We get it. International payments can be complicated. There’s so much jargon surrounding them, plus there are a bunch of processes that you need to get your head around. But no matter how much of a pain they can be, they are unavoidable for many businesses. And the better you understand the ins and outs of international payments, the more likely you are to be able to save your company time and money.

That’s where we come in. In this article, we explain the main international payment systems used in Europe and beyond, as well as how to use these systems, how long they take and how much they cost.

What are the main international payment systems used in Europe?

Let’s start with the basics and take a look at the different systems you might use in Europe to make a payment: SWIFT and SEPA.

SWIFT (aka Society for Worldwide Interbank Financial Telecommunication) is the oldest international financial transfer system in the world, dating all the way back to the 1970s. It’s used by over 11,000 institutions across 200 countries. To put things into perspective, nearly half (40%) of all international transfers use the SWIFT network.

SEPA (Single Euro Payment Area), on the other hand, is a European-based payment network. Fully implemented in 2014, SEPA is currently used by 38 European countries, including several not covered by the eurozone or in the European Union, such as Iceland, Switzerland and the UK.

But how do these two systems differ when it comes to making international payments? And which one is best for your business? Read on to find out.

What’s the difference between SWIFT and SEPA?

The main difference between SWIFT and SEPA is that the former can be made in various currencies while SEPA, on the other hand, is limited to euro-denominated bank accounts.

As an example, while you could happily make a payment from a German account to a Spanish one using SEPA, you would need SWIFT to make a payment from the same German account to a Japanese beneficiary.

Furthermore, SEPA cross-border payments are typically quicker and less expensive than their SWIFT counterparts. However, the payer or payee may have to pay currency conversion fees for payments outside the eurozone, such as those originating or ending in the UK.

What information do you need to make international payments?

Let’s get into the practical stuff. As well as information about the payer and payee account names, international payments may require the following numbers or codes:

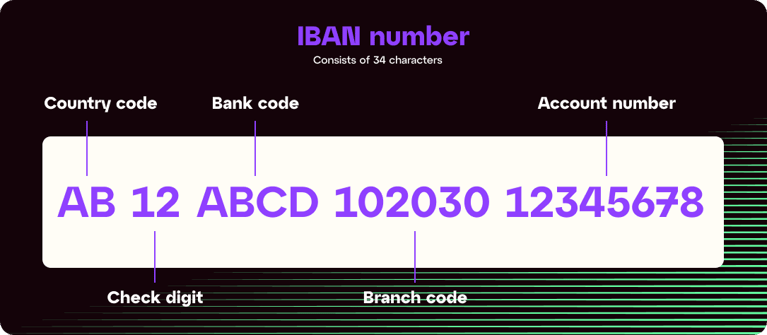

- IBAN (International Bank Account Number)

- SWIFT code or BIC (Business Identifier Code).

In simple terms, the IBAN is used to identify an individual bank account. Before its introduction, each country had its own bank account format. This system led to errors and delays in cross-border transactions. The IBAN system improves the verification of cross-border payments and reduces errors, rejected payments, transfer delays and bank fees. (Click here if you’re interested in the technical specifications of each participating country’s IBAN format.)

You can verify an IBAN number using an online IBAN checker tool before starting an international payment.

Example of an IBAN number

Unlike IBAN, the SWIFT/BIC code is used to identify a financial institution, rather than an individual bank account. BIC codes contain 11 alpha-numerical digits to represent the bank, location, country and branch code.

Every financial institution in the SWIFT network is assigned a unique code: a Business Identifier Code, or BIC.

SWIFT and BIC are often used interchangeably, but in practice, SWIFT is the issuing organisation that controls the use of BICs. You can view the complete list of BICs currently in use around the world by clicking here.

Example of a SWIFT/BIC code

When are IBAN and SWIFT/BIC codes used?

IBAN numbers were originally designed to be used for payments in the eurozone but are now required or recommended by 70+ countries worldwide. You can see the list of countries mandating IBAN numbers by clicking here.

SWIFT/BIC codes are used for global payments across the network involving over 200 participating countries. Notably, SWIFT codes are not used by China, Russia, North Korea, Iran, Syria, Cuba and Ukraine. You can find the list of SWIFT countries by clicking here.

As of 2016, SEPA payments no longer required a SWIFT/BIC code. However, all SEPA transfers require an IBAN number.

How long do international payments take with SWIFT?

In most cases, SWIFT payments take two-to-five business days to be processed. There are, however, three factors that can impact the timing of cross-border payments with SWIFT. Those are as follows:

- Anti-fraud and anti-money laundering procedures that occur before a payment is credited to the recipient’s account

- Whether or not an intermediary bank or network is involved, which occurs when there is no direct relationship between the payer’s and the payee’s banks

- Bank business days, holidays, time zones and individual banking processes and procedures.

SWIFT has recently launched a new initiative – SWIFT Global Payments Innovation (GPI) – aiming to improve the speed, transparency and traceability of international payments. Institutions that join the GPI agree to a new set of rules governing fee transparency, end-to-end payment tracking, confirmation of credit to the recipient's account and data record consistency. This new technology enables real-time tracking of cross-border payments, making international payments as simple as local payments.

How long do international payments take with SEPA?

Generally speaking, SEPA is the fastest system for making international payments within participating countries. However, there are a few different types of SEPA that you need to be aware of.

Typical cross-border payments made with SEPA take up to one business day, making them significantly faster than SWIFT payment. But SEPA offers a payment option that’s even faster – Instant Credit, which is processed within a few seconds, even on holidays and weekends. SEPA also offers B2B Direct Debit, which takes up to three business days to be processed.

How much do international payments cost? SWIFT vs. SEPA

The fees associated with international payments are notoriously complicated, in part because multiple banks and institutions are typically involved in the process. And while the fees will often be charged by the institution that initiates the transaction, they’re not necessarily covered by the payer.

Understanding the different options and costs is vital for businesses to better understand the costs associated with making international B2B payments.

There are three possible options for who covers the fees associated with an international payment. These are SHA, BEN and OUR.

SHA

SHA stands for shared, because for each transaction, the costs are shared between the beneficiary and the issuer of the payment. The costs of the issuing bank are borne by the party sending the funds, while the costs of the intermediary and beneficiary banks are deducted from the amount sent, and borne by the beneficiary. The more institutions involved, the higher the costs will be. This system is used for about 60% of market transactions.

BEN

Short for beneficiary, the transaction costs for this option are invoiced to the payment beneficiary, as a deduction from the payment amount. This system is not very widespread and accounts for only 10% of market transactions.

OUR

The issuer of the payment chooses to cover all costs. This ensures that the beneficiary receives full payment. This model represents about 30% of market transactions.

Generally speaking, fees for SWIFT international payments run between €15 and €50. Currency conversion fees are charged in addition to these fees, when applicable, and can run as high as 3% to 5% of the payment amount.

SEPA transfer fees are minimal, if they are charged at all, and there are usually no bank charges associated with a SEPA transfer. Some banks will charge a fee to receive a SEPA transfer, however. There are never any currency conversion fees associated with SEPA transfers since they are only used between euro-denominated accounts. This makes SEPA transfers the fastest and most economical way to complete international payments.

Your trusted international payment partner

By mastering the different internal payment systems, you can save time and money for your business, gaining an edge over your competitors. If you’re looking for a partner to help you with this, then look no further than iBanFirst.

iBanFirst is a fully licensed and regulated Payment Service Provider (PSP) in Europe and the UK. We’re also a member of SWIFT and SEPA certified, meaning we can securely and efficiently facilitate international and domestic financial transactions in compliance with industry standards and regulations.

So if you’re ready to optimise your cross-border payment processes, then contact our experts today and find out how iBanFirst can help you manage international transactions with ease.