Publication date

There used to be a time when a Chief Financial Officer’s contribution to a company was to provide numbers and data to help other leaders make strategic decisions. These days, Chief Financial Officers (CFO) are much more than just that. “Today, CFOs are fully involved in their company’s growth strategy and have a responsibility to drive performance,” says Arnaud de la Porte, CFO at iBanFirst.

CFOs are expected to ensure strong and stable financial performance, collaborate with a variety of colleagues to support the smooth running of operations, engage with investors, and shape the company’s roadmap.

With such a demanding role, starting a new position as Chief Financial Officer can be a daunting task. The first months in a new position are decisive and the first 90 days of a new CFO are both a whirlwind of new responsibilities as well as a golden opportunity to set the scene and pave the way to future success.

This step-by-step guide and the general overview it provides will help any new CFO start off their first 90 days on the right foot!

Step 1: Gather information and assess performance

Whether you are stepping into the shoes of a CFO for the very first time, or whether you have already been in this role but are transitioning into a new industry, the first step towards success is to know what to expect and to anticipate challenges.

Your first days are not about taking action in any way. That comes later. First, start with simply learning everything you can about the company’s culture, its overall vision, its short- and long-term objectives as well as its strengths and weaknesses. This knowledge will contribute to making you more effective in your leadership role and will help you define the finance department’s goals.

At this stage, you’ll also need to get your hands on the numbers. By assessing the current situation and your company’s financial position, you’ll gain a clearer picture of the overall baseline situation, what is expected of the finance function and the main lines of action you’ll have to take.

There are two areas you need to dive into to know where your company aims to go, and where it’s been so far:

- Historic actuals: compare past data with current data, and budgets with actual results. What trends do the financial statements reveal? Have the company met its targets? Do you have all the records and financial data? Do you have all the supporting documents?

- Forecasts: What are the expected growth forecasts? How is the company expected to reach these forecasts?

To get a holistic view of the company’s financial health and management, the Boston Consulting Group also advises taking a closer look into:

- Accounting Practices. Check with the company’s auditing firm that there are no regulatory issues or accounting practices that need attention.

- Audit Issues. Get in contact with the company’s audit committee to have a look at the company’s audit practices, and its internal controls and the way it tackles cybersecurity. There may be aspects within these areas that need to be addressed urgently.

- Cash Flow. Make sure there are no liquidity issues that the company needs to quickly resolve.

Step 2: Build relationships

As the newly appointed CFO, it cannot be emphasised enough that devoting time to building strong relationships within the company should be one of your top priorities.

Not only will it help you steer your decisions by getting feedback on what works, what needs improvement, and what is expected from the finance function, but your ability to quickly build credibility and trust among your key stakeholders will strongly influence how efficient you’ll be down the line. Soon enough, you will require backing from the rest of the C-suite, board members and other key leaders to bring your vision to life.

As CFO, remember that you’ll also ultimately be a close advisor to the CEO. Forging a strong relationship with the chief executive based on trust, close collaboration, and a shared vision should definitely be one of your goals. This will obviously not happen overnight, nor even in 90 days, but laying the foundations by getting acquainted with your CEO’s operating and communication style and getting on his calendar on a regular basis early on to align on what your priorities should be, is the first step.

Step 3: Evaluate the department’s processes, technology, and capabilities

Now is the time to understand what resources are at your disposal. In your role as CFO, you will need to dedicate time to assess the structure, procedures, and systems of the company you are joining. Keep an eye out on how money is spent and seek to streamline all procedures —from bookkeeping processing to foreign exchange risk — with the aim of simplifying or even eliminating unnecessary tasks and improving efficiency.

After having taken the time to meet everyone in your team, take some time to evaluate the staff within the finance department and identify their strengths and weaknesses. Is the team equipped to meet your objectives? If not, is there a way to bring them up to scratch or will you need to bring in new resources? Do not rush into recruiting new employees until you are sure that they will be required.

Another area of investigation at this stage is the process and tools in place. As new technologies emerge, companies are turning to digital solutions and agile practices to drive a competitive advantage and make a positive impact. Investing in the right tools and the right financial software directly contributes to ensuring improved efficiency in the finance department and the company as a whole. Whether your company needs to improve on its accounting, its payment process, or its budgeting, choosing wisely the financial software that will improve your company’s performance is one of the biggest strategic decisions to make in the first 90 days.

Step 4: Prioritise your actions

After having spent the first 30 days or so getting your bearings, gathering information, and settling in with your colleagues, you’ll have had time to create a list of actions to take and issues to address.

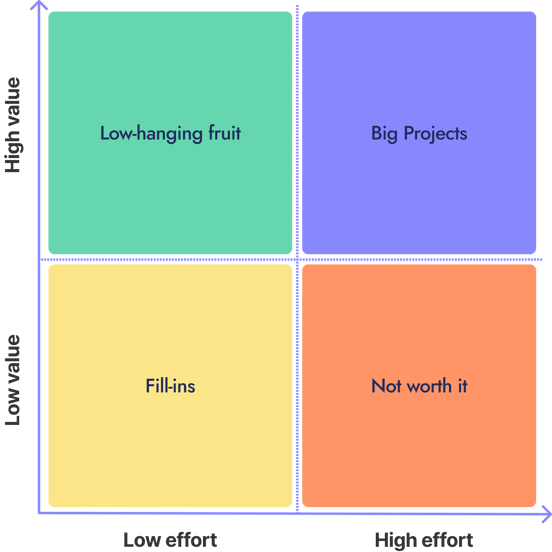

Feeling overwhelmed by your to-do list? A simple but useful tool that can help you sort out and prioritise your next steps is the impact/effort matrix.

- High impact – low effort (upper left): These are your quick wins. Focus on these low-hanging fruit first to demonstrate value early on.

When she stepped into her new CFO role at Blisce, Anne-Claire Colomb rapidly noticed that opaque bank fees, lengthy payments, and even late payments, were preventing the investment firm from operating at its full capacity. By turning to iBanFirst, she was able to regain control of the firm’s international payments. One simple yet effective action upon her arrival enabled her to tick several boxes in one go: securing instant access to faster payments, competitive rates, and transparent fees, and demonstrating her value.

- High impact – high effort (upper right): These projects are critical and will most likely take time and require your full attention. Make sure to include them in your roadmap, co-develop a plan with your team to tackle them and set reasonable milestones and regular checkpoints.

- Low impact – low effort (lower left): These tasks can be delegated to your team members for them to handle whenever they have the time.

- Low impact, high effort (lower right): Any tasks or ideas that fall in this bucket are not worth the effort and can be put aside.

Step 5: Pave your way to success

The last leg of the journey to successfully navigate your first 90 days as CFO is all about turning your vision into an actionable plan.

You should now know what kind of leader you’ll need to be and how you and your department will create value for the company. Now is the time to establish a clear time frame for your goals, define your ideal organisational structure, performance measures and digital tools needed to implement the long-term strategy you have in mind.

It is important to align your team around your action plan as it will bring them a sense of purpose and unity.

On a company level, providing employees with a view of the finance department’s overall mission will reinforce the value of the finance function and help promote greater collaboration.

The bottom line: Be strategic and take it one step at a time

Stepping into a new CFO role comes with many challenges and a steep learning curve. Depending on the number of new issues to handle, it can be tough to know where to start.

It goes without saying that you won’t tick everything off your CFO checklist within the first 90 days. Actions like building relationships and process design are never fully complete. But identifying them during the first three months and having a clear plan of attack to tackle them is what will help you go the distance. Keep an open mind and remember that challenging the status quo and adopting an agile and flexible mind frame will help you navigate smoothly through this new professional adventure.