Many SMEs and mid-caps make significant volumes of cross-border payments. However, they often ignore the products available to secure their margins and neutralise foreign exchange risk. We take a look at the characteristics and advantages of dynamic forward payment contracts in currency risk management.

Businesses operating internationally frequently face foreign exchange challenges. SMEs and mid-caps dealing with customers or suppliers overseas can find themselves adversely affected by currency market fluctuations. Unless carefully managed, the impact on their sales margins can prove detrimental.

To mitigate foreign currency risk and its consequent margin erosion, implementing a proactive currency management strategy is advisable. Evidently, the strategy a business adopts will depend on its currency market exposure and the volume of cross-border payments it makes. Common instruments to lessen the impact of negative forex developments include deliverable forward payment contracts, such as fixed, flexible and dynamic forward payments.

A forward payment allows businesses to fix the buying or selling rate of a currency pair at a particular time, between two set dates, for a specific amount. A flexible forward payment enables them to exchange either the full or partial amount(s) at a predetermined rate, at any stage before payment. A dynamic forward payment offers the benefits of a regular forward payment, while granting the possibility to benefit from favourable FX market movements. But it comes in various forms. So, what kinds of dynamic forward payments are there? And what advantages do they offer?

Dynamic forward payments with full participation

Like all dynamic forward payment contracts, dynamic forward payments with full participation secure a business’s sales margins by fixing a predefined exchange rate, or “protection rate”. This enables this company to make a future foreign-currency payment without fear of adverse fluctuations. “Full participation” means the contracting party may only take advantage of the pre-agreed rate, or an improved market rate, once the contract has reached maturity. There is, however, a set-up charge.

In sum, a business can:

- protect its margins with a guaranteed exchange rate.

- benefit from a favourable FX market fluctuation at the settlement date.

Example:

A small European business named Sirocco places an order for goods amounting to $120,000 (USD), which it will pay in 12 months. At the time of order, the exchange rate (often referred to as the spot rate or reference rate) is EUR 1 = USD 1.2000.

With the help of a forward payment contract, Sirocco can guarantee today’s exchange rate and countervalue for the future invoice. By choosing a dynamic forward payment with full participation, they will also have the option of buying dollars at a more favourable rate at the payment date, depending on market conditions.

At the payment date, there are two possible scenarios:

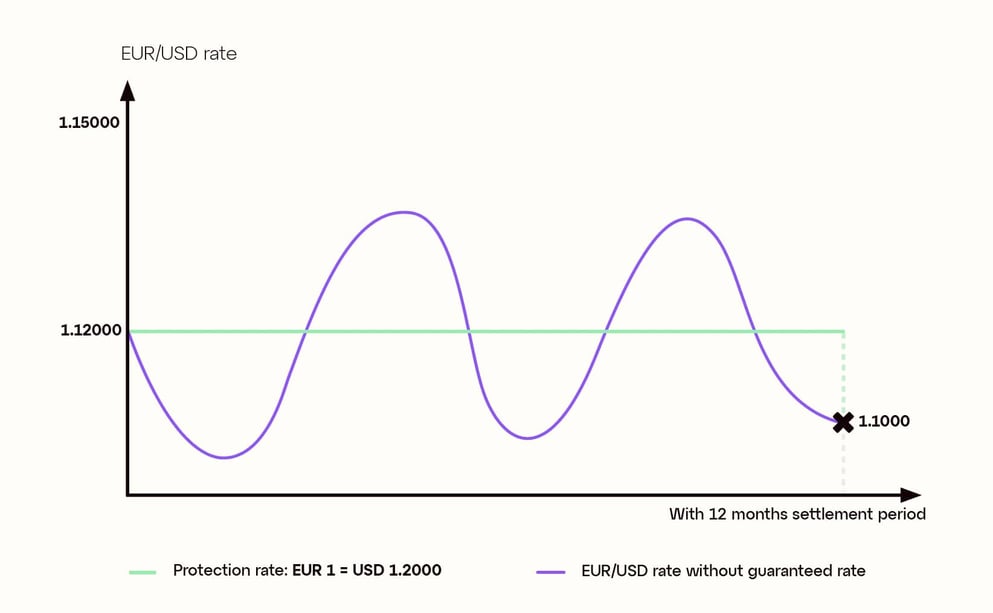

Scenario 1

The EUR/USD reference rate is less favourable than the guaranteed protection rate, atEUR 1 = USD 1.1000. Sirocco therefore opts for the guaranteed protection rate of

EUR 1 = USD 1.2000, buying $120,000 for a countervalue of €100,000 to settle its invoice.

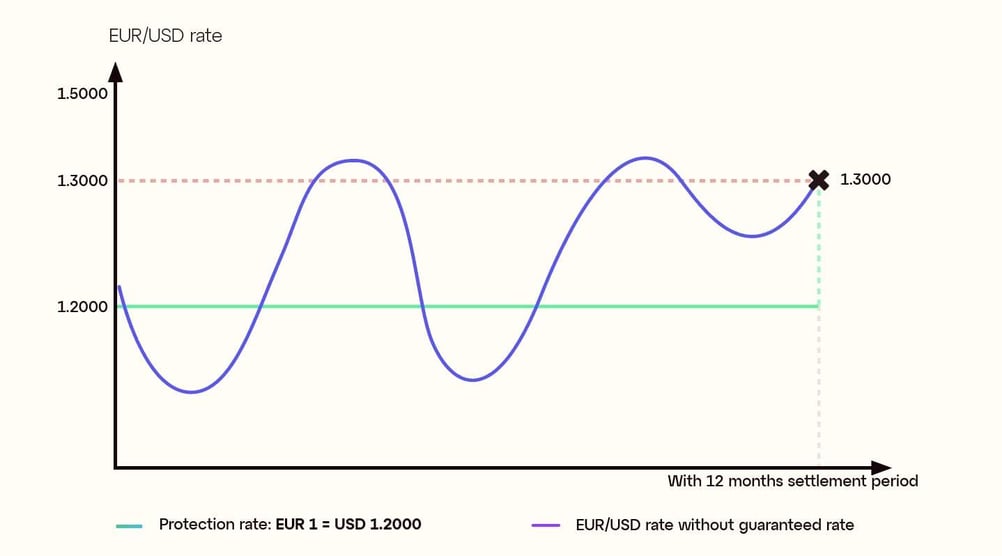

Scenario 2

The EUR/USD reference rate is more favourable than the guaranteed protection rate, atEUR 1 = USD 1.3000. Sirocco thus opts for the reference rate of EUR 1 = USD 1.3000, buying $120,000 for a countervalue of €92,308 to settle its invoice.

Dynamic forward payments with partial participation

Like dynamic forward payments with full participation, this option allows businesses to benefit from a more favourable market rate at the payment date. However, this only applies to a predetermined percentage of their forward payment. Dynamic forward payments with partial participation also aim to secure a business’s sales margins by fixing a guaranteed protection rate that guards against negative FX market developments. Contrary to dynamic forward payments with full participation, however, they require no set-up fee.

In sum, a business can:

- protect its margins with a guaranteed exchange rate, slightly below the initial spot rate, for a proportion of their future payment.

- benefit from a favourable FX market fluctuation at the settlement date for the remaining percentage of their future payment.

- avoid the set-up costs of a dynamic forward payment with full participation.

Example:

A European mid-cap named Khamsin places an order for goods costing $120,000 (USD), which it will pay in 12 months. At the time of order, the exchange rate is EUR 1 = USD 1.2000.

By setting up a dynamic forward payment with partial participation, Khamsin can secure a minimum future exchange rate, or protection rate, of EUR 1 = USD 1.1800 for a proportion of the future payment. The business also maintains the option of buying the remaining percentage of its future dollars at a better rate, depending on currency market conditions at maturity.

At the payment date, there are two possible scenarios:

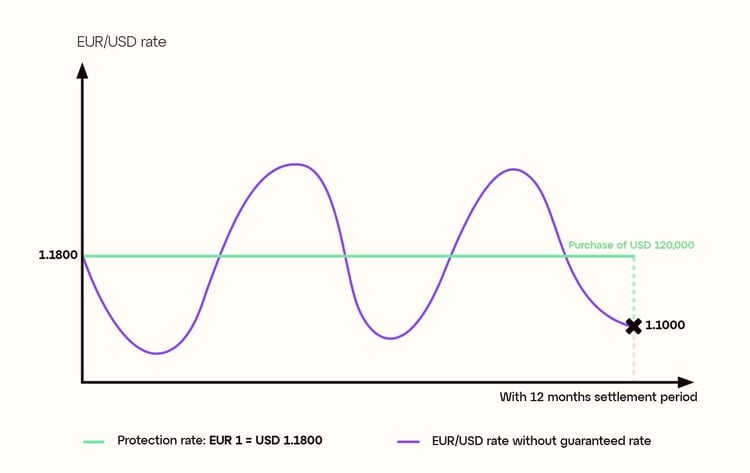

Scenario 1

The EUR/USD reference rate is less favourable than the guaranteed protection rate, atEUR 1 = USD 1.1000. Khamsin opts for the guaranteed protection rate of

EUR 1 = USD 1.1800, buying $120,000 for a countervalue of €101,695 to settle its invoice.

Scenario 2

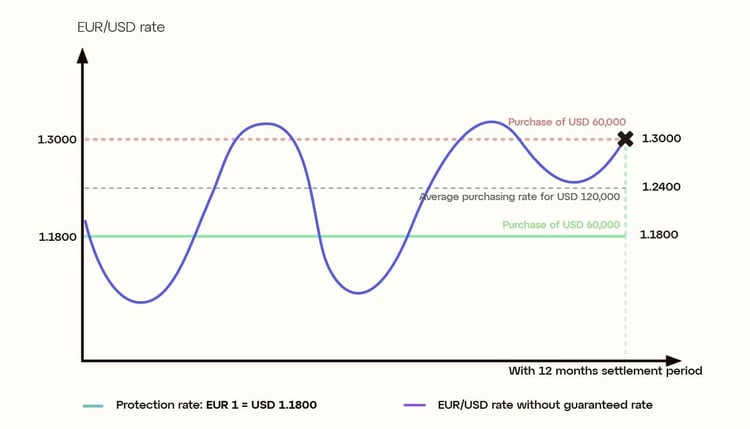

The EUR/USD reference rate is more favourable than the guaranteed protection rate, atEUR 1 = USD 1.3000. Khamsin can therefore benefit from this improved rate, but only for a predetermined percentage of the nominal value at set-up. In this case, 50%.

In line with the agreed terms, Khamsin does the following:

It buys 50% of its dollars (USD) at the more favourable exchange rate of EUR 1 = USD 1.3000. $60,000 are therefore bought for a countervalue of €46,154.

It buys the remaining 50% at the guaranteed protection rate of EUR 1 = USD 1.1800. An additional $60,000 is therefore bought for a countervalue of €50,847.

Overall, to settle its invoice of $120,000, Khamsin has paid €97,001. The average buying rate for the entire conversion amounts to EUR 1 = USD 1.2400.

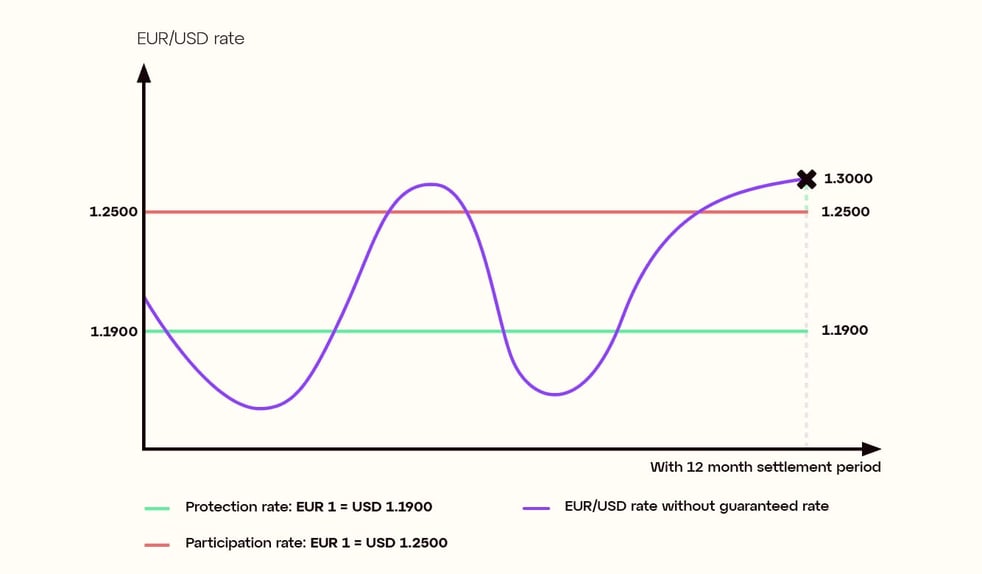

Dynamic forward payments with capped participation

As with all dynamic forward payments, the aim here is to benefit from a more favourable exchange rate once the contract has reached maturity. When it comes to dynamic forward payments with capped participation, a business can once again safeguard its sales margins through a guaranteed protection rate. However, its ability to benefit from advantageous FX market fluctuations is limited to a capped exchange rate at the payment date. This is known as the participation rate.

In sum, a business can:

- protect its margins with a guaranteed exchange rate, slightly below the initial spot rate.

- benefit from a favourable FX market fluctuation at the settlement date, but only up to a predetermined exchange rate referred to as the participation rate.

- avoid the set-up costs of a dynamic forward payment with full participation.

Example:

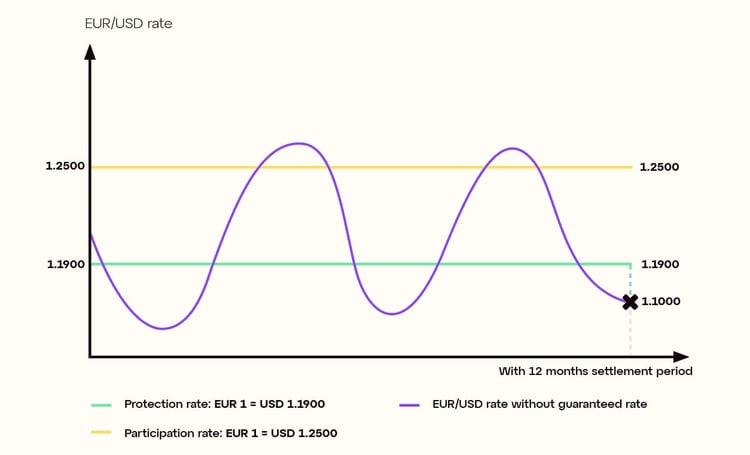

An EU-based SME called Bora places an order for goods costing $120,000 (USD), which it will pay in 12 months. At the time of order, the exchange rate is EUR 1 = USD 1.2000.

By setting up a dynamic forward payment with capped participation, Bora can guarantee a protection rate of EUR 1 = USD 1.1900 for its invoice. Opting for this kind of dynamic forward payment means the business can benefit from a favourable FX market development up to a specified exchange rate known as the participation rate, but not beyond this. The outcome will depend on FX market conditions at maturity.

At the payment date, there are three possible scenarios:

Scenario 1

The EUR/USD reference rate is less favourable than the guaranteed protection rate, atEUR 1 = USD 1.1000. Bora therefore avails of the guaranteed protection rate of

EUR 1 = USD 1.1900, buying $120,000 for €100,840 to settle its invoice.

Scenario 2

The EUR/USD reference rate finds itself between the protection rate and the participation rate, at EUR 1 = USD 1.2200. Bora therefore avails of the reference rate, buying $120,000 for €98,361 to settle its invoice.

Scenario 3

The EUR/USD reference rate is higher than the participation rate, at EUR 1 = USD 1.3000. Bora therefore cannot avail of the reference rate, benefitting instead from the favourable FX market fluctuation only up to the participation rate, at EUR 1 = USD 1.2500. Bora buys $120,000 for €96,000 to settle its invoice.

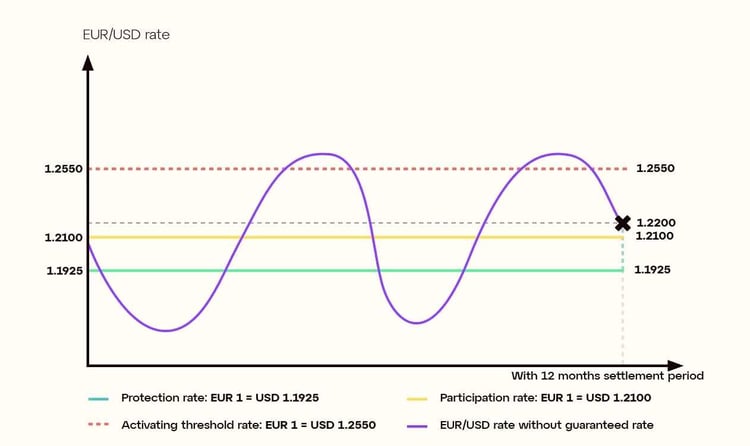

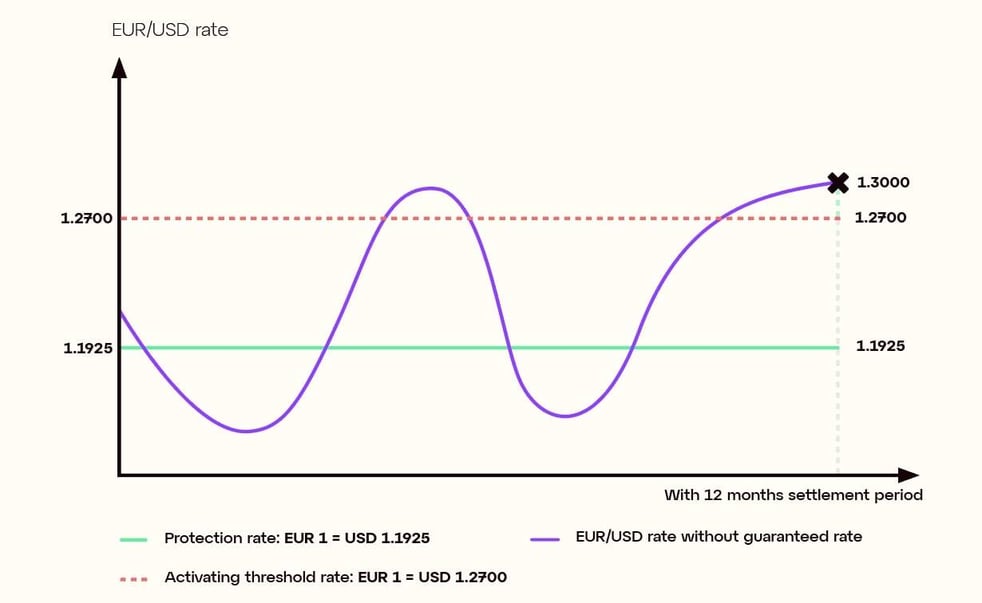

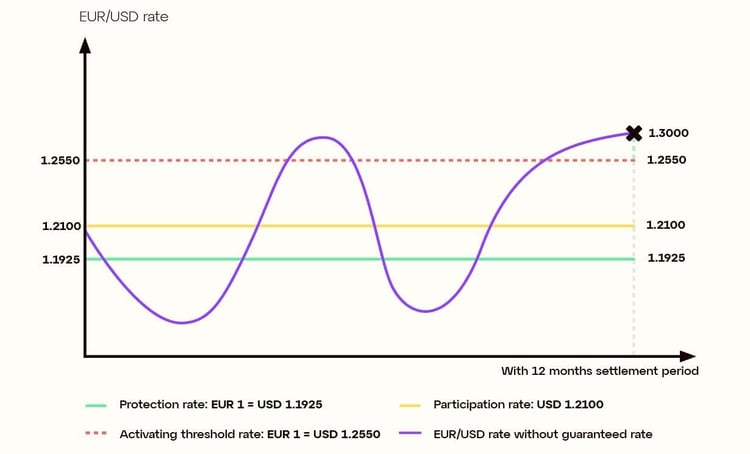

Dynamic forward payments with activating participation

Dynamic forward payments with activating participation are similar to those with capped participation, but there is slightly more at stake. Once again, by setting up this kind of contract, a business protects its sales margins with a guaranteed protection rate. Its ability to benefit from favourable FX market fluctuations is, however, limited to a capped exchange rate at the payment date, known as the activating threshold rate. There is a key distinction here. If the reference rate at maturity exceeds the activating threshold, the business is obliged to avail only of the guaranteed protection rate.

In sum, a business can:

- protect its margins with a guaranteed exchange rate, slightly below the initial spot rate.

- benefit from a favourable FX market fluctuation at the settlement date, but only up to a predetermined exchange rate referred to as the activating threshold.

- avoid the set-up costs of a dynamic forward payment with full participation.

Example:

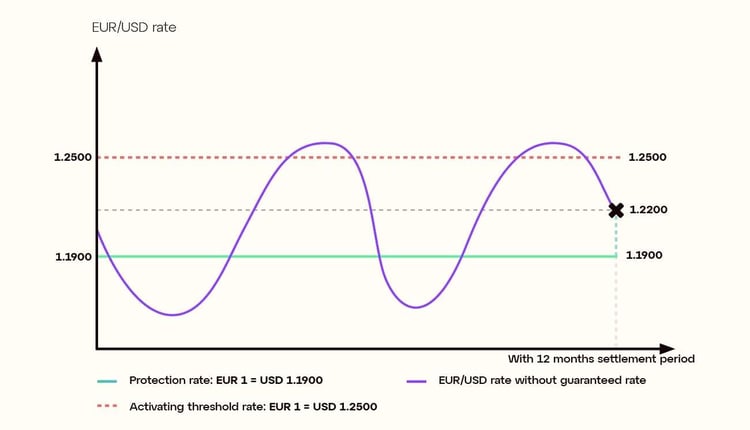

A medium-sized European business called Mistral places an order for goods costing $120,000 (USD), which it will pay in 12 months. At the time of order, the exchange rate is EUR 1 = USD 1.2000.

Through a dynamic forward payment contract with activating participation, Mistral is able to guarantee a protection rate of EUR 1 = USD 1.1925 to pay its invoice. Choosing this kind of dynamic forward payment means the business can benefit from a favourable FX market development up to a specified exchange rate known as the activating threshold. However, if the reference rate has exceeded this by the time the contract reaches maturity, Mistral will find itself obliged to accept the guaranteed protection rate.

At the payment date, there are three possible scenarios:

Scenario 1

The EUR/USD reference rate is less favourable than the guaranteed protection rate, atEUR 1 = USD 1.1000. Mistral therefore avails of the guaranteed protection rate of

EUR 1 = USD 1.1925, buying $120,000 for €100,629 to settle its invoice.

Scenario 2

The EUR/USD reference rate finds itself between the protection rate and the activating threshold, at EUR 1 = USD 1.2200. Mistral therefore avails of the reference rate, buying $120,000 for €98,361 to settle its invoice.

Scenario 3

The EUR/USD reference rate is higher than the activating threshold, at EUR 1 = USD 1.3000. Mistral therefore cannot avail of the reference rate, availing instead of the guaranteed protection rate, at EUR 1 = USD 1.1925. Mistral buys $120,000 for €100,629 to settle its invoice.

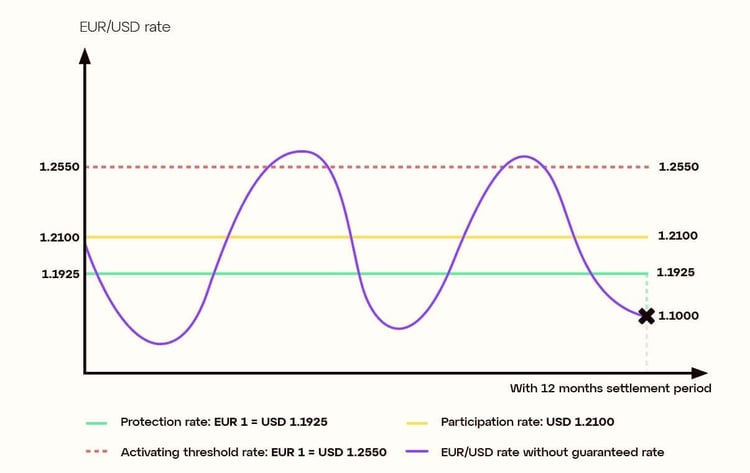

Dynamic forward payments with capped activating participation

Dynamic forward payments with capped activating participation differ slightly from the previous two contracts. As with other dynamic forward payments, a business can use them to protect its sales margins with a guaranteed protection rate. Its ability to benefit from favourable FX market fluctuations is limited to a capped exchange rate at the payment date, known as the activating threshold. A participation rate is also set, above the guaranteed protection rate and below the activating threshold. While the business can benefit from a reference rate at maturity that climbs up to the activating threshold, it will be obliged to avail of the participation rate if this threshold is surpassed.

In sum, a business can:

- protect its margins with a guaranteed exchange rate, slightly below the initial spot rate.

- benefit from a favourable FX market fluctuation at the settlement date, but only up to a predetermined exchange rate referred to as the activating threshold. If this threshold is exceeded, it avails instead of a predefined participation rate.

- avoid the set-up costs of a dynamic forward payment with full participation.

Example:

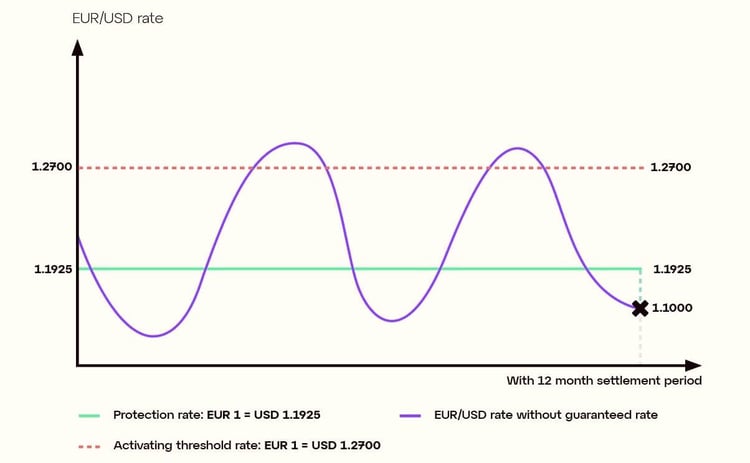

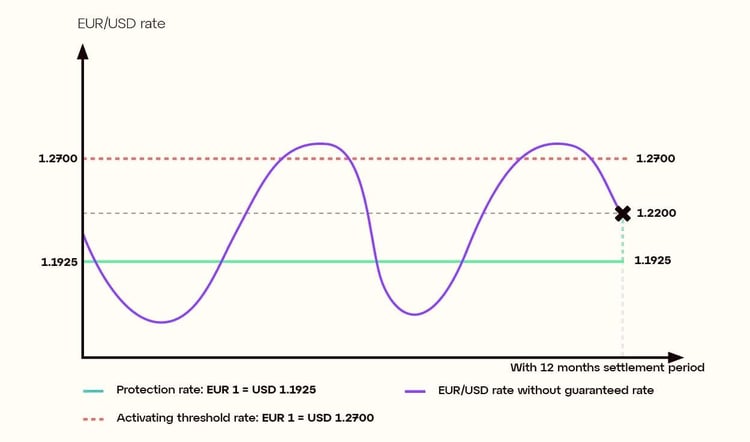

A European mid-cap named Pampero places an order for goods costing $120,000 (USD), which it will pay in 12 months. At the time of order, the exchange rate is EUR 1 = USD 1.2000.

Using a dynamic forward payment contract with capped activating participation, Pampero can benefit from a guaranteed protection rate of EUR 1 = USD 1.1925 for its invoice. Opting for this dynamic forward payment variant enables the business to benefit from a favourable FX market development up to a specified exchange rate known as the activating threshold. However, if the reference rate has exceeded this by the time the contract reaches maturity, Pampero will find itself obliged to accept the participation rate instead. This nonetheless sits above the protection, with both rates are determined at set-up.

At the payment date, there are three possible scenarios:

Scenario 1

The EUR/USD reference rate is less favourable than the guaranteed protection rate, atEUR 1 = USD 1.1000. Pampero therefore avails of the guaranteed protection rate of

EUR 1 = USD = 1.1925, buying $120,000 for €100,629 to settle its invoice.

Scenario 2

The EUR/USD reference rate finds itself between the protection rate and the activating threshold, at EUR 1 = USD 1.2200. Pampero therefore avails of the reference rate, buying $120,000 for €98,361 to settle its invoice.

Scenario 3

The EUR/USD reference rate is higher than the activating threshold, at EUR 1 = USD 1.3000. Pampero therefore cannot avail of the higher rate, instead benefitting only from the participation rate, at EUR 1 = USD 1.2100. Pampero buys $120,000 for €99,174 to settle its invoice.

FX forward payment contracts are designed to neutralise foreign exchange risk, which is a major challenge for businesses making regular foreign-currency payments. Currency market volatility can bear a negative impact on sales margins, making forward payments a compelling option for businesses in this position. Dynamic forward payments eliminate risk and enable businesses to benefit from potentially advantageous currency fluctuations, but they come in many forms.

Dynamic forward payments with full participation guarantee a future exchange rate either above or equal to the spot rate, but they involve a set-up charge. Those with partial participation require no such fee, but the benefits of favourable FX movements are limited to a mere proportion of the future payment. Dynamic forward payments with capped, activating or capped activating participation all set a limit on both the amount the contracting party can gain or lose out on as a result of forex market volatility, with varying levels of risk.

The forward payment contract your business chooses will depend on the volume of your multicurrency payments and the volatility observed in the currency pairs you’re accustomed to. But all SMEs and mid-caps making cross-border payments should consider a proactive currency risk management strategy. Ignoring currency risk is a major oversight for any business serious about protecting its margins. The strength of dynamic forward payments lies in going beyond mere risk protection, offering the opportunity to harness FX market volatility and benefit from it too.

Topics