People are always looking for insight on what’s going on in the world. Investors spell out the economic news with a view to establishing a connection with price rises in the stock exchanges. Currency traders also present their own arguments, either for or against, in order to justify their predictions about the US dollar, the euro and more exotic currencies.

Based on the viewpoint offered by technical analysis – a method that studies only the final results of all buying and selling transactions – most reasoning can be justified. A recent example is the decline in value of the US dollar in comparison with other key currencies in the world. The US dollar fell by more than 7% between 20 March and 10 June this year. By that account, it is quite logical that on 8 June warnings sent out via internationally renowned financial websites about an imminent crash of the dollar suddenly garnered a great deal of extra attention.

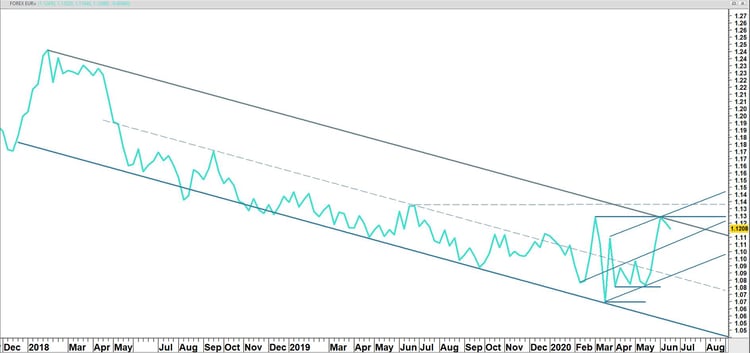

However, there is no cause for concern just yet, as the US dollar is currently clambering back up. When we Europeans take a look at the exchange rate development of the EUR/USD currency pair this year, it is impossible to draw a fixed conclusion from the wild fluctuations between $1.07 and $1.13. However, a line can be discerned in the direction of the trend. The multi-year trend in the euro appears to be falling in a bandwidth of around 600 pips. The euro is currently in the upper regions of the falling trend channel. This can only mean that either the euro has been gaining strength or the US dollar has been weakening.

Recently, higher troughs have been reached, at around $1.08. This offers the prospect of a price increase from 600 pips to $1.14. But as soon as the $1.13 point has been passed on a weekly basis, the downward trend of the euro will come to an end. Those higher troughs at $1.08 are a subtle hint that EUR/USD is starting to get stronger.

EUR/USD from December 2017 onwards

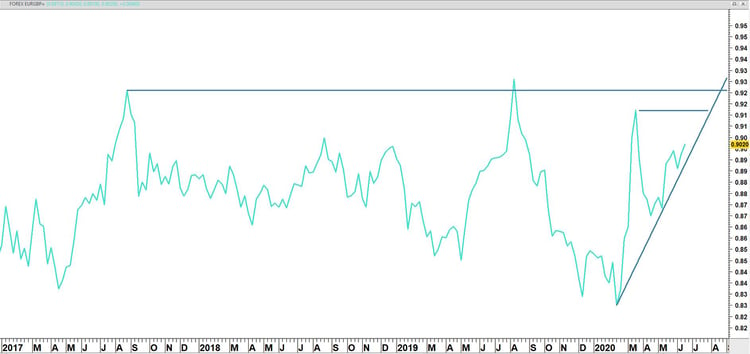

EUR/GBP is making a comeback

The most recent observation shows higher troughs and higher peaks in EUR/GBP, with the ambition of reaching EUR/GBP 0.92.

EUR/GBP on a weekly basis from 2017 onwards

EUR/NOK enjoys a temporary rebound

The upward acceleration phase this year in EUR/NOK has returned to a rising support line that can act as a new springboard.

EUR/NOK on a weekly basis from 2017 onwards

This marketing information was compiled by Edward Loef (mail@edwardloef.com). This blog post reflects Edward Loef's opinion in his capacity as Certified Financial Technician. This information is not intended as professional investment advice or as a recommendation to make certain investments through iBanFirst. It is intended as information provided to private individuals and not as advice for making commercial decisions. The information is explicitly not intended as an offer to buy or sell products. If you enter into a transaction with iBanFirst, we strongly advise you to determine the relevance of this information to your transaction and to take into account your experience, knowledge, financial capabilities, investment objectives and risk appetite.

Topics