Publication date

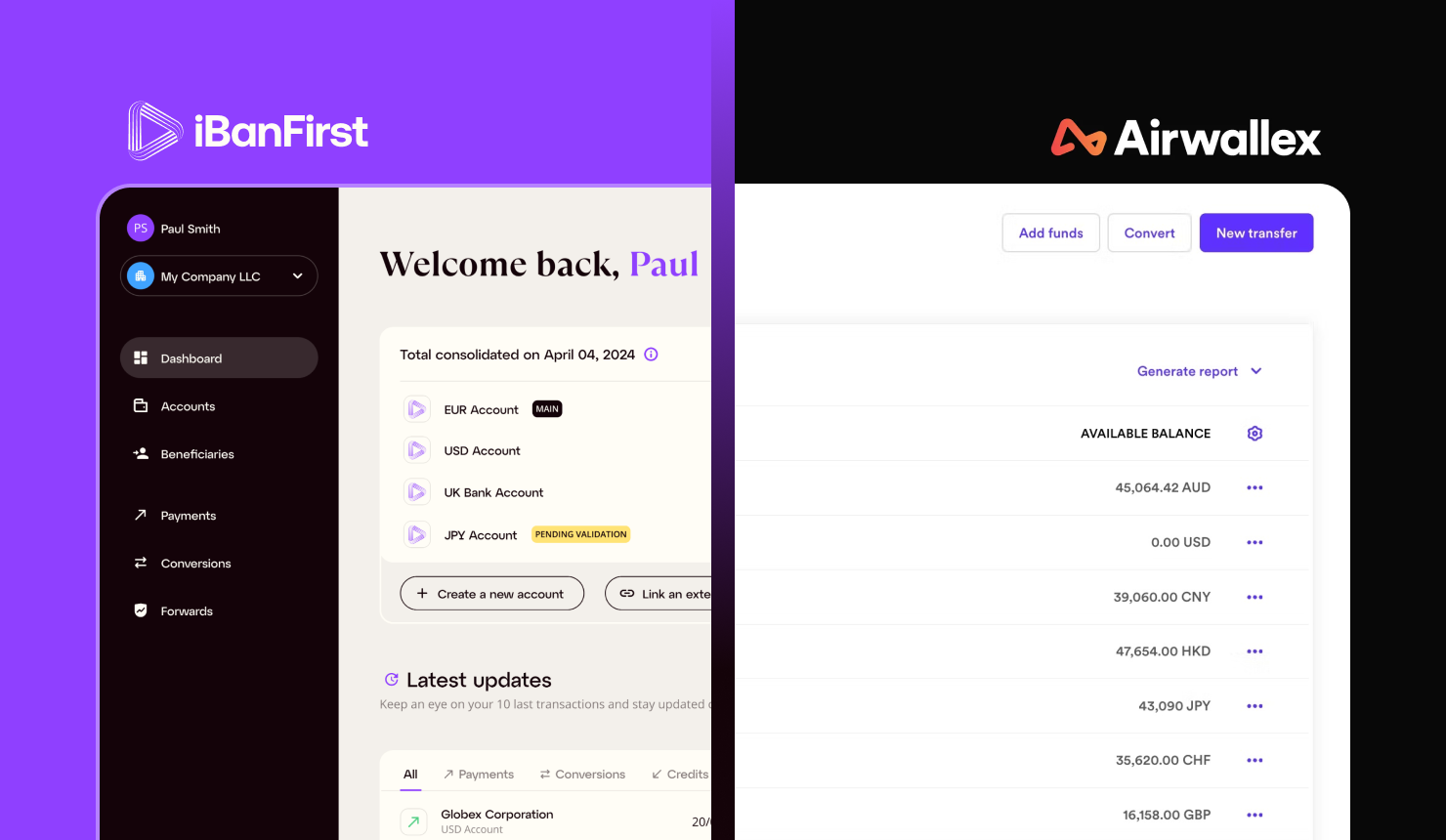

If you're running cross-border payments for a growing international business, chances are you've come across both Airwallex and iBanFirst.

Both serve a similar audience — international businesses managing cross-border payments — but they take fundamentally different approaches.

Airwallex bundles breadth across payments, cards, and e-commerce. iBanFirst focuses on depth for cross-border payment processing and FX risk management.

So which one should you choose?

Well, it depends on your business needs. This guide compares both providers on pricing, currency accounts, international payments, FX risk management, payment tracking, and support, so you can figure out which one makes the most sense for you.

Airwallex overview

Airwallex is a global financial platform founded in Melbourne and is used by over 200,000 businesses across 200+ countries.

The product suite is broad, allowing you to:

- Open and manage multi-currency accounts in 20+ currencies

- Initiate payments in 60+ currencies

- Access payment gateway features to collect e-commerce payments from global customers

- Use virtual and physical cards for expense management

- Control team spending

It covers a lot of scenarios, from online sellers collecting online payments through checkout links to larger businesses managing team expenses. But breadth and depth are different things — and depending on what your business actually needs day-to-day, that distinction matters.

iBanFirst overview

iBanFirst is a European cross-border payment provider built for established SMBs managing significant cross-border payment volumes.

Our offering is narrower than Airwallex's because we focus on meeting the specific needs of our core audience — small to medium-sized multinationals:

- Open and manage multi-currency accounts in 25+ currencies

- Initiate payments in 135+ currencies

- Access real-time payment tracking

- Protect your margins with FX risk management tools

- Access support from dedicated FX specialists

Where Airwallex is a broad platform serving everyone from freelancers to enterprises, iBanFirst is purpose-built for scaling international businesses with real FX complexity.

Airwallex vs iBanFirst at a glance

|

|

Airwallex |

iBanFirst |

|

Pricing model |

Tiered: Ranges from €0 to €999 per month or custom pricing |

Flat: no tiers, no setup fees, uniform exchange rate spread |

|

Currencies |

Hold and receive funds in 20+ currencies, make payments in 60+ currencies |

Hold and receive funds in 25 currencies, make payments in 135+ currencies |

|

FX risk management |

Forward payment contracts for Accelerate tier only |

Forward payment contracts for all clients |

|

Dedicated support |

Support from FX experts for Accelerate tier only |

Support from FX experts for all clients from day one |

|

Payment tracking |

Standard tracking |

Timestamped updates at every step with shareable links for beneficiaries |

|

Cards & expenses |

Virtual and physical cards, expense management |

No debit cards |

|

Payment gateway |

Full e-commerce gateway with checkout links |

Not a payment gateway provider |

Pricing structures and standard fees

Pricing may be where these two providers diverge most, so let's take a closer look at what you actually pay and what you get.

Airwallex pricing: Tiered pricing structure

Airwallex uses a tiered pricing structure with monthly subscription costs that increase with each tier:

- Explore: €0 per month (requires a €10,000 monthly deposit or €10,000 balance maintenance) or €19 per month

- Grow: €49 per month, which adds expense management and bill pay

- Accelerate: €999 per month, the only tier with a dedicated account manager, FX forward payment contracts, and priority support

- Custom: Tailored pricing for high-volume businesses

Airwallex also adds 0.5% to 1% exchange rate markups on currency conversions, depending on the currency pair.

It's worth noting how easily costs can compound. Monthly allowance limits, variable transfer fees, and FX spreads that change by tier and currency pair make it harder to predict your total spend. The Accelerate plan is best suited for the needs of SMBs with FX tools and dedicated support — but the price is on the steeper end.

iBanFirst pricing: Transparent pricing, no tiers

iBanFirst uses a flat, transparent pricing structure with no tiered subscriptions. That means:

- No opening fee to get started (excluding Luxembourg)

- No monthly subscription costs

- No hidden transfer fees

Instead, we use personalised foreign exchange rate quotes, agreed upon during each client’s onboarding process. Clients get the same tools, same support, and pricing structure from day one.

Our model is designed to be predictable. You can forecast your FX costs reliably without worrying about tier thresholds — and that predictability tends to matter more for scaling businesses.

Multi-currency business accounts

A multi-currency account is foundational for any cross-border payment provider. Each provider approaches this slightly differently.

Airwallex multi-currency accounts

Airwallex offers a multi-currency account so you can hold and receive both domestic and international payments in 20+ currencies.

Currency availability and payment capabilities vary based on your entity and location, so the exact currencies you can access may differ. That said, Airwallex's currency coverage is a genuine strength, particularly for businesses with APAC trade relationships, where currencies like CNY and HKD are well supported.

iBanFirst multi-currency accounts

iBanFirst provides multi-currency accounts so you can hold and receive funds in 25+ foreign currencies from a single business account.

The platform is simple yet powerful and puts you in control of your payment operations. All features are accessible from day one. We don't gate currency accounts or functionality behind tiers. If you're managing payments across multiple currencies regularly, you may opt for less breadth of features and choose the option designed for operational simplicity.

Cross-border payments: currencies and coverage

This is where the day-to-day operational differences between these platforms become clearest.

Airwallex cross-border payments

Airwallex supports global payments to 200+ countries with 60+ payout currencies. The platform handles international transfers via SWIFT and local rails, batch payment processing, and API-driven payouts.

Airwallex also doubles as a payment acceptance platform. You can accept payments and receive payments through 160+ payment methods, including local options like Alipay, WeChat Pay, and iDEAL. For e-commerce businesses, that payment acceptance capability is a differentiator.

There's an important distinction here, though. Airwallex works both as a cross-border payment sender and as a payment gateway. For businesses focused on facilitating payments to suppliers rather than collecting from customers, the gateway functionality may not be relevant.

iBanFirst cross-border payments

iBanFirst supports cross-border payments to 180+ countries in 135+ payout currencies with transparent pricing on every transaction. Cross-border payments are what iBanFirst was built for — it's the core of the platform, not one feature among many.

With iBanFirst, you can pay suppliers abroad and collect payments from overseas customers — all from a single platform designed for managing complex international payments at scale.

We don't offer a payment gateway, checkout links, or e-commerce payment acceptance. iBanFirst is specifically built to manage incoming and outgoing international payments, not to process online consumer transactions. If your cross-border payment needs centre on supplier payments, intercompany flows, and international collections rather than e-commerce checkout, iBanFirst is a good fit for your business.

Payment tracking

Once you've sent a payment, knowing where it is and when it will arrive matters — especially when suppliers or partners are waiting on funds.

How payment tracking works in Airwallex

Airwallex provides standard payment tracking. You can track international payments through the dashboard and see status updates as payments progress. Tracking is functional and available across tiers.

There's no feature for shareable tracking links, though. Visibility stays within the platform. If a supplier asks, "Where's my payment?", you'd need to check the dashboard and relay the information manually.

How payment tracking works in iBanFirst

iBanFirst provides detailed payment tracking with timestamped updates at every step of the payment lifecycle, from initiation through settlement.

What sets it apart is the ability to share tracking links directly with suppliers or partners, so they can see payment status themselves. That effectively eliminates the "Where's my payment?" back-and-forth that eats up time for finance teams managing dozens or hundreds of international payments.

Why does this matter? It's not just about convenience. When your suppliers can check payment statuses without calling or emailing, your finance team gets that time back — and your supplier relationships benefit from the transparency.

FX risk management tools to protect your cash flow and profit margins

When you're invoicing or paying in foreign currencies, exchange rate movements directly affect your margins. Even a small shift of a few percentage points can quietly erode a deal's profitability — and the longer the gap between agreement and settlement, the more exposed you are.

The question is how accessible the tools for managing that risk actually are.

Airwallex FX risk management

Airwallex provides spot-rate currency conversions across all tiers, with FX spreads ranging from 0.5% to 1%, depending on the currency pair.

But this is where the tier structure makes the biggest difference: Forward payment contracts, the primary tool for managing currency risk against exchange rate swings, are only available at the Accelerate plan level (€999/month) and above. Explore and Grow tier clients are limited to spot rates only.

What that means practically is that if you're on a lower tier, you're exposed to exchange rate movements on every conversion with no way to lock in rates for future payments. That can lead to unnecessary conversion fees when rates move against you.

What about rate alerts?

Rate alerts are available on all tiers. But alerts without actionable tools (forward payment contracts) only tell you that rates moved. They don't help you manage the exposure. For SMBs that need FX risk management, the Accelerate plan requirement to access forward payment contracts is a significant consideration — especially when those tools are table stakes for managing international payments at scale.

iBanFirst FX risk management

iBanFirst provides FX risk management tools from day one. We don't gate access behind tiers or minimum transaction thresholds.

Three types of forward payment contracts are available for managing foreign currency risks:

- Fixed forward payment contracts: lock in today's exchange rate for a known future payment date and amount

- Flexible forward payment contracts: lock in a rate for a set total amount, then draw down across multiple payments over time

- Dynamic forward payment contracts: lock in a floor rate for downside protection while keeping upside if rates move in your favour

All three are available to every iBanFirst client and are designed for businesses managing recurring currency exchanges across their supply chain.

But this isn't a purely automated or self-serve system where you're left to deal with FX complexity yourself. We pair FX risk management with access to dedicated FX specialists who provide market context, help with execution decisions and ensure you adopt a strategy tailored to your business needs.

Client support

The support you get from each provider looks quite different. And for businesses managing complex FX decisions, the type of support matters as much as its availability.

Airwallex support model

Airwallex's support model is plan-dependent. The level of access you receive scales with the amount you pay.

The Explore tier comes with email, chat, and a knowledge base. The Grow tier adds faster response with limited phone support. And the Accelerate plan is the first tier with a dedicated account manager.

Users have also reported a steep learning curve with the platform. Airwallex's complexity means support access matters more, not less. The combination of a feature-rich platform and self-serve-heavy lower tiers creates friction for teams that need guidance.

iBanFirst dedicated support and FX market expertise

iBanFirst provides dedicated account managers from day one. Every client gets access to FX specialists — regardless of plan level or payment volume.

Our FX specialists have real FX market expertise and help finance teams with execution timing, FX strategy and market context. They're not generic support agents reading from scripts.

Dedicated support isn't just about issue resolution either. When you're making FX decisions that directly affect your margins, having a real person who understands your business context makes a difference — especially when automated tools alone don't give you the full picture.

For businesses where FX decisions directly affect margins, that kind of accessible human expertise is a genuine operational advantage.

Who is each provider best for?

Both providers serve international businesses, but they're built for different business needs.

When Airwallex may be the better fit

Airwallex is a strong choice if your needs extend beyond cross-border payments into e-commerce payment acceptance, team expense management and corporate cards.

- You're an e-commerce business that needs a payment gateway with checkout links and 160+ payment methods

- You need physical cards and debit cards for team spending, with controls to manage expenses

- You want integrated accounting tools (Xero, QuickBooks, NetSuite) with automated bank feeds

- You're a larger business comfortable with a higher monthly subscription for access to FX tools, virtual cards, and more from a single provider

- You have significant APAC trade relationships where Airwallex's regional connectivity is a genuine advantage

When to look for an Airwallex alternative

That said, not every business fits that profile. And there are clear signals that Airwallex may not be the right cross-border payment provider for your needs.

Three signs you might need an alternative:

- You're paying for features you don't use: Tiered pricing unlocks developer tools, automation, and embedded finance capabilities that many SMBs never touch, but you may end up paying for them to get the functionality you do need

- Pricing doesn't match your volume profile: Airwallex's pricing structure isn't the most SMB-friendly, especially if your volumes are steadily growing but modest compared to a large enterprise business

- You need human support you can't access: Self-serve dominates the lower tiers, and dedicated support requires a premium plan

If any of these resonate, it's worth comparing alternatives. And for businesses needing to receive foreign currency or manage intercompany flows, purpose-built tools may serve better than a broad platform where those capabilities are one of many features.

When iBanFirst may be the better fit

If those signals sound familiar, iBanFirst is built to address them directly.

We focus on established international businesses where cross-border payments, FX risk management and cash flow protection are the core priorities.

iBanFirst may be the better fit if:

- You're managing international supply chains with regular multi-currency payments to suppliers across borders

- You need FX risk management tools (forward payment contracts) to protect against foreign currency risks — accessible from day one, not gated behind a premium tier

- You want dedicated support from FX specialists from the start, not after upgrading to a more expensive plan

- You value transparent, predictable pricing over a tiered model with variable costs

- You're among the scaling international businesses that have outgrown entry-level providers and need professional-grade tools without enterprise complexity

If cross-border payments and FX are your primary operational challenge, our focused approach provides deeper coverage where it matters. The tools and support that other providers like Airwallex reserve for their highest tiers come standard with iBanFirst.

Choose the right cross-border payment provider for your business

The Airwallex vs iBanFirst decision comes down to what your business actually needs day-to-day. Airwallex offers breadth across payments, cards, and e-commerce. iBanFirst offers depth on cross-border payments, FX risk management, and dedicated human expertise.

Here's exactly what you'll get with iBanFirst:

- Multi-currency accounts to manage 25+ global currencies from one dashboard

- Easily send, receive and convert funds on your schedule

- Fixed, flexible and dynamic forward payments to manage currency exposure and lock in rates

- Support from real, human FX experts — not just chatbots and complex help docs

- Real-time payment tracking for international payments with timestamped updates and shareable links for your suppliers and partners

- No feature gating — you get access to the platform, FX experts and dedicated support from day one

- Transparent pricing with no hidden fees

Request an account today and see why thousands of international businesses choose iBanFirst.

Pricing and features referenced in this article were reviewed in 2026. We recommend verifying current details on each provider's website.

Topics