If you’re a CFO and you’re wondering which tools you need to take your business to the next level, then don’t worry – you’re not alone. It’s a difficult decision, but it’s also an important one. A well-assembled fintech stack can enable growth, deliver scalability and help to control costs.

Assembling a best-in-class fintech stack helps CFOs achieve career-defining goals such as:

- Protecting and increasing profitability as your business scales

- Ensuring compliance across all financial and accounting operations

- Uncovering and mitigating hidden costs

- Providing a well-resourced employee experience

What to look for when evaluating finance tools

Whether you're just starting to build out your fintech stack or you're finetuning what you already have, the prospect of finding the right set of tools to grow your business can be a daunting one.

Thankfully, we've got you covered.

We're going to run through some of the best-in-class picks for your ideal fintech stack below. And if you're not sure which tools are right for you, take a peek at our guide on how to build a modern finance tech stack as well.

14 best CFO software tools to help your financial operations run as smooth as ever

Below, we've pulled together 14 tools across key categories like accounting, expense management, cash flow forecasting and cross-border payments. For each tool, we'll share a quick snapshot of what they have to offer and how their pricing works to help you identify which tools may be best for your business.

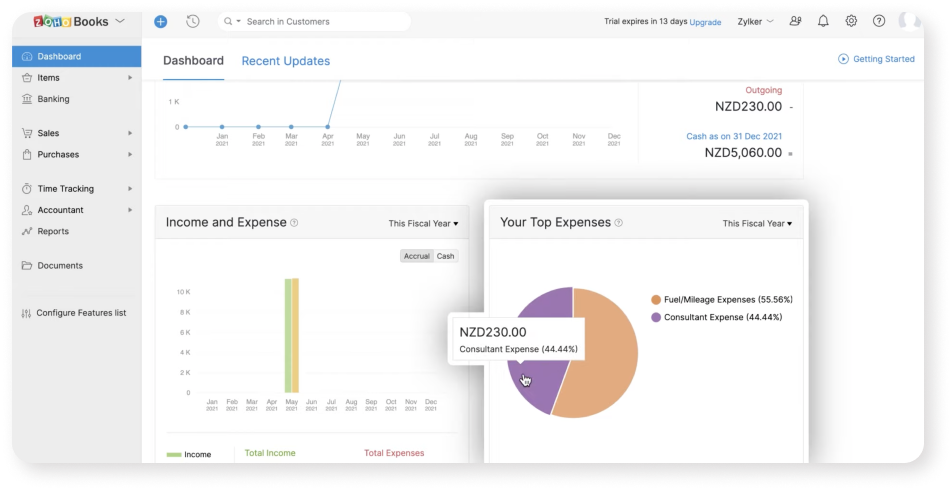

1. Zoho Books (accounting software for early-stage businesses)

Best suited for small and medium-sized businesses, Zoho Books is a great cloud-based software that makes day-to-day accounting fast and manageable. And you can’t beat its price.

Zoho offers a suite of other products, from sales support to IT management, with which Zoho Books (unsurprisingly) integrates seamlessly. And while larger SMBs may eventually outgrow Zoho Books and seek a more personalised approach to their fintech stack, many startups and growing companies rely on it to remove pain points from accounting tasks.

Zoho Books pricing

Zoho Books starts as low as €12 per month and offers a free 14-day trial.

Zoho Books rating

Trustpilot rating: 4.1 stars

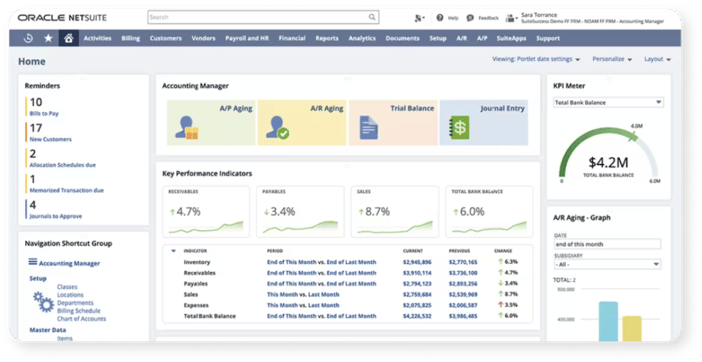

2. NetSuite from Oracle (ERP for accelerating businesses)

If your business is beginning to outgrow its SMB status, you’ll need to update your enterprise resource planning (ERP) software accordingly. And NetSuite could be the platform for you, offering robust financial reporting options, especially for businesses operating several legal entities.

The user interface is also highly rated, with customisable reports, dashboards and views to increase productivity and streamline standard processes.

NetSuite pricing

You have to contact NetSuite for a product tour and price quote.

NetSuite rating

G2 rating: 4.1 stars

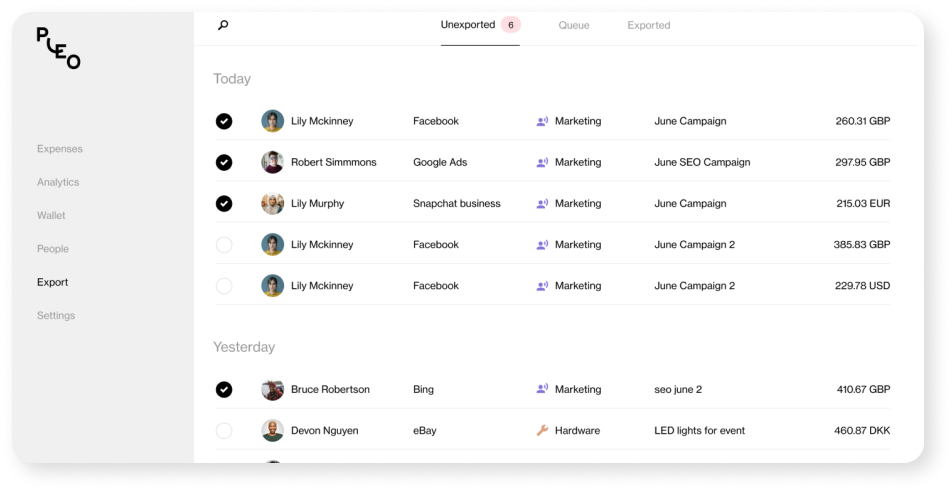

3. Pleo (expense management and tracking)

Expense management is often regarded as a laborious but essential activity for every business. Pleo helps those businesses by reducing manual admin processes thanks to a complete set of automated tools.

By providing employees with smart company cards, Pleo allows organisations to keep on top of expense data and receipts with real-time visibility. Streamlined with links to in-house finance departments, it’s a huge timesaver for everyone across the business.

Pleo pricing

Pleo offers multiple subscription tiers, from the ‘Starter’ package at €9.50 up to ‘Beyond’ at €199 per month.

Pleo rating

Trustpilot rating: 4.2 stars

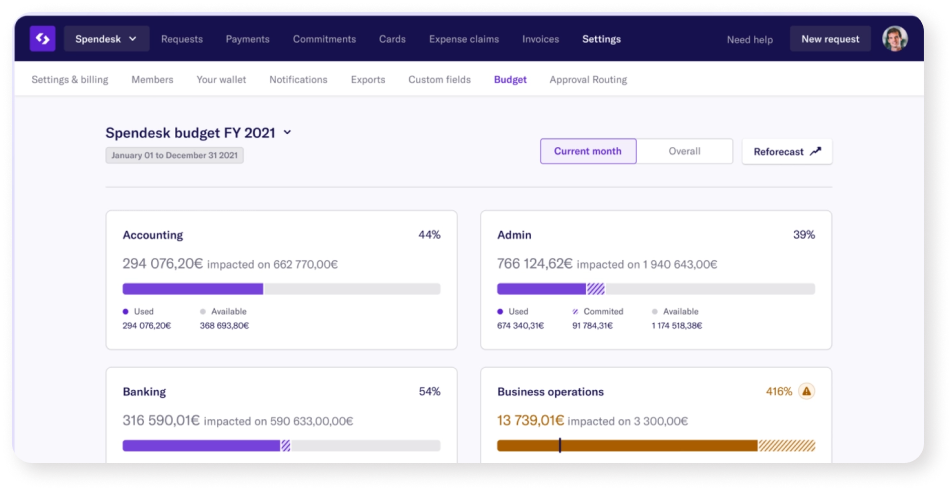

4. Spendesk (expense management and tracking)

How can a platform help businesses avoid paying company expenses with their own cards? And how can leadership retain control while providing greater access to spending company money? Spendesk offers solutions to these common challenges.

Expense management inevitably creates operational bottlenecks, but Spendesk handily breaks them down. The platform provides single-use or ongoing virtual cards for online spending and safety assurance. And for business trips, Spendesk issues physical cards to take on the road.

The platform enables CFOs to retain up-to-date expense tracking across the company, compare actual spending to budgets, assign customisable card limits and access detailed records if desired.

Spendesk pricing

Multiple pricing tiers are available to Spendesk users, which you can learn more about by requesting a quote from their team.

Spendesk rating

Trustpilot rating: 4.1 stars

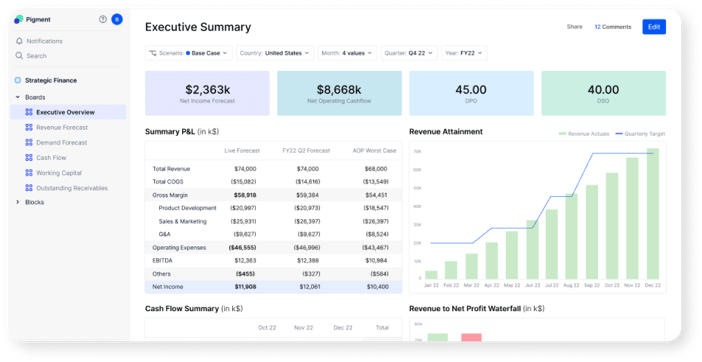

5. Pigment (financial planning and analysis)

Pigment is a powerful business planning tool that’s as flexible as it is functional. Designed for FP&A and RevOps teams, it enables users to consolidate, aggregate and make dynamic models of key data, such as revenue sources. With this, users can identify trends, risks and opportunities to move their business forward.

Pigment is particularly strong when it comes to visual storytelling. Think all-hands meetings, board retreats and other venues for important presentations. You want your team equipped with the best-in-class dashboards and visualisation tools when advocating for budgets and informing stakeholders on company performance.

Pigment pricing

Pigment does not have publicly available pricing. You need to request a demo to learn more.

Pigment rating

G2 rating: 4.6 stars

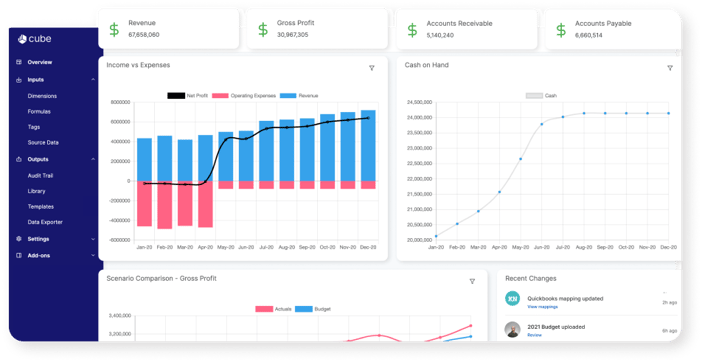

6. Cube (financial planning and analysis)

Cube is an ideal tool for SMBs looking to simplify financial reporting workflows. It aggregates and syncs hundreds of data sources into a polished user interface, customisable by user types and departments.

Users report that Cube allows them to spend less time creating reports and more time analysing and extracting insights. It also promises ‘endless’ integrations across data sources, such as data warehouses, query engines, transactional databases and data visualisation tools, such as business intelligence platforms, notebooks and front-end frameworks.

And, of course, you can also use Cube to create a single source of truth. From here, the platform batch exports data directly into spreadsheets for business teams that prefer creating data visualisations with Excel or Google Sheets.

Cube pricing

Cube does not have publicly available pricing. You'll need to request a demo for more info.

Cube rating

G2: 4.5 stars

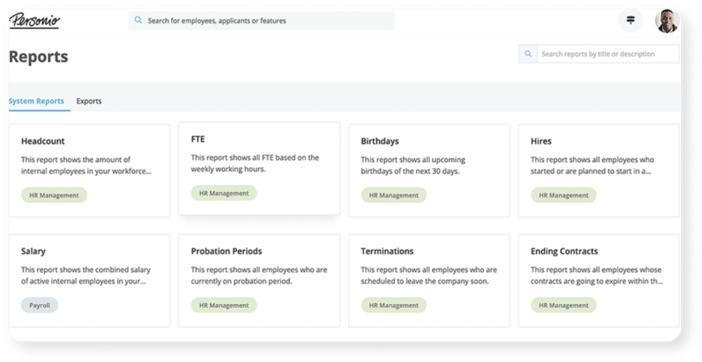

7. Personio (payroll for growing SMBs)

As Europe’s leading HR software for SMBs, Personio has made a good name for itself, thanks to its feature-rich and easy-to-use platform.

Users praise Personio for its excellent customer support, which helps clients from implementation through to the day-to-day tasks of payroll management.

Personio boasts an all-in-one HR platform, from recruiting to offboarding, centralised data and seamless integrations with other software. However, some users have suggested the platform lacks a sufficiently wide range of available reports.

Personio pricing

Personio offers two subscription tiers, but pricing is not listed. You'll need to request a demo for more info.

Personio rating

Trustpilot rating: 4.2 stars

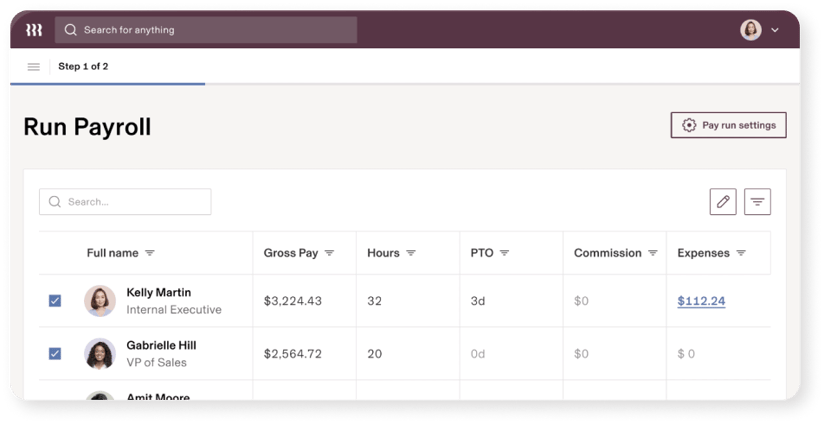

8. Rippling (payroll and HR for larger SMBs and enterprises)

Global payroll, HR, IT, benefits and onboarding management — all in one platform? Rippling promises all these features and more in one neat package.

The Rippling HR Cloud offers benefits administration, payroll, PTO management, pulse surveys, learning management, full-service payroll and applicant tracking — all the features that enable a successful partnership between the CFO and CPO.

Rippling pricing

Rippling does not list exact pricing, but does state that they typically operate on a per-seat structure. You'll need to request a demo for more info.

Rippling rating

Trustpilot rating: 4.6 stars

9. Stripe (credit card payment processing)

Easy, fast payments are critical to growth-stage startups and SMBs alike, but they can also be a real pain.

Stripe is a leading payment processor offering core financial infrastructure for online businesses. Users do not need to create a merchant account. Instead, Stripe starts collecting credit and debit card payments immediately on your behalf.

Stripe supports payments in several major currencies and delivers robust financial reporting tools that play nicely with most FP&A and accounting platforms listed above.

Stripe pricing

Stripe’s rates are transaction-based and some of the most competitive worldwide. There are no setup or monthly fees associated with the service.

Stripe rating

G2 rating: 4.3 stars

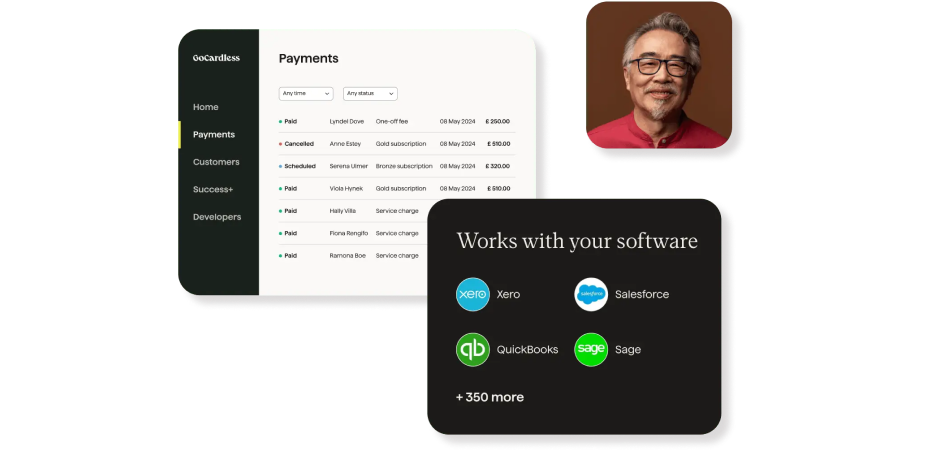

10. GoCardless (direct debit payment processing)

There are many benefits to offering alternative payment methods. ACH transfers and direct debit payments are cheaper for businesses. Plus, many online shoppers prefer to spend their cash instead of using a credit card.

GoCardless is a great option for SaaS or subscription-based businesses that set up recurring customer payments. It reduces transaction costs substantially.

GoCardless automates customer payments using ACH and direct debit from checking or savings accounts. Their platform helps users to increase payment conversions, reduces the need for collections efforts and keeps payments secure along the way.

GoCardless pricing

Users pay a variable fee per transaction. Custom pricing is also available.

GoCardless rating

Trustpilot rating: 2.3 stars

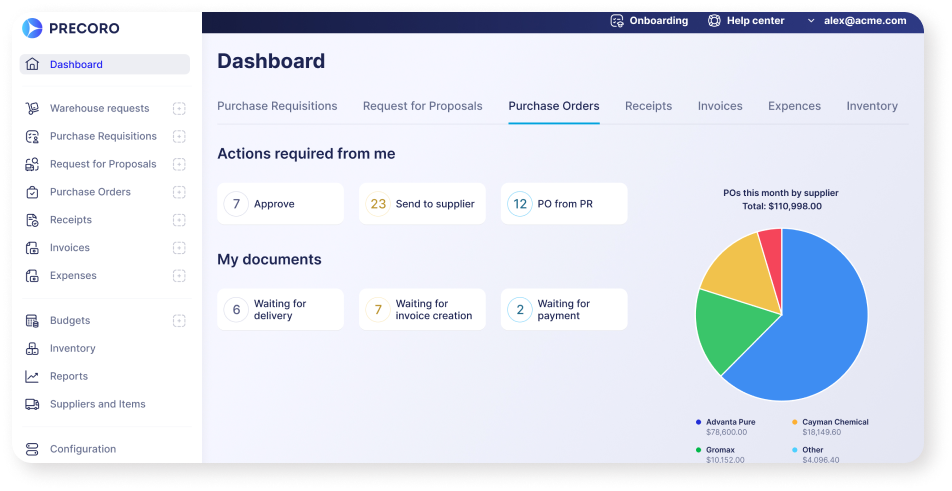

11. Precoro (supply-chain vendor management)

As inflation rises worldwide, CFOs need real-time insights into supply-chain vendor performance and costs. Precoro is a rising star in the vendor software category for its user-friendly, in-app experience and comprehensive budget, supplier and inventory management features.

Use Precoro to fulfil compliance obligations and centralise multiple countries, currencies, offices and reports into one secure database.

Precoro pricing

Precoro offers three subscription tiers, with prices ranging from $499 to $999 per month, plus a custom-priced enterprise tier.

Precoro rating

Trustpilot rating: 4.2 stars

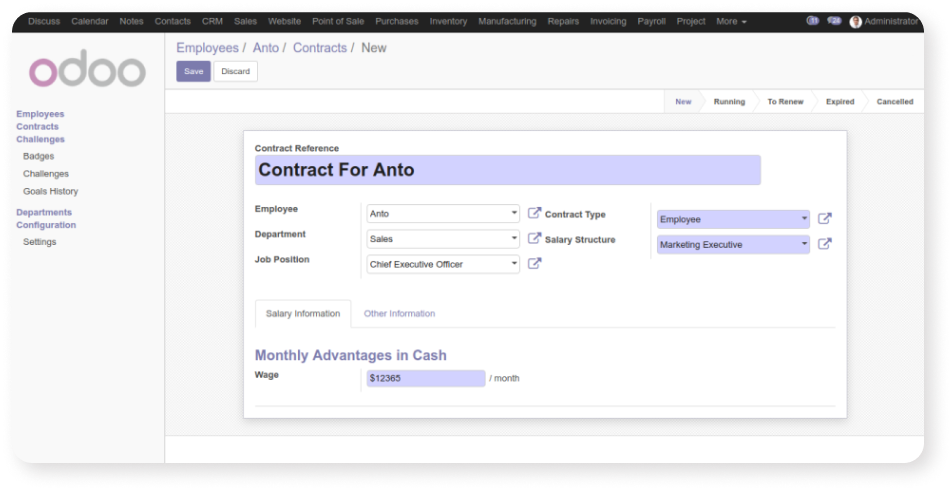

12. Odoo (supply-chain vendor management)

Recognised as an established play by Capterra, Odoo is an open source software that is flexible and can be adapted to SMEs or large corporations.

Its wide range of robust features includes everything, from vendor onboarding to data analysis to payment reminders.

Odoo pricing

Odoo offers three pricing tiers, including a free option. Pricing ranges from $30 to $50 per month.

Odoo rating

Trustpilot rating: 3.3 stars

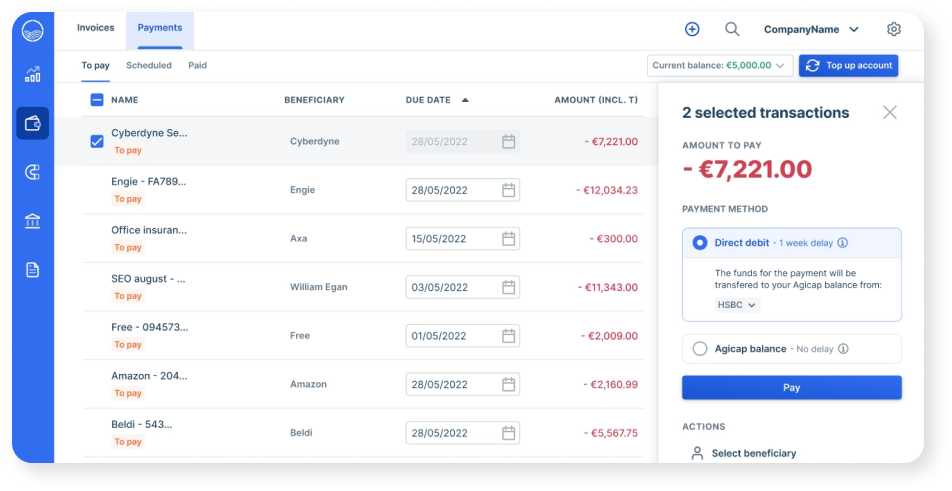

13. Agicap (cash flow management)

Perfect for SMBs, Agicap supports over 3,500 finance teams on a daily basis, with automation and data-analysis tools that allow users to track their cash flows in real time.

Proponents of Agicap say that it’s a huge timesaver, and they appreciate how it integrates easily with bank accounts and other businesses.

Agicap pricing

Agicap's prices vary massively depending on the user organisation's specific needs. You'll need to request a quote for more info.

Agicap rating

Trustpilot rating: 4.2 stars

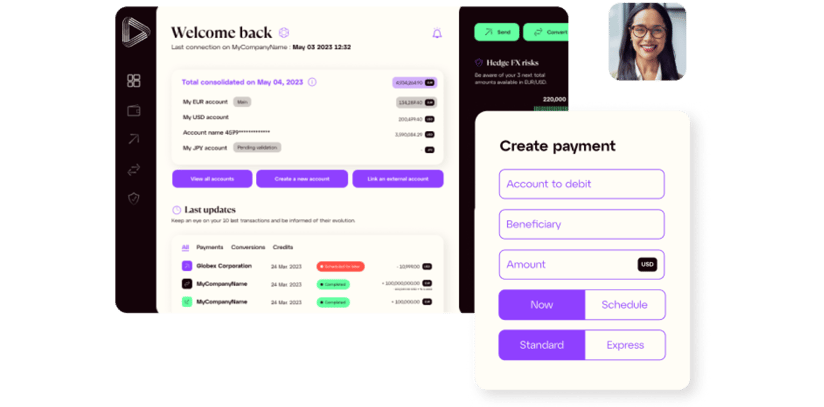

14. iBanFirst (for international payments and currency risk management)

When it comes to cross-border transactions, prohibitive fees, slow and fragmented processes, and unpredictable currency exchange rates can quickly become a finance team’s nightmare.

By taking the complexity out of currency transactions, iBanFirst keeps CFOs in the driver's seat when managing cross-border payments. With iBanFirst, you can collect, convert and send funds efficiently across 140+ countries while protecting your business from currency market volatility.

iBanFirst pricing

Unlike many cross-border payment providers, iBanFirst delivers complete transparency with its pricing, fees and terms. There are no initial setup or monthly subscription fees. For full pricing details, take a look at our pricing guide.

iBanFirst rating

Trustpilot rating: 4.8 stars

Get started with iBanFirst today

Building the right fintech stack means choosing tools that actually solve your specific problems. If cross-border payments and currency management are part of your operations, you need a provider that can handle both.

When you open an account with iBanFirst, you get:

- A multi-currency account to hold, send, receive and track funds in 25+ currencies

- Currency risk management tools like fixed, flexible and dynamic forward payment contracts to protect your profits from exchange rate swings

- Support from real human FX experts who understand your business and can help you implement an FX strategy that works

We built iBanFirst specifically for SMBs with significant international payment volumes. No hidden fees, no complex pricing tiers, no fighting with chatbots when you need help.

Ready to simplify your cross-border payments? Open an account and join thousands of companies that've already transformed how they handle international transactions.