Publication date

Share this article

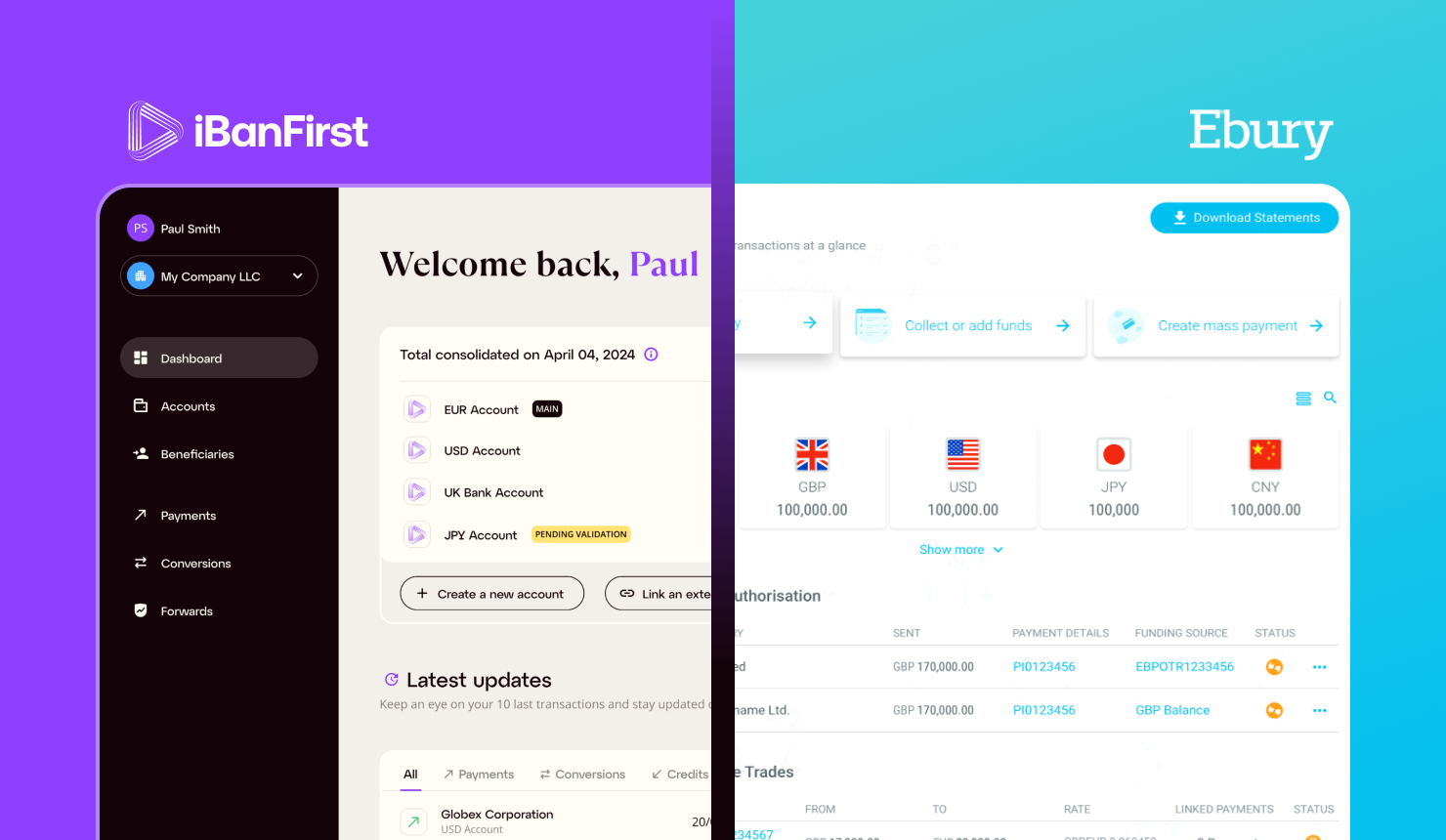

If you're comparing cross-border payment providers, iBanFirst and Ebury are likely on your shortlist. Both specialise in international payments and FX risk management for established SMBs, so your decision boils down to a few key differences.

So where do the two actually differ?

This guide compares iBanFirst and Ebury across pricing, multi-currency accounts, cross-border payments, FX risk management, payment tracking, and support so you can decide which provider is the best match for how your business actually operates.

Let's start from the top with a quick overview of each provider.

Ebury overview

Ebury is a specialised financial services provider focused on foreign exchange, international payments, and trade finance for medium-sized businesses with significant cross-border operations. Founded in the UK in 2009, Ebury is now majority-owned by Banco Santander (which acquired a 50.1% stake in 2019).

With an Ebury account, you can:

- Open and manage currency accounts in 30+ currencies

- Initiate payments in 140+ currencies

-

Protect your margins with forward payment contracts and other FX risk management tools

-

Access trade finance solutions, including invoice financing

- Access support from dedicated FX specialists

Ebury brings genuine depth in FX and trade finance, backed by more than 15 years of cross-border experience and the institutional weight of Santander. The details of how those tools are accessed and priced are worth digging into, and that's where this comparison gets interesting.

iBanFirst overview

Founded in 2016, iBanFirst is a European cross-border payment provider built for established small and medium multinationals managing significant cross-border payment volumes. Every client gets the same tools, pricing model, and access to FX specialists.

With an iBanFirst account, you can:

- Open and manage currency accounts in 25+ currencies

- Initiate payments in 135+ currencies

- Access real-time payment tracking

- Protect your margins with forward payment contracts

- Access support from dedicated FX specialists

iBanFirst centres on consistent, visible pricing and a simple yet powerful platform designed for scaling international businesses that need professional-grade tools and predictable costs. It's purpose-built for managing day-to-day business operations: currency accounts, payments, FX and tracking in one unified platform.

Ebury vs iBanFirst at a glance

|

|

Ebury |

iBanFirst |

|

Pricing model |

Custom, variable — spreads may differ by currency pair, transaction size, and relationship |

Custom spread set at onboarding — transparent rates across all transactions and currency pairs |

|

Currencies |

Hold and receive funds in 30+ currencies, make payments in 140+ currencies |

Hold and receive funds in 25 currencies, make payments in 135+ currencies |

|

FX risk management |

Forward payment contracts, market orders, window forwards |

Forward payment contracts for all clients |

|

Dedicated support |

Relationship managers (emphasis on larger clients) |

Support from FX experts for all clients from day one |

|

Payment tracking |

Standard tracking |

Timestamped updates at every step with shareable links for beneficiaries |

|

Trade finance |

Invoice financing, import/export financing |

Not offered |

The key differences are in pricing consistency, platform usability, and how accessible the tools are at different relationship stages.

Pricing structures and fees

Pricing is often where international businesses start when comparing providers, and Ebury and iBanFirst take fundamentally different approaches to pricing — and it says a lot about who they're best for.

Ebury pricing: Custom rates

Ebury uses a custom pricing model. Costs are tailored based on your transaction volume, currency pairs, transaction size, and relationship with your account manager.

The key cost components:

-

FX spreads that vary by currency pair and client relationship

-

Potential transaction fees (especially for smaller or high-cost corridor payments)

-

The possibility of account maintenance fees

What does this mean in practice? Your spread on a EUR/USD transaction might differ from your spread on a GBP/ZAR transaction. A larger payment might carry a different rate than a smaller one. And as your relationship evolves, pricing may shift too. If you're trying to forecast your quarterly FX spend, that variability can make budgeting harder.

The pricing isn't plan-dependent, as there are no tiered monthly subscription costs like some other providers. It's relationship-dependent, which creates a different kind of opacity. Prospects also need to engage with sales to understand their actual currency exchange costs before getting started.

iBanFirst pricing: Consistent costs

iBanFirst uses a flat, transparent pricing structure, which means:

- No opening fee to get started (excluding Luxembourg)

- No monthly subscription costs

- No hidden transfer fees

Instead, we use personalised foreign exchange rate quotes, agreed upon during each client’s onboarding process. Clients get the same tools, same support, and pricing structure from day one.

Our model is designed to be predictable. You can forecast your FX costs reliably without worrying about tier thresholds — and that predictability tends to matter more for scaling businesses.

Many finance teams don't realise how much consistency matters until they've spent a quarter wrestling with variable costs. Understanding how FX commissions work helps you compare pricing models across providers, and knowing how to manage FX volatility puts you in a stronger position regardless of which provider you choose.

Multi-currency accounts and cross-border payments

A multi-currency account is foundational for any cross-border payment provider. And Ebury and iBanFirst approach this slightly differently.

Ebury

With an Ebury multi-currency account, you can hold and receive funds in 35+ currencies and make payments in 140+ currencies to 200+ countries and territories, including emerging market corridors. This breadth of coverage is a strength, particularly for businesses operating in less common corridors.

The payment capabilities include international transfers via SWIFT, SEPA, and local clearing systems in select corridors. Mass payments cover payroll, supplier payments, and high-volume scenarios handling multiple international transactions. You also get scheduled and recurring payment services and approval workflows for managing multiple payments.

But the trade-off is on the platform side. Many reviews note that Ebury's interface is functional but dated, and the UX hasn't kept pace with newer fintech competitors. Navigation can feel complex even for straightforward tasks like initiating payments or checking statuses. For finance teams interacting with their cross-border payment platform regularly, that can cause operational friction.

iBanFirst

With an iBanFirst multi-currency account, you can hold and receive funds in 25+ foreign currencies and make payments via SWIFT and SEPA in 135+ currencies to 180+ countries, all from a single dashboard designed for managing complex international payments at scale.

Many reviews note how simple yet powerful the platform is. It puts you in control of your payment operations. And all features are accessible from day one. If you're managing payments across multiple currencies regularly, you may opt for the option designed for operational control and simplicity.

Payment tracking

International payments don't always arrive on a predictable timeline. And when your supplier is waiting on funds to release a shipment, or a partner needs confirmation before moving forward, payment visibility becomes more than a nice-to-have.

How payment tracking works in Ebury

Ebury provides standard payment tracking. You can track international payments through the dashboard and see status updates as payments progress.

Tracking is functional and available to all clients. But there's no feature for shareable tracking links, though. Visibility stays within the platform. If a supplier asks, "Where's my payment?", you need to check the status and relay the information manually.

How payment tracking works in iBanFirst

iBanFirst provides detailed payment tracking with timestamped updates at every step of the payment lifecycle, from initiation through settlement.

What sets it apart is the ability to share tracking links directly with suppliers or partners, so they can see payment statuses themselves. That effectively eliminates the "Where's my payment?" back-and-forth that eats up time for finance teams managing dozens or hundreds of international payments.

Why does this matter? It's not just about convenience. When your suppliers can check payment statuses without calling or emailing, your finance team gets that time back — and your supplier relationships benefit from the transparency.

FX risk management tools to protect your cash flow and profit margins

Currency exposure is one of those risks that's easy to underestimate until it hits your P&L. If you're quoting prices in one currency and settling in another, every rate movement between invoice and payment can affect your margin.

Ebury FX risk management tools

Ebury has a deep FX heritage. FX risk management and foreign exchange trading are core to the business, and the available tools reflect that.

The FX capabilities include spot FX at current market rates, forward payment contracts for locking exchange rates against future swings, market orders (auto-execute at target rates), window forwards (draw down within a time window), and dedicated dealing teams for consultative guidance on managing foreign currency risks.

Ebury's FX toolkit is comprehensive. The range of FX risk management tools available covers multiple currency risk management strategies for businesses managing foreign currency exposure.

The nuance is in how you access those tools. Ebury's consultative model means the sophistication of tools and guidance you receive scales with your relationship and volumes. Newer or smaller clients may not get the same depth of access as established, high-volume accounts. That's the trade-off of a relationship-driven approach: it rewards loyalty, but your starting point depends on your profile.

iBanFirst FX risk management

iBanFirst provides FX risk management tools with no volume thresholds or relationship gating. Every client can access forward payment contracts.

Three types of forward payment contracts are available for managing foreign currency risks:

- Fixed forward payment contracts: lock in today's exchange rate for a known future payment date and amount

- Flexible forward payment contracts: lock in a rate for a set total amount, then draw down across multiple payments over time

- Dynamic forward payment contracts: lock in a floor rate for downside protection while keeping upside if rates move in your favour

There's no volume threshold or account tier required to access any of these. They're part of the standard toolkit for every iBanFirst client, built for businesses with ongoing multi-currency payment obligations.

The tools don't stand alone. Every iBanFirst client also gets access to FX specialists who bring market insight and hands-on guidance for execution decisions. So when you're weighing whether to lock in a rate now or wait, you're not relying solely on your own read of the market. Human expertise and platform tools work in tandem. For a comprehensive overview of how forward payment contracts work, the guide covers all three types in detail.

Level of client support offered

Support models differ between these two providers. And when your team is making FX decisions that directly affect deal profitability, the calibre of support you can actually reach matters more than the label on the service tier.

Ebury’s support model

Ebury takes a relationship-driven approach to support. Finance teams get access to knowledgeable FX professionals by phone and email for market insights and strategic guidance on complex FX scenarios.

Ebury's support model scales with relationship size, which means newer or smaller clients may find the ramp-up period harder without equivalent support access. That's a genuine trade-off, not a flaw. Relationship-driven models have real advantages: they reward loyalty and can deliver deeply personalised guidance for the right profile.

iBanFirst's support model

iBanFirst provides dedicated account managers from day one. Every client gets access to specialists with real FX expertise. They help finance teams with execution timing, FX strategy and market context. They're not generic support agents reading from scripts.

Dedicated support isn't just about issue resolution either. When you're making FX decisions that directly affect your margins, having a real person who understands your business context makes a difference — especially when automated tools alone don't give you the full picture.

For businesses where FX decisions directly affect margins, that kind of accessible human expertise is a genuine operational advantage.

Who is each provider best for?

Ebury and iBanFirst are both solid options when managing your cross-border payments and FX risk. The question is: which one aligns with your specific priorities and how you operate day to day?

When Ebury may be the better fit

Ebury is a strong choice if your business needs extend beyond core cross-border payments into trade finance, or if you value a relationship-driven model with consultative FX guidance.

Ebury may be the better fit if:

-

You need trade finance solutions

-

You're an established business with high transaction volumes looking for a consultative FX partner where relationship depth unlocks better pricing and more tailored foreign exchange services

-

You're in sectors where Ebury has deep specialisation, like education or NGOs

When to look for an Ebury alternative

That said, not every business is best served by Ebury. Here are three signs you might need to look at an alternative:

- You need consistent, predictable costs — Ebury's pricing can vary by currency pair, transaction size, and relationship stage, making it difficult to predict costs from one payment to the next. For finance teams that need reliable cost projections for budgeting, that variability creates real friction.

- You prioritise a modern, intuitive platform — Ebury's interface carries a steeper learning curve than newer competitors, and for teams that use their payment platform daily, that UX gap compounds.

- You want full access without needing to build up a relationship first — Ebury's relationship-driven model means tool access, support depth, and pricing can improve as your volumes and relationship grow. If you value agility and want quick, easy access, the model may not match your timeline.

When iBanFirst may be the better fit

We focus on established international SMBs whose cross-border payments, FX risk management and cash flow protection require a modern, easy-to-use platform combined with FX support.

iBanFirst may be the better fit if:

- You value transparent, predictable pricing over a custom model with variable costs

- You want dedicated FX specialist support from the start

- You value the control and transparency of a modern payment platform

- You long for real-time payment tracking with shareable links, giving your finance team confidence in payment status and reducing supplier back-and-forths

If transparent costs, accessible tools, and operational visibility are what you're looking for, iBanFirst's focused approach delivers.

Request an account today and see why thousands of international businesses choose iBanFirst.

Pricing and features referenced in this article were reviewed in 2026. We recommend verifying current details on each provider's website.

Topics