Since its launch in 2015, Revolut has taken the world by storm, quickly becoming the go-to app for all things money. Whether you're transferring funds across borders, enjoying fee-free spending on your next vacation, or sharing a joint account with your partner, Revolut makes it all feel effortless. But here’s the thing—Revolut shines brightest in the personal finance space. So what about businesses that deal with regular international transactions?

If you’re a European company:

- Regularly transacting with overseas suppliers, contractors, or partners in foreign currencies

- Needing to manage currency risk effectively

- Looking for expert guidance to steer through the FX market

… Revolut might not fully meet your needs.

Enter iBanFirst. Designed specifically for small and medium-sized businesses, iBanFirst is a cross-border payment solution that goes beyond the basics. With robust FX risk management tools and experienced FX specialists by your side, iBanFirst offers a more specialised approach to navigating the complexities of global transactions.

In this article, we’ll dive into the differences between Revolut and iBanFirst, helping you figure out which one is the better fit for your business.

iBanFirst vs Revolut Business: an overview

Launched in the UK in 2015 with the goal of creating a financial super-app, Revolut quickly established itself as one of the world's first neobanks and has become the go-to choice for frequent travellers, freelancers and solopreneurs.

In 2017, Revolut expanded its offerings to small businesses, introducing a range of features to help business owners effortlessly send and accept payments, convert currencies, manage currency risk, handle employee expenses, and more.

iBanFirst, launched in 2016, is a cross-border payment provider catering exclusively to SMBs operating globally. They combine an easy-to-use platform with the human-touch support of dedicated FX specialists to deliver a seamless payment experience to each client.

With business-focused features such as multi-currency accounts, custom payment approval workflows, payment tracking, FX alerts, and a wide range of currency risk management solutions, and support from an experienced and proactive team of payments experts, iBanFirst makes it easy for small and medium-sized businesses to operate efficiently across multiple currencies.

Bottom line: Revolut is all about offering a versatile, tech-focused platform that serves a wide range of customers - mostly for personal needs, whereas iBanFirst focuses on providing a specialised, hands-on service designed to meet the specific cross-border payment needs of SMBs.

Revolut Business vs iBanFirst: top features

To compare the two options effectively, it’s important to take a closer look at their features. We'll break down what each provider offers, helping you make a smart choice based on your business needs and priorities.

Revolut Business

Revolut Business offers a plethora of features, with access varying by account tier. There is one free option and three paid options, each with different capabilities and pricing conditions.

For cross-border transactions, Revolut Business provides multi-currency accounts supporting over 25 currencies for sending and receiving payments, and local accounts in GBP, USD, and EUR. It allows for custom payment approval rules, currency pair alerts, limit and stop orders, and both fixed and flexible forward payment contracts.

Revolut Business also includes features to help manage expenses. You can issue both physical and virtual company debit cards to your team, set spending limits, track transactions, and control where the cards can be used.

Merchant accounts and payment processing options enable businesses to accept payments through various methods, including online gateways, e-commerce integrations, and contactless QR codes.

Additionally, the Revolut Business mobile app lets you manage your finances on the go, and the platform supports integrations with accounting software like Xero, QuickBooks, and Sage.

iBanFirst

iBanFirst’s features are exclusively geared towards small and medium businesses managing cross-border payments.

The iBanFirst platform allows you to instantly open multi-currency accounts in 25+ currencies, making it easy to hold, receive, and send payments across 180+ countries.

Custom user rights and payment validation rules ensure transactions align with your company's internal policies, providing an added layer of security and control.

A standout feature of iBanFirst is the payment tracker, allowing both you and your beneficiaries to monitor payments every step of the way—especially useful for suppliers needing payment confirmation before shipping orders.

To manage foreign exchange risk, iBanFirst offers a comprehensive and highly customizable approach. You can set up FX alerts to notify you when currencies hit your target rates and use market orders to optimise spot conversions. Beyond standard fixed and flexible forward payment contracts, iBanFirst also provides dynamic forward payments, offering flexibility to adapt to changing market conditions. Most importantly, a team of FX experts will work closely with you to fully customise your FX risk management strategy to fit your specific business needs and goals.

For smoother financial operations, connect the iBanFirst platform with your existing accounting or treasury software. You can also link your external bank accounts to iBanFirst, giving you instant access to all your balances directly from your iBanFirst dashboard.

Bottom line: If you're after a versatile, tech-savvy platform that can tick off various items on your finance checklist, Revolut Business could be a great choice—depending on the plan you pick. On the other hand, if reliable and fast cross-border payments, advanced FX risk management tools, and personalised support are high on your list, iBanFirst might be a better match for your SMB.

Customer support — In-app chat vs tailored human support

Revolut Business customer support

The primary support channel for Revolut business users is the in-app chat. This feature allows users to connect with support agents for assistance with account-related queries, transactions, and other issues. The chat is accessible directly from the Revolut Business app or web platform. Other support channels include the Help Centre, the Community Forum, and Email Support for non-urgent matters. Only Enterprise account holders get the option to speak directly with an account manager.

iBanFirst customer support

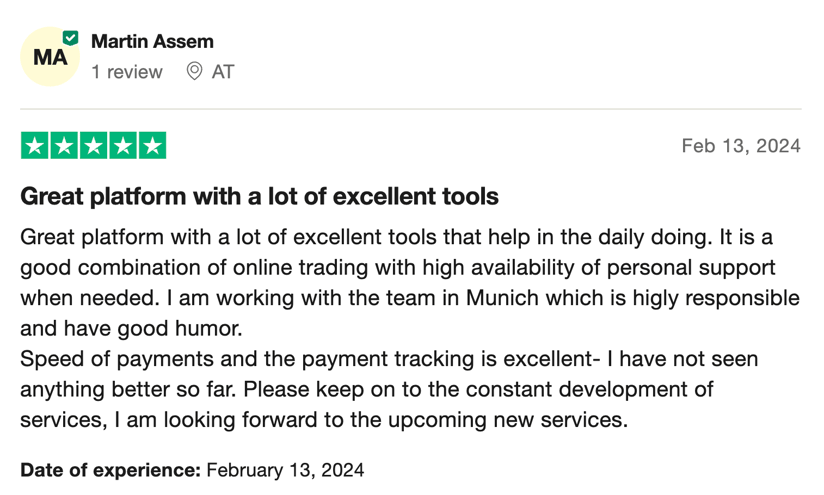

iBanFirst distinguishes itself by offering highly personalised, human-centred support. Each client is paired with a dedicated account manager who becomes intimately familiar with your business, ensuring that whenever you need assistance, you're speaking with someone who truly understands your specific needs. With 12 regional offices across Europe, iBanFirst also brings local expertise to the table, enhancing the quality and responsiveness of its service.

Support is available through multiple channels—phone, in-app chat, and email—allowing you to get help quickly and conveniently. If you prefer to troubleshoot on your own, the Help Center has information on bank accounts, international payment protocols, exchange rates, and much more.

This personalised support isn’t just about resolving issues; it’s about providing proactive, expert guidance. Whether you need help navigating the FX markets, selecting the right accounts, or developing a risk management strategy, your account manager is there to offer tailored advice that’s specific to your business.

For businesses involved in cross-border transactions, this level of direct, knowledgeable support is invaluable. iBanFirst’s approach ensures that you have a consistent point of contact who can help manage risks and ensure smooth operations—an aspect that clients often highlight as one of the most appreciated benefits of working with iBanFirst.

Bottom line: iBanFirst takes a human-led approach to customer support through a dedicated account manager with expertise in FX markets for each client, while Revolut Business customers mostly rely on in-app chat.

Pricing — iBanFirst and Revolut fee breakdown

Revolut Business fees

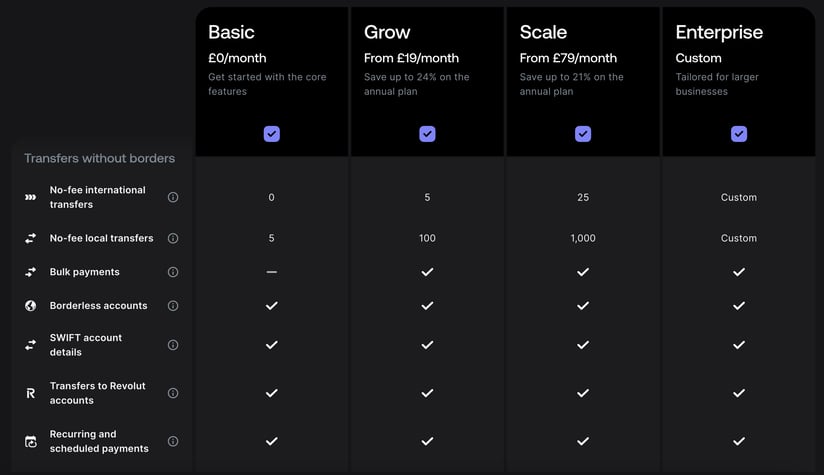

Revolut has 4 main pricing tiers for business accounts.

The free Basic plan gets you started with five no-fee local transfers, a €1000 in currency conversion at the interbank rate and charges extra for each international transaction. If you want to make international payments without fees, you'll have to opt for a paid plan for at least €19/month (Grow plan).

The Grow plan gives you five international money transfers and 100 local fee-free transfers and you’ll also be able to exchange €10,000 at the interbank rate. But if you run an international business, this transaction volume might not be enough to pay your suppliers or contractors.

Revolut’s Scale plan for €79/month takes it up a notch with 25 no-fee international transactions, 1,000 no-fee local transfers and a €50,000 allowance for currency conversion at the interbank rate. This can be a good fit for small to mid-sized businesses that need to manage a higher volume of transactions.

For larger businesses, Revolut offers an Enterprise plan. You can negotiate custom terms for no-fee international transfers and tailor your currency exchange cap at the interbank rate. Plus, it’s the only plan that offers customer support beyond just chat, giving you more direct and personalised assistance. For pricing details, you’ll need to speak with Revolut’s sales team.

If you go over your monthly allowance in any plan:

- Local transfers will cost €0.20 per transaction.

- International transfers will cost €5 each.

- Currency exchanges come with a 0.6% fee, and 1% if done outside market hours.

While Revolut’s fee structure is somewhat transparent, the additional fees for currency exchanges, additional transfers, and card services can add up quickly, making the cumulative cost much higher than anticipated.

iBanFirst fees

iBanFirst differentiates itself from Revolut Business by offering a transparent, pay-as-you-go pricing model with no monthly or subscription fees. This flexibility ensures that businesses only pay for the services they actually use.

Another advantage of iBanFirst is that most account administration fees are free, allowing businesses to operate efficiently without being burdened by ongoing costs. Here’s a breakdown:

|

Concept

|

Associated fee

|

|

Opening fee

|

Free

|

|

Maintenance fees

|

Free

|

|

Online account statements

|

Free

|

|

Unlimited access to account history

|

Free

|

|

Viewing and managing multi-company group accounts

|

Free

|

|

Account closure fee

|

Free

|

When it comes to payments, iBanFirst keeps it straightforward:

|

Concept

|

Associated fee

|

|

Payments between iBanFirst accounts (instant payment)

|

Free

|

|

SEPA payment fees

|

Free

|

|

DSP payment fees

|

€5

|

|

SWIFT payment fees

|

€0/BEN1,

€5/SHARE2,

€10/OUR3

|

|

Surcharge for express payments

|

€6

|

|

Real-time payment tracker

|

Free

|

|

Access to bank transfer messages

|

Free

|

1 BEN: The payment beneficiary is bearing all the fees

2 SHARE: fees are split between the payment initiator and beneficiary

3 OUR: the payment initiator is bearing all the fees

For currency conversions, iBanFirst applies a variable spread that depends on the currency and transaction volume. This spread is the difference between the interbank rate and the rate offered to the customer. Despite the spread, the rates remain competitive, offering a solid balance between cost and service.

Keep in mind: iBanFirst clearly shows all fees upfront, so there are no surprises when you send, receive, or convert money. You'll know exactly what it will cost before completing any transaction.

Bottom line: iBanFirst offers a flexible, pay-as-you-go model with no subscription fees, making it ideal for businesses that want to pay only for what they use. Revolut’s structure, with extra charges if you exceed your monthly limits, can make it difficult to predict costs, especially if your transaction volumes vary each month. Additionally, while Revolut provides mid-market rates within a set allowance, iBanFirst offers competitive exchange rates that, despite including a spread, remain highly competitive.

Who is Revolut for?

Revolut is a solid option for individuals who need an easy way to send and receive payments from friends and family or solo freelancers working with clients abroad. For businesses, Revolut is ideal for companies looking for a single tool that covers a wide range of financial needs, from multi-currency accounts to expense management and payment processing. If you value breadth of features over specialised services, Revolut Business could be a good fit. However, keep an eye on extra costs if you exceed your plan's limits, and be aware that customer support is primarily chat-based, which might not suit everyone.

Who is iBanFirst for?

iBanFirst is specifically designed for small and medium-sized businesses that need to send, receive, and track international payments regularly. It's an excellent choice for companies that require both an easy-to-use platform and personalised support to manage cross-border transactions efficiently. Businesses that find iBanFirst most useful include importers and exporters, wholesalers and retailers with overseas counterparties, and companies with subsidiaries or multiple offices around the world.

The platform offers powerful tools for managing cross-border payments, currency risk, and more, with transparent, pay-as-you-go pricing. Plus, every client gets a dedicated account manager, providing expert guidance tailored to your business. If you value both cutting-edge tech and human support, iBanFirst is a strong choice.

Revolut vs iBanFirst — Which international payment provider is better for you?

|

|

iBanFirst

|

Revolut

|

|

Key customer segments

|

Small and medium-sized businesses

|

Individuals, Freelancers, and businesses

|

|

Coverage

|

Primarily EU

|

Global

|

|

Top features

|

Global accounts in 30+ currencies, Payment Tracker, fixed, flexible and dynamic forward payments

|

Global accounts in 25 currencies, debit cards, Revolut Pay

|

|

Pricing

|

- Free to open an account

- SEPA transfers are free

- DSP and SWIFT start at €5/transfer

|

Starts at €19/month with 100 no-fee local transfers and 5 no-fee international transfers.

|

|

Customer support

|

Dedicated Account Manager for every client. Phone, chat, or email support available.

|

In-app chat or email. Phone support is reserved for the enterprise account tier.

|

Choosing between Revolut and iBanFirst ultimately comes down to what your business values most.

Revolut is ideal if you're looking for a broad, tech-driven platform that can handle various financial tasks, all within one tool. It's a strong choice for freelancers and small businesses that want a versatile solution with features like multi-currency accounts, expense management, and payment processing. However, Revolut's tiered pricing structure, which imposes additional fees if you exceed your plan’s limits, requires careful monitoring. Additionally, the primarily chat-based customer support might not meet the needs of businesses that require more direct and personalised assistance.

On the other hand, iBanFirst is built for small and medium-sized businesses that regularly deal with international payments and need a more specialised approach. If your business is an importer, exporter, wholesaler, or operates across multiple countries, iBanFirst’s powerful platform—coupled with the support of FX specialists—offers a significant advantage. With transparent, pay-as-you-go pricing and personalised support, iBanFirst ensures that your business gets the expertise and tools needed to navigate the complexities of cross-border transactions.

In summary, if you need a versatile platform for a range of tasks, Revolut is a strong choice. But if your focus is on efficient international payments with transparent pricing and personalised support, iBanFirst is likely the better option. Request your free iBanFirst account

here.

Frequently asked questions

Is iBanFirst a bank?

iBanFirst is not a bank in the traditional sense. It is an accredited payment service provider in Europe and the UK. iBanFirst is SEPA-certified and a member of the SWIFT network.

Who can apply for an iBanFirst account?

Any business or company with international and foreign exchange payment volumes of more than €200,000 per year. Restrictions may apply depending on the country of origin, the activity of the company, or the origin of the funds.

How can I contact iBanFirst support?

Get in touch with iBanFirst via this contact page or call any of iBanFirst’s 12 local offices, located in major European cities. If you’re already a client, you can get in touch with your dedicated account manager by mail, phone or within the platform.

Is Revolut a good choice for business accounts?

Revolut is a good choice for small businesses and freelancers looking for a versatile, tech-driven platform with features like multi-currency accounts and expense management. However, for businesses that require specialised tools for international payments and personalised support, iBanFirst may be a better option, offering a tailored approach to cross-border transactions.