Publication date

Jump straight to

- What are the main international payment systems used in Europe?

- What’s the difference between SWIFT and SEPA?

- What information do you need ot make international payments?

- When are IBAN and SWIFT/BIC codes used?

- How long do international payments take with SWIFT?

- How long do international payments take with SEPA?

- How much do international payments cost? SWIFT vs. SEPA

- Your trusted interational payment partner

Share this article

We get it — international payments can be complicated.

There's so much jargon surrounding them, plus there are a bunch of processes that you need to get your head around. But no matter how much of a pain they can be, they are unavoidable for many businesses. And the better you understand the ins and outs of cross-border payments, the more likely you are to be able to save your company time and money.

In this guide, we'll cover the main international payment systems used in Europe and beyond, as well as how to use these systems, how long they take and how much they cost.

What are the main international payment systems used in Europe?

Europe uses two main international payment systems: SWIFT and SEPA. SWIFT handles multi-currency transfers globally, while SEPA processes euro payments within European countries. SWIFT works with any currency but takes longer, while SEPA is faster and cheaper for euro transactions.

Here's how each international payment system works:

SWIFT payment network

SWIFT (aka Society for Worldwide Interbank Financial Telecommunication) is the oldest international financial transfer system in the world, dating all the way back to the 1970s. It's used by over 11,000 institutions across 200 countries. To put things into perspective, nearly half (40%) of all international transfers use the SWIFT network.

SEPA payment network

SEPA (Single Euro Payment Area), on the other hand, is a European-based payment network. Fully implemented in 2014, SEPA is currently used by 40+ European countries, including several not covered by the eurozone or in the European Union, such as Iceland, Switzerland and the UK.

But how do these two systems differ when it comes to making international payments? And which one is best for your business?

What’s the difference between SWIFT and SEPA?

The main difference between SWIFT and SEPA is that the former can be made in various currencies, while SEPA is limited to euro-denominated bank accounts.

As an example, while you could happily make a payment from a German account to a Spanish one using SEPA, you would need SWIFT to make a payment from the same German account to a Japanese beneficiary.

Furthermore, SEPA cross-border payments are typically quicker and less expensive than their SWIFT counterparts. However, the payer or payee may have to pay currency conversion fees for payments outside the eurozone, such as those originating or ending in the UK.

What information do you need to make cross-border payments?

Let’s get into the practical stuff. As well as information about the payer and payee account names, international payments may require the following numbers or codes:

- IBAN (International Bank Account Number)

- SWIFT code or BIC (Business Identifier Code).

Let's break down what each looks like.

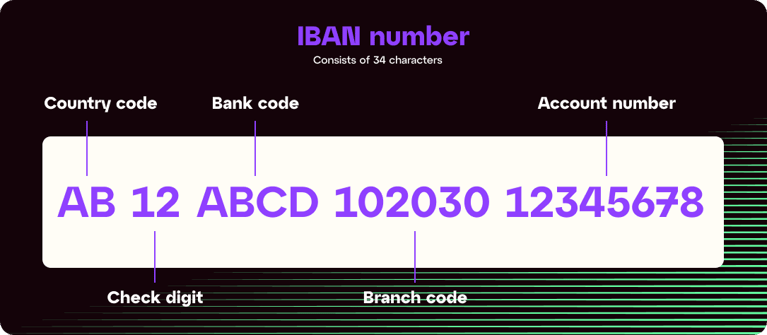

Example of an IBAN number

In simple terms, the IBAN is used to identify an individual bank account. Before its introduction, each country had its own bank account format. This system led to errors and delays in cross-border transactions. The IBAN system improves the verification of cross-border payments and reduces errors, rejected payments, transfer delays and bank fees. Click here if you're interested in the technical specifications of each participating country's IBAN format.

You can verify an IBAN number using an online IBAN checker tool before starting an international payment.

Example of an IBAN number

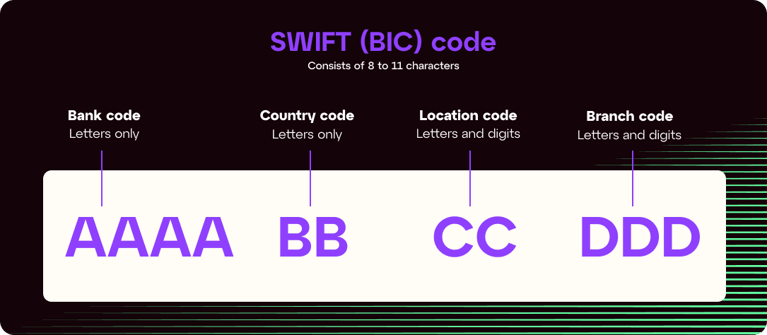

Example of a SWIFT/BIC code

Every financial institution in the SWIFT network is assigned a unique code: a Business Identifier Code (BIC).

Unlike IBAN, the SWIFT/BIC code is used to identify a financial institution, rather than an individual bank account. BIC codes contain 11 alphanumeric digits to represent the bank, location, country and branch code.

SWIFT and BIC are often used interchangeably, but in practice, SWIFT is the issuing organisation that controls the use of BICs. You can view the complete list of BICs currently in use around the world by clicking here.

Example of a SWIFT (BIC) code

When are IBAN and SWIFT/BIC codes used?

IBAN numbers were originally designed to be used for payments in the eurozone but are now required or recommended by 70+ countries worldwide. You can see the list of countries mandating IBAN numbers by clicking here.

SWIFT/BIC codes are used for global payments across the network involving over 200 participating countries. Notably, SWIFT codes are not used by China, Russia, North Korea, Iran, Syria, Cuba and Ukraine. You can find the list of SWIFT countries by clicking here.

As of 2016, SEPA payments no longer require a SWIFT/BIC code. However, all SEPA transfers require an IBAN number.

How long do international payments take with SWIFT?

In most cases, SWIFT payments take two to five business days to be processed. There are, however, three factors that can impact the timing of cross-border payments with SWIFT, including:

- Anti-fraud and anti-money laundering procedures that occur before a payment is credited to the recipient’s account

- Whether or not an intermediary bank or network is involved, which occurs when there is no direct relationship between the payer’s and payee’s banks

- Bank business days, holidays, time zones and individual banking processes and procedures.

SWIFT recently launched a new initiative – SWIFT Global Payments Innovation (GPI) – to improve the speed, transparency and traceability of international payments. Institutions that join the GPI agree to a new set of rules governing fee transparency, end-to-end payment tracking, confirmation of credit to the recipient's account and data record consistency. This new technology enables real-time tracking of cross-border payments, making international payments as simple as local payments.

How long do international payments take with SEPA?

Generally speaking, SEPA is the fastest system for making international payments within participating countries. However, there are a few different types of SEPA that you need to be aware of.

Typical cross-border payments made with SEPA take up to one business day, making them significantly faster than SWIFT payments. But SEPA offers a payment option that’s even faster – Instant Credit, which is processed within a few seconds, even on holidays and weekends. SEPA also offers B2B Direct Debit, which takes up to three business days to be processed.

How much do international payments cost?

The fees associated with international payments are notoriously complicated, in part because multiple banks and institutions are typically involved in the process.

Generally speaking, transaction fees for SWIFT international payments run between €15 and €50. Currency conversion fees are charged in addition to these fees, when applicable, and can run as high as 3% to 5% of the payment amount.

SEPA transfer fees are minimal, and there are usually no bank charges associated with a SEPA transfer. Some banks may charge a fee to receive a SEPA transfer, however. There are never any currency conversion fees associated with SEPA transfers since they are only used between euro-denominated accounts. This often makes SEPA transfers the fastest and most economical way to complete international payments when both the sender and beneficiary are working in euros.

Who's responsible for paying the fees for international transactions?

There are three possible options for who covers the fees associated with an international payment. These are SHA, BEN and OUR.

SHA (shared)

SHA stands for shared, because for each transaction, the costs are shared between the beneficiary and the issuer of the payment. Both the sender and the receiver pay a portion of the fee. The costs of the issuing bank are borne by the party sending the funds, while the costs of the intermediary and beneficiary banks are deducted from the amount sent and borne by the beneficiary. The more institutions involved, the higher the costs will be. This system is used for about 60% of market transactions.

BEN (beneficiary)

Short for beneficiary, the transaction costs for this option are invoiced to the payment beneficiary, as a deduction from the payment amount. This system is not very widespread and accounts for only 10% of market transactions.

OUR (issuer)

The issuer of the payment chooses to cover all costs. This ensures that the beneficiary receives full payment. This model represents about 30% of market transactions.

iBanFirst: Your trusted international payment partner

By mastering the different internal payment systems, you can save time and money for your business, gaining an edge over your competitors. If you’re looking for a partner to help you with this, then look no further than iBanFirst.

iBanFirst is a fully licensed and regulated Payment Service Provider (PSP) in Europe and the UK. We’re also a member of SWIFT and SEPA certified, meaning we can securely and efficiently facilitate international and domestic financial transactions in compliance with industry standards and regulations.

So if you’re ready to optimise your cross-border payment processes, then contact our experts today and find out how iBanFirst can help you manage international transactions with ease.

Common questions on international payment systems

We've covered the main international payment systems and how they work, but there are a few more practical questions that may still come up when businesses start sending money internationally. Here are the answers to some of the most common ones we hear.

What's the difference between international and domestic payment methods?

Domestic payments are typically processed through local networks using your own currency, making them faster and cheaper business transactions. International payments often require currency exchange, cross-border payment networks like SWIFT, and often multiple intermediary banks, which increases processing time and transaction fees compared to domestic payment systems.

What payment methods can I use for international transfers?

Technically, you can use credit card payments, online payment platforms, payment gateways, or traditional bank transfers through SWIFT or SEPA networks. But you'll likely end up paying much higher fees and exchange rate markups than necessary. Your best bet is to work with a dedicated cross-border payment provider like iBanFirst.

Are there monthly fees for international payment accounts?

Traditional banks often charge monthly maintenance fees for business accounts with international capabilities. Many specialised cross-border payment providers offer accounts with no monthly fees — you only pay when you actually make transactions.

With iBanFirst, there are no setup or recurring monthly fees, and the exchange rate markup we charge is fully transparent and consistent across all currency pairs.

How do foreign exchange rates affect my international payments?

Exchange rates directly impact how much you pay or receive in international transactions. Rates fluctuate constantly based on market conditions. Most providers add a markup to the mid-market rate, so comparing exchange rates across providers can save you money on currency exchange.

Topics