The designation litmus test in the current technical analysis of the currency pair EUR/USD hints at the ultimate test to discern the reliability of something. This applies for both the trust in the euro and confidence in the US dollar.

Two weeks ago (on 20 February 2020) Het Financieel Dagblad (Dutch financial newspaper) reported that the euro weakens against the dollar. At the same time, it was also established that the strengthening of the dollar roughly kept pace with the virus outbreak in China. A litmus test is all about conducting an investigation with an irrefutable result.

What has happened since then?

On 19 February this year, an irrefutable result was explained in the technical analysis. There was a series of eleven lower intraday quotes in EUR/USD. During the present century, this occurrence was reported once before on two trading days: on Friday 13 March and Monday 16 March 2015. And thus, the foundation was laid for higher values in EUR/USD from $1.0493 (to rise to approx. $1.17).

On February 20 this year, yet another foundation was established for higher values. The currency pair rose from $1.0775 to above $1.13 this week. As a result, the euro rose by more than 3.5% against the US dollar in an incredibly short period of time (i.e. eight days).

A study of the past can now serve as a guide for a new litmus test. Within 12 months after March 2015, six trading periods were recorded in which the euro rose in value by 3.5% within eight trading days. These dates are 23 March 2015, 30 April 2015, 8 June 2015, 24 August 2015, 9 December 2015 and 10 February 2015. In all six of the occurrences mentioned, EUR/USD fell back within four weeks.

Conclusion: based on these litmus tests, we can anticipate a EUR/USD value below $1.1300 in approximately four weeks.

EUR/USD as of July 2018 + 20/120-day averages

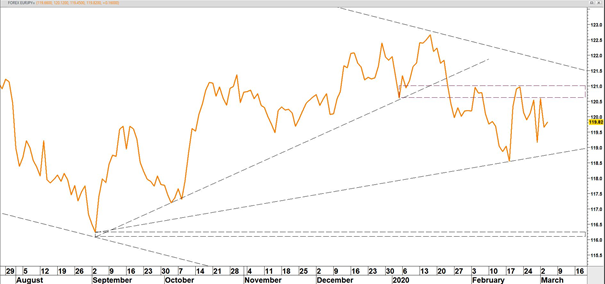

EUR/JPY

A double peak regarding EUR/JPY 121 resulted in numerous investors taking refuge in the Japanese yen after the turning point at the end of January 2020.

EUR/JPY as from the end of July 2019

EUR/GBP

The EUR/GBP currency pair has left the falling trend channel at its peak.

Anticipated support for EUR/GBP 0.8555

EUR/GBP as from the end of July 2019

This marketing information was compiled by Edward Loef (mail@edwardloef.com). This blog post reflects Edward Loef's opinion in his capacity as Certified Financial Technician. This information is not intended as professional investment advice or as a recommendation to make certain investments through iBanFirst. It is intended as information provided to private individuals and not as advice for making commercial decisions. The information is explicitly not intended as an offer to buy or sell products. If you enter into a transaction with iBanFirst, we strongly advise you to determine the relevance of this information to your transaction and to take into account your experience, knowledge, financial capabilities, investment objectives and risk appetite.

Topics