Publication date

Jump straight to

- Key trends affecting finance department structure

- Key functions in the finance department

- Common finance department roles explained

- 4 finance department organizational charts

- 5 best practices for structuring your finance department

- How a cross-border payment provider can help your finance department scale internationally

Share this article

Championing digitisation. Building resilience. Shifting the focus from crunching numbers and balancing the books to driving strategic business decision-making.

As a CFO, you may have noticed the changing demands your business is placing on you. You may have also realised that your finance department's structure is misaligned with these goals.

Figuring out how to structure your finance department in the face of such changes can seem intimidating. However, by understanding critical trends and using technology, you can transform your finance department into a business driver.

Let's dive into how CFOs can structure their finance department optimally.

Key trends affecting finance department structure

The trick to future-proofing finance is understanding the major trends affecting this space and organising your department to leverage them.

Here are the six most important trends affecting finance right now.

1. Finance is going selectively lean

AI and automation are transforming finance, leading to speculation that the function will soon become obsolete. However, Deloitte's Susan Hogan and Anton Sher think otherwise.

Writing in Deloitte's Finance 2025 report, they say, "Some find it interesting to speculate about finance disappearing under the crush of digital disruption, but we don’t see that happening. Yes, finance will likely be leaner, but that will mostly be a function of headcount in operational finance (order-to-cash, procure-to-pay, transactional accounting, etc.)."

Bottom line: CFOs must understand that while automation is reducing the number of human employees firms need, it's replacing repetitive manual functions, not all of finance.

2. Finance must add business value

Technology will reduce the number of human employees in operational finance but will force CFOs to rethink how they organise business finance.

In Deloitte's report, Hogan and Sher write, "Whether finance continues to direct the resources currently under its control will be dependent on its ability to add value. That will require quality insights and exceptional customer service."

As a result, "Expectations for support from business finance (business partnering, reporting, planning, budgeting, forecasting, etc.) and specialised finance (tax, treasury, IR, etc.) will continue to grow."

Bottom line: CFOs must deliver business insights, not just reports, to their organisations.

3. Real-time forecasting will increase

Most financial processes, like monthly closes, look backwards. Deloitte predicts that as technology improves, demand for real-time forecasting will increase.

"Finance organisations will still need to meet external demands for cyclical information, but outside investors may also want more frequent performance information," says Hogan and Sher. "There is no close. You’re not forecasting once a month or quarterly. It’s all happening in real-time."

Bottom line: CFOs must invest in ad-hoc, real-time tracking tools that give them accurate insights into their business.

4. Automation will replace outsourcing

Hogan and Sher believe CFOs must fully embrace automation. "Automation provides a new lever for managing costs," they say, "one that gives finance organizations the opportunity to reevaluate how they’re organised, where work gets done, and what kinds of processes no longer require human intervention.

Bottom line: CFOs must rethink outsourcing arrangements, exploring technology's ability to reduce costs and deliver work faster.

5. Finance skills are changing

Collaboration, storytelling ability, and customer orientation are just as important as analytical skills. Hogan and Sher advise. "All of your people should be able to contribute to elevating the value of finance in terms of communication, impact, and influence."

"Your finance organisation should be looking at every new hire through the 2025 lens."

Bottom line: CFOs must make every new hire count, aiming to future-proof finance as much as possible.

Key functions in the finance department

Now that you grasp the pivotal trends influencing the organisation of financial departments, here are the common functions found in most finance teams. Keep in mind that your company's size and industry will affect the importance and relevance of each one.

Procure-to-pay

The procure-to-pay function handles supplier relationships, from purchase orders to accounts payable. It's all about managing your company's spending — making sure you pay what you owe accurately and on time.

A well-run procure-to-pay function helps maintain vendor relationships while optimising when and how you spend your money. They're the ones making sure your supplies keep flowing without cash flow disruptions.

Order-to-cash

The O2C function handles customer relationships — from invoicing and accounts receivable to dispute handling and collections. They're responsible for turning your sales into actual money in the bank.

Your cash flow lives or dies by how well this team performs. The faster they can convert orders to cash, the more working capital you have available to run and grow your business.

Treasury

The treasury function manages working capital and cash flow. They handle bank relationships and monitor your company's credit status.

Treasury teams make decisions about what to do with your company's money — invest it, save it, or use it to pay down debt. For companies operating across borders, they also manage currency exchange and the risks that come with it.

Financial planning and analysis (FP&A)

FP&A is a relatively new finance function that handles forecasting, budget projections and efficiency tracking. They help answer the big questions like:

- Can we afford this initiative?

- Which products are most profitable?

- What happens if sales drop by 10%?

And so on. Essentially, FP&A bridges the gap between accounting (what happened) and strategic planning (what might happen). They turn data into insights that help leaders make smarter decisions about the company's future.

Tax

The tax function ensures your company complies with government norms and defines internal reporting standards. Beyond filing returns, tax teams also look for legitimate ways to minimise what you owe.

For businesses operating across borders, tax becomes increasingly complex — with each country having its own rules and regulations to navigate. A strong tax function helps you avoid surprises that could drain your cash reserves.

Accounting

The accounting function prepares accounting statement reports and manages expenses. They're the scorekeepers of your business — tracking what came in, what went out and what you have left.

Accounting provides the financial data that every other function depends on. Their accuracy and integrity create the foundation for all financial decisions, from daily operations to long-term strategy.

Common finance department roles explained

Finance departments rely on clear roles with specific responsibilities to run effectively. In smaller companies, people often wear multiple hats (hello weekend spreadsheets!), while larger organisations split duties among specialists. Let's break down who's who in a typical finance team.

Chief Financial Officer (CFO)

The CFO serves as the strategic financial leader, steering all things finance-related and partnering with the CEO and executive team on business decisions. Gone are the days when CFOs just crunched numbers—today's CFO is front and centre in shaping where the company is headed.

They're typically responsible for:

- Developing financial strategies that support business goals

- Managing relationships with investors and financial institutions

- Overseeing all financial operations, from accounting to FP&A

- Identifying opportunities for growth and cost optimisation

The CFO role has transformed dramatically over the past decade. They're now part strategist, part communicator and part risk manager—translating complex financial data into insights everyone can use to make better decisions.

Financial Controllers

Think of the Controller as your company's accounting chief and financial gatekeeper. They're usually the ones making sure your financial statements tell the true story of your business — and that you're playing by the rules.

Controllers often manage the accounting team, oversee financial reporting, and maintain proper accounting records. When auditors show up, your controller is typically the one leading the charge.

In small businesses especially, Controllers frequently take on broader responsibilities. It's not unusual to see them handling everything from treasury functions to tax oversight. As companies grow, this role tends to become more specialised, zeroing in on accounting integrity and compliance.

Finance Managers

Finance Managers typically run the day-to-day operations that keep your business moving. They're the bridge between number-crunching and decision-making — turning financial results into practical business insights that don't require a finance degree to understand.

What do great Finance Managers often bring to the table? They can:

- Prepare forecasts and track budgets against actual spending

- Spot trends before they become problems (or opportunities)

- Create financial reports that make sense to non-financial leaders

- Connect money matters to real-world business activities

You won't come across many successful companies that don't have someone translating between "finance speak" and "business speak" — that's where Finance Managers typically shine. They help both worlds communicate effectively about performance, resources, and goals.

Financial Planning and Analysis (FP&A) Analysts

While accountants tell you what happened yesterday, FP&A Analysts help you see what might happen tomorrow. They're the forward-looking financial experts in your business — and they're becoming more valuable by the day.

FP&A Analysts typically build financial models, develop forecasts, set KPIs and analyse business performance from different angles. Their real value? Spotting trends, opportunities, and risks before they're obvious to everyone else. When leadership asks "what if" questions, it's usually FP&A providing the answers.

Accounts Payable (AP) Specialists

AP Specialists manage your outgoing money flow, making sure the right people get paid the right amounts at the right time. They're often the unsung heroes keeping your suppliers happy while watching your cash flow like hawks. Their day-to-day responsibilities frequently include:

- Processing and verifying incoming invoices

- Scheduling and executing payments

- Reconciling vendor statements

- Maintaining accurate vendor records

- Resolving those inevitable payment hiccups

Accounts Receivable (AR) Specialists

AR Specialists manage your incoming money flow — from sending invoices to handling collections. Their efficiency directly impacts how much cash your business has available day-to-day.

They're typically responsible for generating invoices, processing incoming payments and following up on overdue accounts (probably the least fun part of the job for some). The best AR Specialists find that sweet spot between getting paid promptly and keeping customers happy.

For subscription-based businesses, this role becomes particularly critical. Your recurring revenue depends on consistent payment collection and quick handling of payment issues. A great AR Specialist doesn't just chase money — they help strengthen customer relationships.

Additional specialist roles that strengthen your finance team

Beyond these core positions, you'll often find specialised roles in larger or more complex organisations:

- Payroll Managers typically oversee employee compensation, ensuring everyone gets paid accurately and on time. They often manage wage calculations, tax withholdings and compliance with labour laws, frequently working alongside HR.

- Treasury Analysts usually handle cash flow, banking relationships, investments and financial risk. For international companies, they often manage foreign exchange operations and help protect against currency swings that can wreck profit margins overnight. They're the ones making sure your money works as hard as possible for your business.

- Tax Specialists navigate the ever-changing maze of tax regulations while finding legitimate ways to minimise what you owe. Their expertise becomes especially valuable when you're operating in multiple jurisdictions, each with its own complicated rulebook. A great Tax Specialist doesn't just file returns — they help structure business decisions for optimal tax efficiency.

- Risk Analysts identify potential financial threats and typically develop strategies to protect your business. They often assess market conditions, evaluate partnerships, and model different scenarios to help prepare you for what might happen next.

The structure that works best for your finance team depends on your business size, industry and growth stage. As your company evolves, your finance department should adapt alongside it, adding specialists when and where they'll create the most value.

4 finance department organisational chart examples (for businesses of all sizes)

Now that we've outlined the essential functions in a finance department, the lingering question is: how do you go about structuring them within your company?

Here are four finance team structures based on company size and business presence.

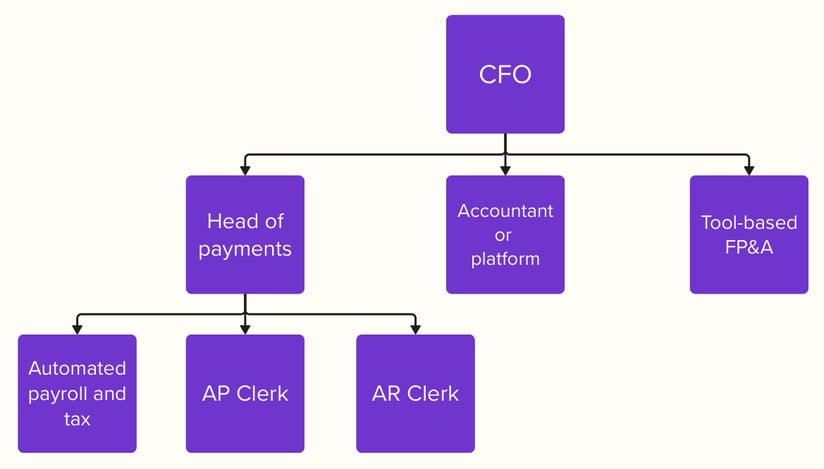

Finance department structure for a fast-growing startup

Finance department structure of a fast-growing startup

Fast-growing startups need agility. To this end, Controllers supervise all payments and accounting. Startups can outsource or automate accounting to reduce the manual burden.

To ensure growth, startups must include a strategic finance function that reviews cash burn efficiency and models growth paths. A strategic finance tool must assist this role.

These companies are better off outsourcing payroll or using an automated human resources platform.

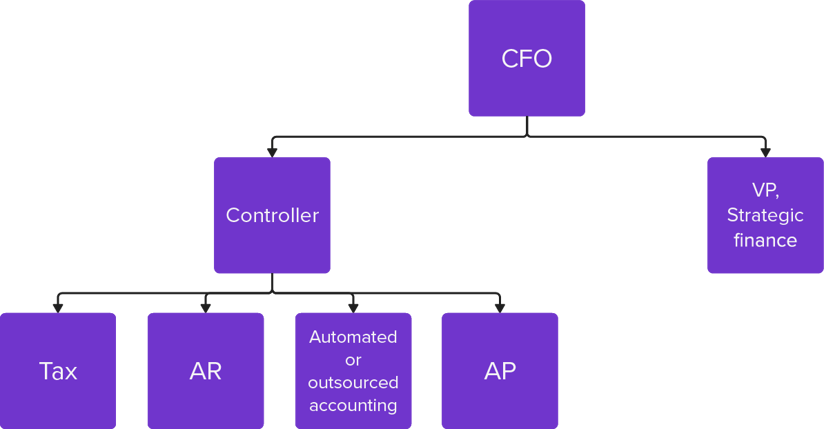

Finance department structure for an established small business

Finance department structure of a small business

A small business must be cost-conscious. This structure helps small businesses function with a lean team, handling payments in-house to ensure they maintain business relationships.

Small businesses can also use automated tools to simplify many of these processes. Automating payroll, tax compliance, and accounting (or outsourcing them) will reduce the burden on the company's CFO.

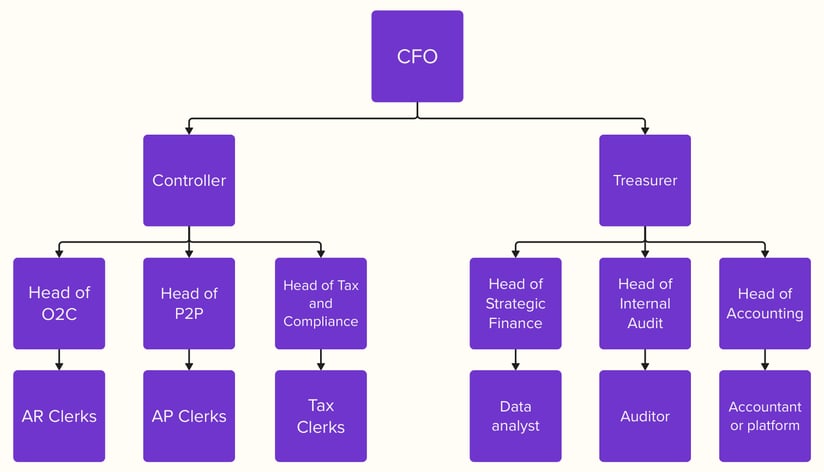

Finance department structure for a mid-sized business

Finance department structure of a mid-sized company

Mid-sized businesses are complex and need distinct treasury and controller-led departments. Controllers supervise payments and compliance with the help of sub-departments and tools. Treasurers supervise strategic planning, internal audit controls, and accounting workflows.

Every mid-sized business is different, so tailor this structure to suit your needs. For instance, you might automate or outsource accounting. Or you might fold payroll under your Controller's purview instead of organising it under HR.

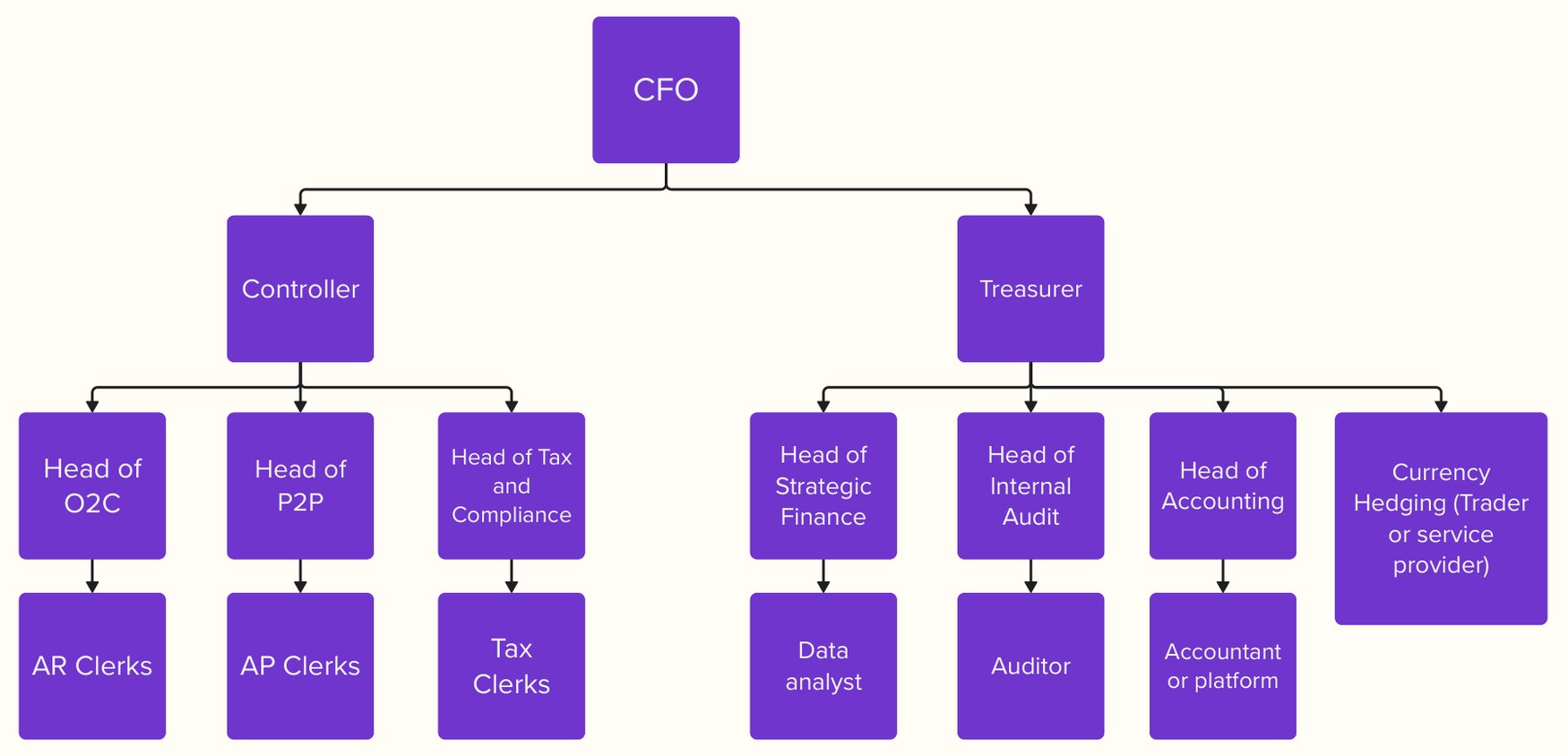

Finance department structure for an international mid-sized business

Finance department structure of an international mid-sized company

Mid-sized businesses operating overseas can use the department structure we highlighted above.

As illustrated, they need to incorporate a currency risk management function responsible for minimising the exchange rate risks associated with operating in multiple currencies.

While larger businesses could opt for in-house traders, small and medium-sized businesses are better off outsourcing their needs to a specialist who can help them accurately gauge their FX risk exposure and define an effective currency risk management strategy for their business.

5 best practices for structuring your finance department

Here are five great ways to ensure you squeeze the most out of the organisational structures we've highlighted.

1. Get the basics right

When you're figuring out how to set up your finance team, it might be tempting to tackle everything all at once. But, hold on a sec! It's better to start with the basics first.

That means inspecting your data sources for integrity, installing sound accounting principles, and taking a closer look at where your team might be struggling.

Growing can make existing problems even trickier. So, the key is to focus on getting the basics right from the get-go.

2. Prioritise tools as much as people

Technology can free finance teams from repetitive, highly structured tasks. Prioritise automation and tool usage as much as your headcount.

For instance, evaluate tools that automate cash application and journal entries. Automating these tasks is especially relevant for businesses operating across borders since it saves time translating currencies and preparing your books.

Christian Martinez, Finance Analytics Manager at the Kraft Heinz Company, outlines a method for CFOs to organise department activities and strike a balance between automation and human input in the process.

“Start by creating a comprehensive list of all the tasks and responsibilities that fall under the purview of the finance department: budgeting, financial reporting, compliance, risk management, and others,” he says.

“Add a column next to each task to evaluate its value or impact,” he continues. “For instance, tasks like financial reporting might have a high value due to their legal and strategic importance. The next column should be dedicated to assessing the complexity of each task.”

“Some tasks might be straightforward, requiring minimal specialised knowledge, while others, like tax planning, could be highly complex. After evaluating the value and complexity, the next step is to analyse which tasks can be automated.”

He notes that while automation is great for “routine, time-consuming tasks, it's crucial to ensure that automation doesn't compromise the quality or integrity of the work.”

3. Screen for the right skills

More than ever, finance teams must function as business storytellers. Future-proof your team by screening for data analysis and interpretation skills as much as technical ones. Hire people who collaborate well with different departments to unearth new areas of growth.

“It's essential to have team members who are knowledgeable about automated processes,” Martinez adds. “This ensures there's someone who can troubleshoot and resolve issues if the automated systems encounter problems.”

“It also ensures continuity and understanding of the processes within the team, which is critical for maintaining control and oversight of the department's functions.”

4. Promote finance as a key CX driver

Finance is a critical difference-maker in establishing customer relationships. Functions like accounts receivable (AR) can help you deliver memorable CX. For instance, AR teams can use automation to avoid invoice errors, giving them more time to solve complex customer issues.

Thanks to this additional time, AR can orient itself around customer needs and strengthen customer relationships.

“CFOs need to foster a culture within the finance department — and the organisation at large — that prioritises the customer in every decision,” Martinez says.

“This might include training finance staff to think from a customer-centric perspective or integrating customer satisfaction metrics into financial performance indicators.”

Martinez encourages CFOs to collaborate with departments like marketing and sales to understand customer journeys and should rely on technology to orient their departments around customer needs.

“CFOs should also advocate for investments in technologies and systems such as CRM software or data analytics tools,” he says, “that provide valuable insights into customer preferences and behaviours.”

5. Review and scale

Review your finance team's structure as your company grows. For instance, as your company expands internationally, you should review and analyse operations at each new location and region.

“ CFOs should create a department that can adapt to increasing complexities and demands while maintaining financial integrity and supporting overall business objectives,” Martinez explains.

“They must assess and possibly redesign the structure of their finance team,” he continues. “This might involve creating specialised roles or divisions (like treasury, tax, financial planning and analysis) to handle the increased workload and complexity.”

Reviewing processes for efficiency is also a critical task. “As the business grows,” Martinez says, “CFOs should ensure that their financial systems are scalable and can integrate seamlessly with other business systems (like CRM, ERP, etc). Upgrading to more robust financial management software might be necessary to handle increased transaction volumes and complex financial reporting requirements.”

Curious about which tools can help you build a lean finance team? Check out our list of the best fintech tech stacks for CFOs.

How a cross-border payment provider can help your finance department scale internationally

As your finance team evolves to handle global operations, the right cross-border payment provider becomes essential. Specialised providers like iBanFirst take the complexity out of international payments, letting your finance team focus on strategy and business growth.

iBanFirst helps growing SMBs transform their approach to international payments with:

- Multi-currency accounts: Hold, send and receive funds in 25+ currencies from one central dashboard

- Detailed payment tracking: Follow your payments across borders with timestamped updates you can share with suppliers

- Currency risk management: Protect your margins from exchange rate swings with fixed, flexible and dynamic forward payment contracts and access to dedicated FX experts

Request an account today and join 10,000+ international SMBs already managing cross-border payments with iBanFirst.

Topics