Among the various solutions that help companies protect themselves against foreign exchange market volatility are forward payment contracts.

Flexible forward payment contracts (FFC) are an FX contract that allows the contracting party to fix the buy or sell rate of a currency pair at a particular time, between two set dates, for a specific amount. In addition, and depending on the contracting party’s business, they can either exchange the full or partial amount(s) at any time during the contract’s duration, at the pre-agreed rate.

Protect profit margins, control currency exchange risk, gain flexibility

Companies use flexible forward payment contracts to manage currency risk when they need to make or receive a series of payments on uncertain dates or for still unspecified amounts. Either all, or a mere proportion, of the flexible forward can be used over the course of the agreed period to make one or more foreign exchange payments, or to convert one or more payments received at a guaranteed exchange rate.

Use cases for flexible forward payments:

- You are an importer and want to control the cost of your purchases in one or more foreign currencies.

- You are an exporter and want to secure the price of your foreign currency sales.

- You are uncertain about settlement dates with your customer and supplier partners.

- You want a single exchange rate for several forward exchange transactions.

Flexible forward payment contract characteristics

| Characteristics | Guideline |

| Security | Take control of your profit margins by benefiting from a guaranteed exchange rate on future payments in foreign currencies |

| Flexibility | Make use of your foreign currency reserve and the flexibility it provides, in accordance with the due dates of your invoices |

| Buy currency | Any of the 30 currencies offered by iBanFirst, excluding EUR |

| Sell currency | EUR only |

| Nominal amount currency | Buy currency |

| Minimum amount | €15,000 |

| Settlement date | From 1 to 12 months |

| Beginning of take-up period date |

Variable depending on the currency pair; the first possible take-up date is automatically calculated and shown on the platform |

| Take-up period | From the beginning of the take-up period to the settlement date |

| Take-up minimum amount | €1,500 |

| Minimum or maximum take-up figure |

None |

Risks

- In cases where the purchased currency depreciates in value, there may be a loss of opportunity, as the guaranteed forward exchange rate is non-modifiable.

- The flexible foreign exchange is a firm commitment, so it is not designed to cover uncertain transactions, such as quotes, invitations to tender and so forth.

How flexible forward payments work

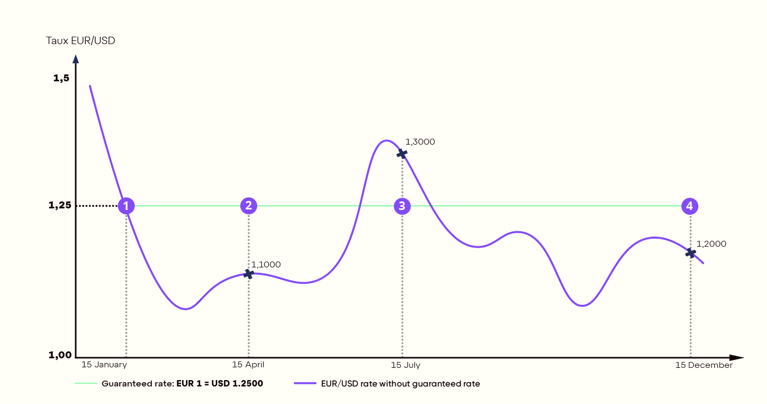

You are an importer located in Europe and on 15 January both you and your US-based supplier agree on the total amount of goods to be bought for the current year.

You expect to buy products for a total value of $450,000. However, at this stage, you have no clear visibility as to the quantity of products needed or the date on which you will place your orders, so you remain uncertain of the breakdown of payments to be invoiced.

In order to avoid currency exchange risks and secure your profit margin, particularly as you cannot change the selling price of the goods concerned, you would like to buy a flexible forward payment contract from iBanFirst, ensuring that you can convert EUR to USD at several points throughout the year at a fixed exchange rate.

You contact your iBanFirst Account Manager and agree to buy a flexible forward payment contract with the following features:

- Buy Currency: USD

- Sell Currency: EUR

- Nominal amount: $450,000

- Settlement date: 15 December

- Beginning of take-up period: 1 February

- Take-up period: 1 February until 15 December.

- Agreed guaranteed rate: 1 EUR = $1.2500

Lifecycle of the flexible forward payment

|

|

15 January You buy a flexible forward payment contract from iBanFirst. The nominal value is set at $450,000 against the euro, at a guaranteed price of €1 = $1.2500, to be used by 15 December. |

|

3 April You make a payment for an invoice of $260,000, at a guaranteed price of €1 = $1.2500, equivalent to €208,000. |

If you had used the spot price on the day (€1 = $1.1000), the amount you would have spent would have reached €236,363. So, in theory, you have a positive currency impact of €28,363 by using your flexible forward payment contract.

|

15 July You make a payment for an invoice of $130,000, at a guaranteed price of €1 = $1.2500, equivalent to €104,000. |

If you had used the spot price on the day (€1 = $1.3000), the amount you would have spent would have reached €100,000. So, in theory, you have a negative currency impact of €4,000 by using your flexible forward payment contract.

|

15 December You make a final payment for an invoice of $60,000, at a guaranteed price of €1 = $1.2500, equivalent to €48,000. |

If you had used the spot price on the day (€1 = $1.2000), the amount spent would have been €50,000. So, in theory, you have a positive currency impact of €2,000 by using your flexible forward payment contract.

Conclusion

All throughout the year, you were able to benefit from the same exchange rate and manage your currency risks. You knew from 15 January that you would need €360,000 to cover the costs of your US-based supplier. Therefore, you were able to budget the total costs of your USD invoices and set your sales with the appropriate profit margin, without worrying about the EUR/USD currency pair’s fluctuations.

Topics