The world news in 2020 seems to be dominated by the COVID-19 pandemic. In its purest form, technical analysis focuses exclusively on price charts and the indicators derived from them. In the graph for the EUR/USD currency pair, the influence of the coronavirus and the measures taken to contain it seem of little significance.

From 2018 onwards, prices movements occur within a clearly defined downward trend channel, via two support and resistance lines that appear to run parallel to one another. The rally of the euro from $1.0775 on 20 February this year was curbed at around $1.1450 by the falling resistance line drawn along the peaks in spring 2018. The relapse after that was picked up around $1.0635 when it approached the falling support line. Apparently, currency traders or computerised algorithms value the extrapolation of past trend movements. A practical indicator for determining the long-term direction of the trend is the 100-day average (shown in red in the chart). Its angle of inclination is currently declining. This means that all progressive knowledge of the facts and all positive or negative expectations (including those in connection with the consequences of the COVID-19 pandemic) point towards the continuing weakness of the euro.

However, it can also be argued that the US dollar functions as a safe haven. Of course, buying and selling transactions are constantly alternating. To illustrate: the five-day price changes are shown in red. The currency pair are constantly demonstrating a rhythm in which the euro rises or falls by more than one per cent in five days. On the other hand, the ups and downs of the euro often briefly rise above the 100-day average and then fall back again. In recent weeks, we have seen the emergence of a triangular formation. Given the long-term trend, a drop from the triangle to the bottom of the downward trend channel seems likely soon.

EUR/USD as of 2018 + 100-day average + 5-day percentage change

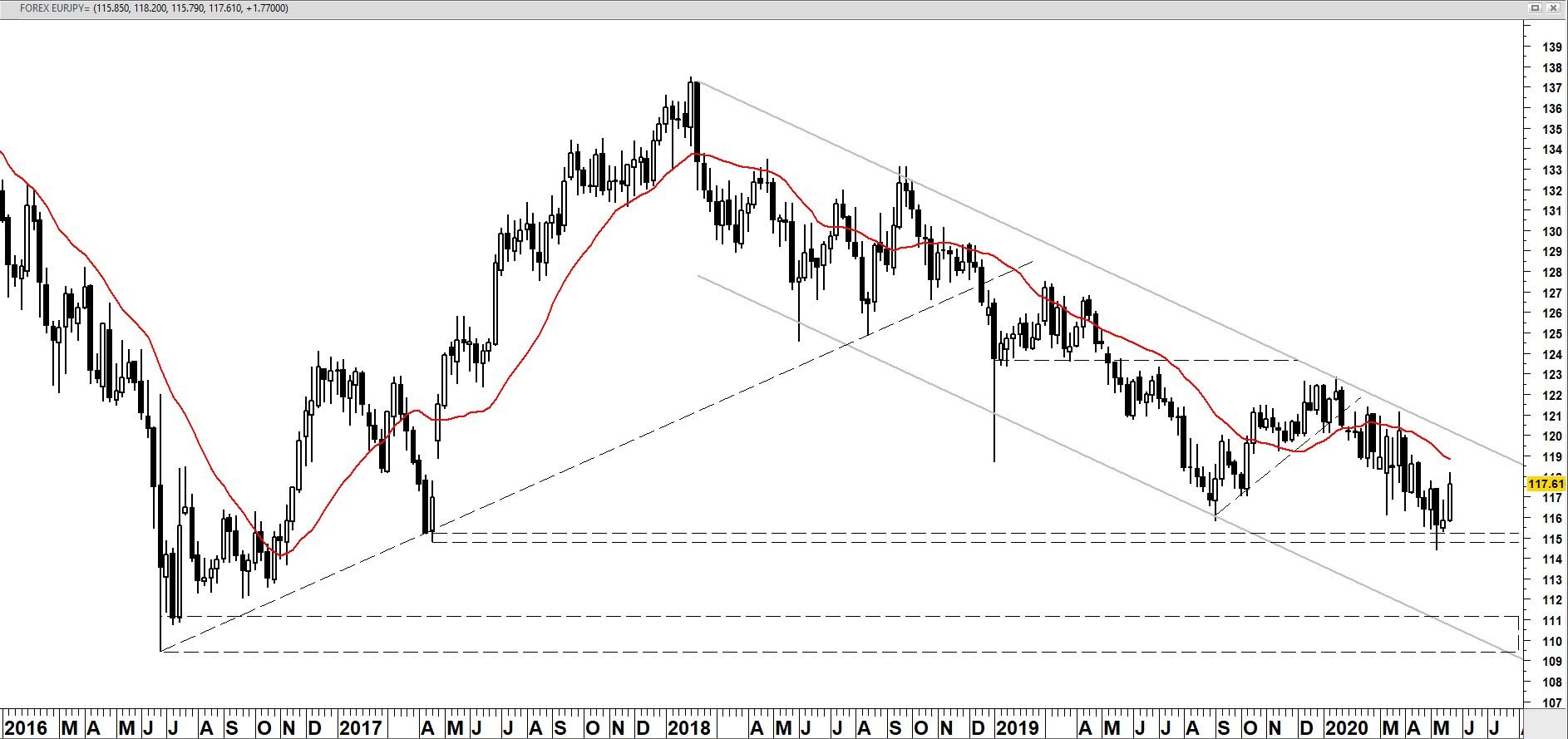

EUR/JPY enjoys a temporary rebound

The long-term trend of the euro is also declining against the Japanese yen. The yen is also seen as a port of refuge in times of uncertainty.

EUR/JPY on a weekly basis from 2016 + 20-week average

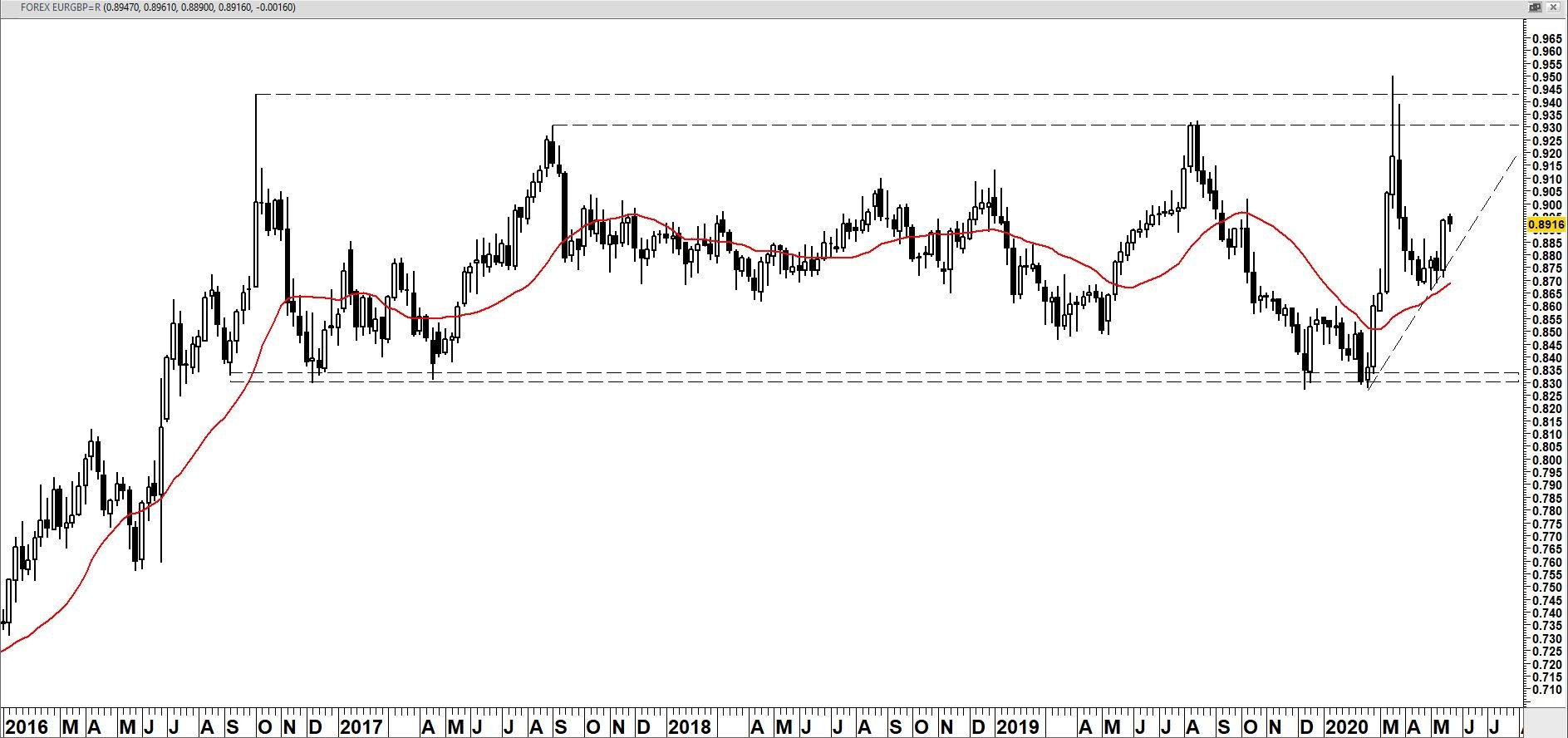

EUR/GBP shows a higher bottom line

The higher bottom line in EUR/GBP above the rising 20-week average indicates a return to the top of a large sideways-moving trading range.

EUR/GBP on a weekly basis from 2016 + 20-week average

This marketing information was compiled by Edward Loef (mail@edwardloef.com). This blog post reflects Edward Loef's opinion in his capacity as Certified Financial Technician. This information is not intended as professional investment advice or as a recommendation to make certain investments through iBanFirst. It is intended as information provided to private individuals and not as advice for making commercial decisions. The information is explicitly not intended as an offer to buy or sell products. If you enter into a transaction with iBanFirst, we strongly advise you to determine the relevance of this information to your transaction and to take into account your experience, knowledge, financial capabilities, investment objectives and risk appetite.

Topics