details in 9 of those currencies (including EUR, USD and GBP) and can use SWIFT account details for the rest.

Wise also offers business cards that work internationally by linking directly to the account balance in your chosen currency. It converts at the mid-market rate when you spend in different currencies, with transparent fees for each conversion.

What you get with Revolut

Founded in 2016, UK-based Revolut lets you hold funds in 25+ currencies, but you'll only get local bank details for EUR, USD and GBP. For all other currencies, you'll use SWIFT account details.

Revolut takes a broader approach to the tools on offer. Instead of focusing solely on local and cross-border payments, it aims to build a complete financial services solution. You can access FX management tools in the form of fixed and flexible forward payment contracts and make use of Revolut’s advanced expense management tools, payment gateways and HR and e-commerce integrations.

Revolut also provides virtual and physical cards for your team with expense categorisation, spending controls, and real-time notifications for all transactions.

Wise vs Revolut pricing and fee structures

Wise and Revolut structure their fees quite differently. Let's break down how they both approach pricing.

Wise Pricing

As you might expect, Wise’s pricing is fairly straightforward. There’s an initial opening fee of €50. Wise uses the mid-market exchange rate but adds a fee as a variable percentage (starting from 0.33%). For international payments, you'll pay a transfer fee — usually between 0.33% and 1%, depending on the currency pair. After that, there are no hidden costs or monthly account fees to worry about.

Revolut Pricing

Unlike Wise, there's no setup fee to open a Revolut business account. Instead, Revolut offers different tiered plans for business account clients, each with its own monthly fee, limits and features.

Here's how it works:

- Basic: €10 per month, limited features

- Grow: From €30 per month, exchange up to €15,000 monthly at the interbank rate

- Scale: From €90 per month, exchange up to €60,000 monthly at the interbank rate

- Enterprise: Custom pricing with specialised account management

Each plan comes with a monthly allowance for currency exchanges at the interbank rate. Once you hit your limit — or if you decide to make a transfer during weekends or outside market hours — the extra fees kick in (typically 0.6% to 1%).

Revolut plans also come with a fixed amount of no-fee payments. For example, the “Grow" plan comes with just five no-fee international payments per month. Beyond those limits, you'll need to pay an additional transfer fee.

There are specific features only available with certain plans. For example, bulk payments only kick in from “Grow” while things like specialised account management are only available on the "Enterprise" plan.

Who Wise and Revolut are best for

Both Wise and Revolut suit different types of businesses, and knowing which provider fits your needs can save you a lot of headaches down the road. Here's when Wise or Revolut may be the best provider for managing your cross-border business payments.

Wise: For businesses just getting started on the international stage

Wise works best for freelancers, solopreneurs and smaller businesses who are just getting started with international payments. If you're beginning to grow beyond borders and need something simple to handle occasional international payments, Wise fits the bill. It’s especially good for:

- Freelancers with some international clients

- Small businesses just starting to work with overseas partners and suppliers

- Business owners that want a simple, no-frills solution without any monthly fees

- Companies that don’t yet require currency risk management features

Revolut: Built for everyone (with some tradeoffs)

Revolut casts a wider net. It's trying to be everything to everyone — from the solo freelancer to growing SMBs and even enterprise businesses. This broader focus has its pros and cons.

On the plus side, Revolut does offer more advanced features than Wise. You'll get tools for team spending, expense management, and can use fixed and flexible forward payment contracts to manage currency risk.

But here's where it gets tricky:

- The more features you need, the higher your monthly fees climb

- Their tiered approach means some features might be more than you need, while other plans may feel overly simplified

- FX risk management features can be complex, but Revolut’s more personalised support only comes at the “Enterprise” tier

When Wise and Revolut might not be your best bet

Beyond the basics like which has the best pricing or most currencies or features, choosing a provider is about finding the best fit for where your business is today and where it's heading tomorrow. So, let's talk about the types of scenarios where you might need something more robust than what Wise and Revolut offer.

You're a growing international SMB

If your payment volumes are climbing and your annual turnover is growing, business is good! But at this scale, you need more than just simple international payment features with fee structures built to serve smaller transaction volumes. You're looking for:

- Exchange rates and fee structures designed for higher transfer volumes

- Tools that can help you protect your business against currency volatility

- Real, human support from people who understand your business

These are the areas where both Wise and Revolut start showing their limitations. Their fee structures aren't built for your business type or this volume of transactions, and you'll likely find yourself hitting plan limits or paying premium fees more often than you'd like. A 0.6% fee doesn't sound massive on its own. But on a €250,000 payment, that’s €1,500 in fees alone!

You're running import-export operations across Europe

If your business imports or exports goods, you've likely got funds coming and going in multiple currencies. You make regular cross-border payments to multiple suppliers and receive payments from international customers. Currency risks can impact your earnings and tracking payments can be a real headache.

You can hold, convert and send money internationally with Wise and Revolut, but tracking those transfers isn't as detailed as you might hope. You want to know where your money is, how many intermediary banks it’s going through, and when it will arrive. And you want your suppliers to have the same information as you without having to chase for it. Access to more advanced tools helps you manage currency fluctuations the smart way, protecting your margins by fixing exchange rates.

You handle wholesale payments in multiple currencies

For international wholesalers handling significant volumes of goods and money, managing FX risk is more than just a nice-to-have — it's a core part of your business strategy.

You need competitive exchange rates and fees geared toward high-volume payments that don't eat into your margins. You also need to know where your payments are thanks to real-time tracking that keeps you and your beneficiaries in the loop.

Wise's simple currency exchange and cross-border payment features might work for smaller operations, but if you’re a wholesaler, you’ll likely struggle with the climbing transaction fees and lack of FX risk management tools. And while Revolut does come equipped with advanced features on the higher tiers, the need for detailed payment tracking and hands-on, responsive support will leave you wanting.

An alternative to Wise and Revolut: iBanFirst

All the scenarios where Wise and Revolut may not cut it? That's where iBanFirst comes in.

10,000+ international SMBs trust iBanFirst as their cross-border payments provider. Here's why.

Built specifically for SMBs managing high-volume cross-border payments

As your cross-border payment volumes grow, you need a provider that grows with you. IBanFirst is specifically designed for SMBs — not individuals, freelancers, enterprises and everyone in between!

We're transparent about our fees. You know exactly what you’ll pay from day one — no surprises. Unlike Wise and Revolut, you won't have to pay higher fees depending on the currencies you're converting — nor will you have to pay extra just to send a payment outside of market hours.

No setup fees, no monthly subscriptions, and absolutely no surprise rate increases when you exceed transfer limits (because there are no limits to begin with). Your costs stay predictable as you scale.

Detailed international payment tracking

Tired of not knowing where your payment is or when it will arrive? With the iBanFirst Payment Tracker, you can track your outgoing payments with timestamped updates at every stage — much like tracking a parcel!

You can also share tracking links with your beneficiary partners and suppliers so they can see real-time updates too. No more back-and-forth emails asking where the money is. No more suppliers chasing invoices. Just crystal-clear updates that keep everyone in sync and your business relationships strong.

![]()

Expert FX support and protection against currency volatility

Here's something you won't find with Wise or Revolut: Actual human FX specialists who understand your business and provide actionable support. This becomes crucial as your international payment volume grows — because at some point, you need more than just general customer support, chat bots or help docs.

When you're moving serious money internationally, a small market swing can have a big impact on your margins. That’s where our in-house FX experts come in. They can help you craft a custom currency strategy to manage currency risk and set up fixed, flexible, and dynamic forward payment contracts to shield your money from market volatility.

Plus, you can set up real-time alerts for any currency pair movements and get expert assistance on exactly how to respond. That way, you can focus on actually growing your business.

Get started with iBanFirst today

Growing beyond small-scale cross-border payments means you need a partner that actually understands what you're trying to build and that grows with you.

With an iBanFirst account, you get:

- International payment functionality across 25+ global currencies

- Crystal-clear payment tracking that keeps everyone in the loop

- Support from real humans with FX expertise who understand your business

- Transparent prices that don't vary by currency or day of the week

Ready to transform how you handle international payments? Request an account today and join over 10,000 businesses that’ve already made the switch.

Topics