In periods of great uncertainty, market parties in the financial sector traditionally look for so-called “safe havens”. In the foreign exchange markets, the US dollar usually acts as a refuge in such circumstances. Still, everything must be placed in perspective. In recent years, for example, the US dollar gradually lost ground against the Japanese yen. Whereas at the beginning of 2017 a rate of over 118 was noted for USD/JPY, this year the currency pair swung violently up and down between 112.21 and 101.17.

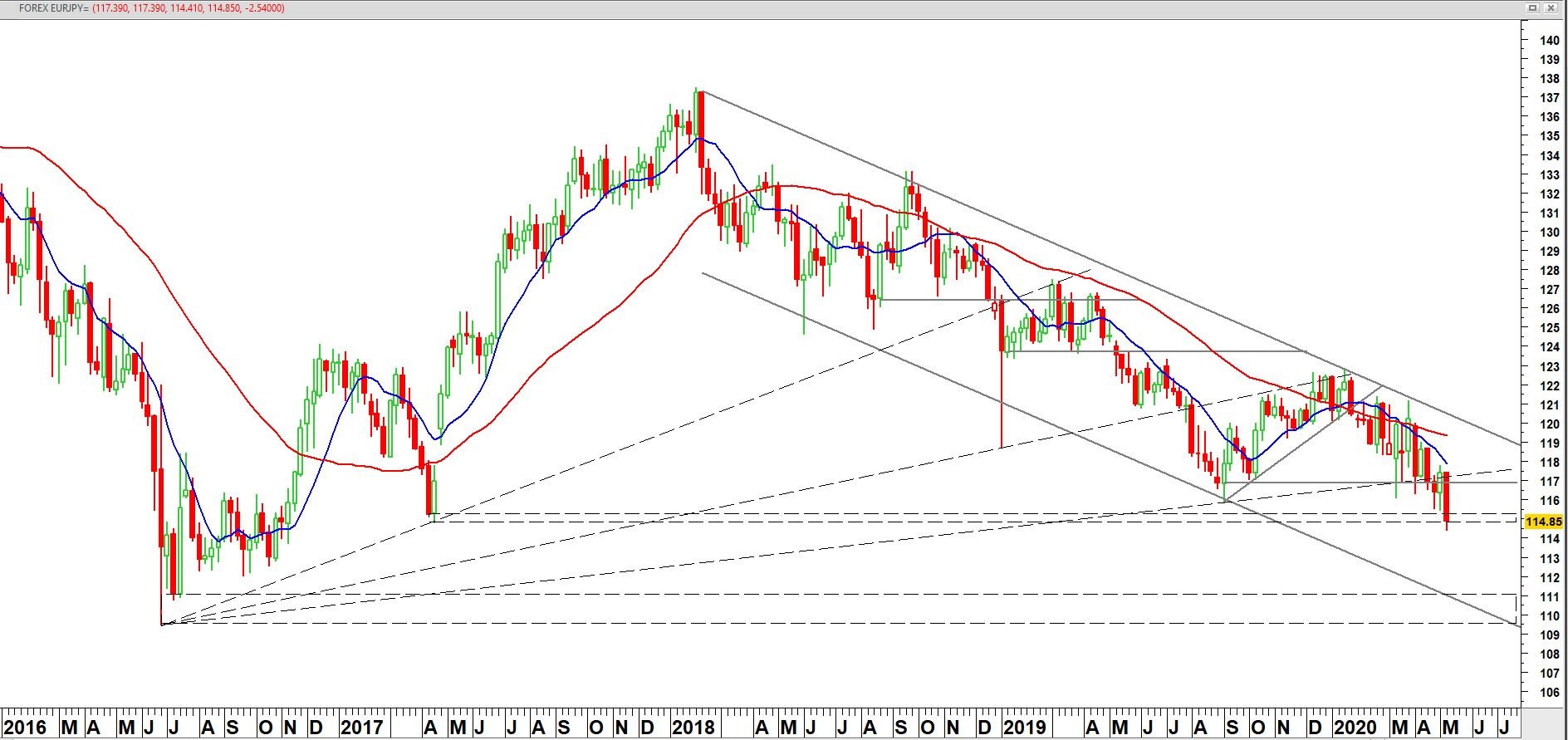

The euro has also been losing ground against the Japanese yen for some time. Regardless of any alleged fundamental causes, the trend for the EUR/JPY pair is clear. From the price break in February 2018 onwards, a declining trend channel has emerged, with the falling resistance line along the peak levels in 2018 causing the currency pair to fall again in January of this year. A descending support line drawn in parallel is indicative of the extent of the downward price potential. A fall to EUR/JPY 110 in the coming months is not inconceivable. In the last two years, the declining support line has been seen three times before.

The current red week candle illustrates a drop and at the same time a new low this year. The bottom of April 2017 around EUR/JPY 114.82 nevertheless offers some security. A short-term but temporary recovery attempt to EUR/JPY 116.82 (= weekly closing 30 August 2019) cannot be ruled out in this forecast. It is not unusual to return briefly to the broken trend lines after drops beneath indicative support lines along the bottom. The graph shows an example of this in 2019 after the fall below the diagonal and horizontal trend line. EUR/JPY also rebounded briefly at the end of 2019 and the beginning of 2020. When EUR/JPY falls below 114.82 the forex market will have to seek out benchmarks from the period before 2017. This summer the support lines will converge at EUR/JPY 110. This is the target for now.

EUR/JPY currently below the falling 10-week and falling 40-week averages on a weekly basis from 2016 onwards

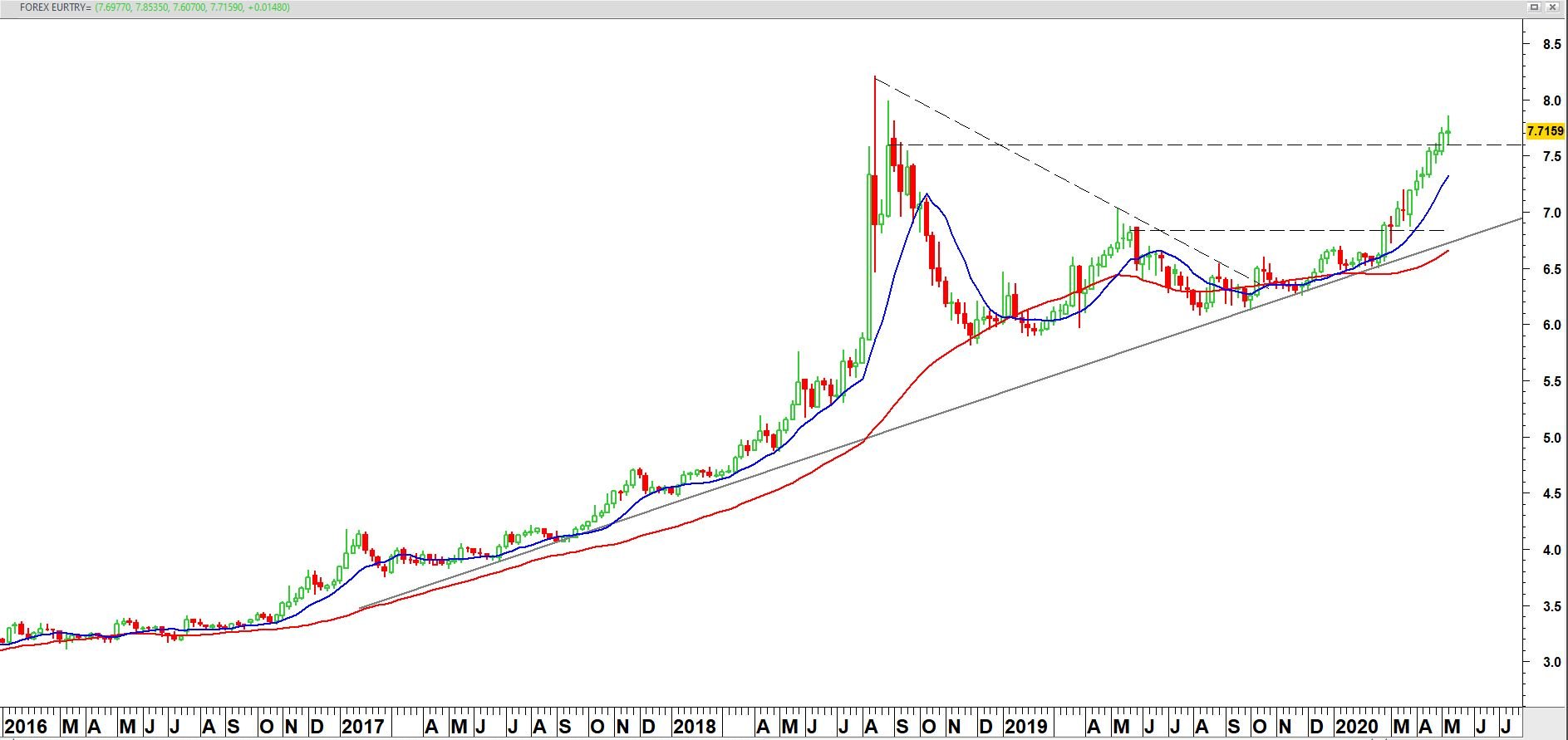

EUR/TRY approaching record heights

The euro has initiated a new rally against the Turkish Lira. The Turkish currency will therefore be falling.

EUR/TRY as of 2016 on a weekly basis + 10/40-day averages

EUR/SEK tests bottom of the trend channel

The euro rebounds in the rally against the Swedish krona, but the multi-year upward trend channel is still intact.

EUR/SEK as from 2015 on a weekly basis

This marketing information was compiled by Edward Loef (mail@edwardloef.com). This blog post reflects Edward Loef's opinion in his capacity as Certified Financial Technician. This information is not intended as professional investment advice or as a recommendation to make certain investments through iBanFirst. It is intended as information provided to private individuals and not as advice for making commercial decisions. The information is explicitly not intended as an offer to buy or sell products. If you enter into a transaction with iBanFirst, we strongly advise you to determine the relevance of this information to your transaction and to take into account your experience, knowledge, financial capabilities, investment objectives and risk appetite.

Topics