Publication date

Jump straight to

Share this article

For more and more organisations, managing international transfers is a crucial part of their day-to-day operations. And businesses able to make cross-border payments in the fastest, least-expensive way possible may find themselves gaining an important edge on the competition.

However, knowing exactly how long an international transfer will take to process is far from straightforward. There are plenty of factors and moving parts involved, making the whole process a complicated — and oftentimes an unenviable — one for businesses to navigate.

Fortunately, there is a way to make international transfers easier to manage. By familiarising yourself with how international transfers work, you can develop a better idea of how long each one will take. And you might end up saving yourself and your business time and money in the process.

How long do international business payments take?

International business payments typically take anywhere from a few minutes to five business days, depending on the currency, destination, payment method and provider you choose. Let's take a closer look at the latter two:

- Payment type — whether you're using SEPA, SWIFT or wire transfers

- Your provider — traditional banks vs dedicated cross-border payment providers

The difference between these options can be massive. We're talking about payments potentially settling within the same day versus waiting almost a week (perhaps more). Let's break down exactly how long each payment type takes and what you can expect from different providers.

SEPA payments vs SWIFT payments vs wire transfers

Not all international payments are created equal. Each system operates differently, serves different purposes, and — most importantly for your business — takes different amounts of time to get your money where it needs to go.

Here are the three main options for you to choose from:

- SEPA payments — Fast transfers within Europe using euros

- SWIFT payments — Global network handling most international currencies

- Wire transfers — Electronic money movement between worldwide banks

Before we talk timing, here's something that trips up a lot of people: Wire transfers and SWIFT payments aren't actually competing systems — they often work together. Think of a wire transfer as the actual digital "envelope" that contains your money and the SWIFT network as the messaging network that tells banks where that envelope needs to go.

Most international wire transfers use the SWIFT network for these instructions, but not all of them. Some banks have their own networks or use alternative systems. That's why understanding the difference matters when you're planning your payments and trying to figure out timing.

How long do SEPA payments take?

Most SEPA transactions are processed within one business day, though they can take up to four in exceptional cases.

SEPA is Europe's unified payment system for euro transactions. It covers credit transfers, direct debits and card payments across participating European countries — basically eliminating the hassle of separate national payment systems.

Here's why they're faster: Compared to cross-border transactions that involve multiple currencies, SEPA payments are far simpler. There are no currency conversions needed and no intermediary banks bouncing your money around — just straightforward transfers within the European zone.

How long do SWIFT payments take?

SWIFT payments typically take 2-5 business days to settle, although they can take longer if weekends or public holidays get in the way.

Unlike SEPA, SWIFT operates across a massive range of currencies worldwide. But naturally, that global reach comes with trade-offs that can slow things down.

Each country has different regulations, banking hours, and processing requirements. Settlement times vary based on destination country, intermediary banks and compliance processes.

So what are the major factors that affect speed? In our Speed of International Payments 2025 report, we break this down in more detail.

A few key factors that stand out:

-

Time zones and banking hours: Your money only moves during business hours in each country it passes through. A USD payment from Europe to China, for example, will transit through at least one US intermediary bank, then needs to wait for Chinese banks to open — often adding 10+ hours of idle time to a single payment.

-

When you initiate the payment matters: Payments sent by 10am on a Monday or Wednesday have the highest chance of same-day execution. Anything initiated after Friday afternoon cutoffs will typically sit idle over the weekend.

-

The "final mile" bottleneck: Swift's own data shows that 90% of payments reach the beneficiary's bank within an hour, but only 43% are credited to the recipient's account that quickly. The biggest delay often isn't the journey; it's the receiving bank's internal processing.

How long do international wire transfers take?

International wire transfers typically take 2-5 business days to reach your beneficiary.

Yes, that's the exact same timeframe as SWIFT payments. As we mentioned earlier, most international wire transfers actually use the SWIFT network for their routing instructions. This means when you're sending a wire transfer overseas, you're likely dealing with the same intermediary banks, processing delays and time zone issues that slow down SWIFT payments.

Some banks do use their own networks instead of SWIFT for certain transfers, but for most international business payments, you're looking at that familiar 2-5 business day window either way.

International payments with traditional banks vs cross-border payment providers

As mentioned, your choice of payment provider is one of the major factors affecting payment speed. Now let's dig into why that matters.

Traditional banks and dedicated cross-border payment providers handle international payments very differently — and those differences show up directly in your transfer times.

Transferring money with traditional banks

So we know what SEPA and SWIFT payments are, and we know that the latter almost always involves currency exchange and could take more than a week when processed with a traditional bank.

At this point, you may be thinking that this longer turnaround time comes with lower transaction costs. If only it were that simple! In fact, money transfers made between different currencies by traditional banks come with a host of different fees, including issuing commissions, exchange commissions and increased rate commissions, plus the fees charged by intermediary and receiving banks. It's worth remembering that money transfers are not a bank's core business.

Don’t worry, though! There is an alternative to traditional banks. One that offers faster execution, greater visibility and competitive rates.

Transferring money with iBanFirst — a cross-border payment provider

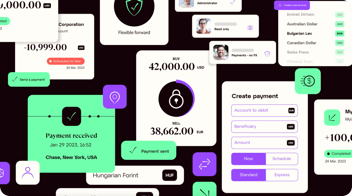

Unlike traditional banks, iBanFirst offers a whole suite of different payment speeds, so that you can choose the best option for you and your business. In fact, iBanFirst allows you to control the speed and cost of your payments (depending on account currency, bank and beneficiary’s country).

Our different rates of payment speed:

- Instant: Payments between iBanFirst accounts are instantaneous and free of charge

- Standard: Payments are generally credited to the beneficiary's bank account within two to three working days.

How to track an international transfer

When you make international payments through your bank, you get little to no visibility of where it is, when it's likely to arrive or whether it's been delayed.

With iBanFirst, you'll have access to a payment tracker to get detailed, timestamped updates on international payments made via the SWIFT network. It's like tracking a parcel! You can see where your payment is, which intermediary banks it's passing through, and when it arrives. And for even greater transparency, you can share tracking links with your beneficiaries, allowing them to follow the payment at every step too.

Get started with iBanFirst and maximise your control over international payments

For businesses, sadly, there's no magic system you can use to make instantaneous and free money transfers across different currencies. But that doesn't mean you can't find solutions that are faster, less expensive and provide greater visibility than those offered by traditional banks.

Alternative partners like iBanFirst ensure transparent, secure, international money transfers, low-cost international payment tracking and, above all, shorter transfer times than traditional banks.

Ready to get started?

Request an account today to get the ball rolling, or start with our quick interactive product demo to see the iBanFirst platform in action for yourself.

Topics