Currency hedging solutions offering high levels of flexibility are a compelling option for businesses that wish to secure their commercial margins. We take a look at some of the most appealing dynamic FX hedging solutions on offer.

More than ever before, foreign exchange market volatility poses a threat to your margins. Prices negotiated in a foreign currency, the time elapsed between invoicing and payment, not to mention currency repatriation,are just some of the reasons to be concerned about foreign currency risk management. If your company conducts business abroad or possesses overseas subsidiaries, or if you sell and make purchases in foreign currencies, FX hedging is an option worth exploring.

When developing a suitable currency hedging strategy, it is especially important for a business to take into account its level of exposure and establish a corresponding budget reference rate.

There are a variety of currency hedging products that aim to limit the effects of currency volatility, including several varieties of FX forward contracts. A classic forward contract sets a predetermined exchange rate for an invoice denominated in a foreign currency, thereby protecting a business’s sales margins over time, without tying up its cash flow.

There are however different forward contract variants that provide even greater flexibility. Here we refer to flexible forwards, dynamic forwards with full participation and dynamic forwards with capped activating participation. The latter is notably characterised by a predetermined activating threshold rate, which you will find detailed below.

Flexible forwards

- These flexible forward contracts offer the advantage of a guaranteed exchange rate over a predefined period of time for settling your company’s invoices in foreign currencies.

- The conditions of the future transaction (amount, exchange rate, date, etc.) are determined when the forward contract is set up.

Main benefit: they protect against a rise in value of the foreign currency involved, with no set-up fees.

Dynamic forwards with full participation

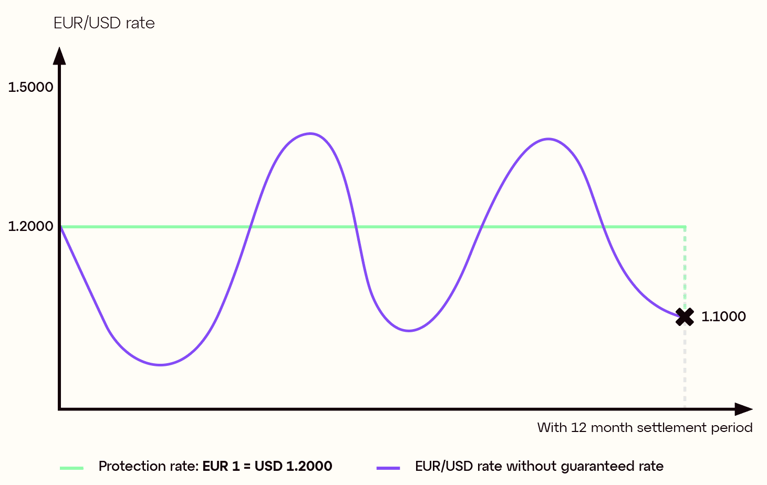

- Sometimes referred to as participating forwards, these offer the advantage of a guaranteed exchange rate and help secure your company’s margins.

- When mature, dynamic forwards enable the contracting party to benefit from potentially favourable movements on the foreign exchange market over the course of the contract’s validity period.

Main benefit: when mature, the contracting party has two options – they can opt for the exchange rate set at the beginning of the contract (the protection rate) or they can take advantage of a potentially more beneficial market rate due to exchange rate fluctuations.

Dynamic forwards with capped activating participation

- Sometimes referred to as forward extras, these offer the advantage of a guaranteed exchange rate and help secure your company’s margins.

- When mature, they also enable the contracting party to benefit from potentially favourable movements on the foreign exchange market over the course of the contract’s validity period. This is limited by a predefined market rate referred to as the activating threshold.

- Three rates are determined when the contract is set up and these are analysed once the contract reaches maturity. These consist of the protection rate (the minimum rate the contracting business can benefit from), the participation rate or spot rate (a range of possible exchange rates based on fluctuations over the contract's validity period), and the activating threshold rate or trigger level (the exchange rate threshold established – if, at maturity, the market rate exceeds this level, the contracting party will be subject to the participation rate).

Main benefit: when mature, if the market rate is more favourable, the contracting party benefits from this rate, although the rate the business can avail of is limited.