Publication date

Ever found yourself manually typing invoice details into your payment platform at 6pm on a Friday, wondering if there’s a better way? You're not alone.

In fact, 82% of SMEs* still process invoices manually — and it's costing them time, money, and causing more than a few headaches.

What if you could skip the data entry altogether and create payment drafts with a simple email forward? Handily, you can!

Meet iBanPay, the intelligent payment assistant that eliminates tedious invoice processing and puts precious hours back into your day.

In this article, we'll walk you through why manual invoice processing is holding your business back and how iBanPay can transform your payment workflow.

The hidden cost of manual invoice processing

Let's face it: nobody got into business to spend their days copying numbers from invoices into payment forms.

But that's exactly what most finance teams are doing — manually entering beneficiary details, amounts, currencies and reference numbers for every single payment. It's mind-numbingly slow, and it's surprisingly expensive when you factor in the costs of labour.

Time is money (and manual processing wastes both)

Here’s how a typical workflow might look:

- Your supplier sends an invoice.

- Someone on your team has to open it, read through the details, switch to your banking or payment platform and manually type in the beneficiary information.

- They need to double-check the amount, add the reference number, select the currency, and submit the payment for approval.

- Then someone else needs to verify all of these details.

For a single invoice, maybe that's 15 minutes. Not terrible, right?

But what happens when you're processing 20, 50, or 100 invoices per month? Suddenly, you're looking at hours of work that could be spent on tasks that actually grow your business. Your finance team didn't sign up to spend their time on data entry — they're capable of much more.

Human error is inevitable (and costly)

Here’s an uncomfortable truth: manual data entry creates mistakes. It's just human nature, especially when you're typing the same types of information repeatedly throughout the day.

Errors such as incorrect IBAN, SWIFT/BIC, or routing numbers are among the most common causes of failed or delayed payments. Or it might be a missing suffix (Ltd, SA, GmbH), using the beneficiary’s trading name instead of their registered legal name or even missing punctuation that causes issues.

An incorrect amount could lead to underpayment or overpayment — and awkward supplier conversations. Mix up the currency? That's a different type of headache.

These errors don't just waste time as you work to fix them — they can damage supplier relationships, create accounting nightmares, and can even result in late payment fees or lost early-payment discounts.

Financial oversight becomes a nightmare

When every invoice is processed manually, tracking payments can become a guessing game (depending on the level of visibility you get with your payment provider). Which invoices have been paid? Which are pending? Who approved what? When was it actually sent?

Without automated workflows and detailed tracking, your team ends up maintaining spreadsheets to keep track of payments. That's more manual data entry — and it doesn't give you real visibility into your outgoing payments.

How iBanPay transforms your payment workflow

So how do you fix an obsolete process? You remove the manual work altogether.

According to McKinsey, finance teams can free up 30% to 40% of their capacity with automation, allowing them to focus their time on analysis, forecasting and more strategic tasks.

You just need to implement the right automation.

Here's how iBanPay works (in 3 simple steps)

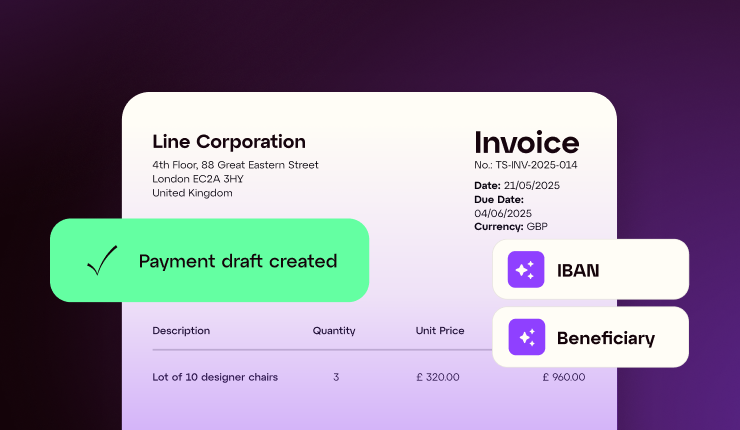

iBanPay is an AI-powered payment assistant that reads your invoices and creates payment drafts automatically. No typing. No copying and pasting. No switching between windows. Just verify and send the payment when ready.

Here’s how it works.

Step 1: Forward your invoice

Simply forward invoices to your dedicated iBanPay email address. Each company gets their own unique address, so there's no confusion about where invoices should go.

You can forward invoices directly from your email and have your team members and external accountants send invoices from theirs. You can even send multiple invoice attachments in one email. However you want to work, iBanPay adapts to your workflow — not the other way around.

Step 2: iBanPay creates your payment drafts

This is where the magic happens: iBanPay's AI engine reads your invoice and extracts all the relevant information — beneficiary details, amount, currency, due date, reference numbers, everything.

Within moments, a complete payment draft appears in your iBanFirst platform with all fields automatically pre-filled. No manual entry required. No transcription errors. Just accurate, ready-to-review payment information.

Step 3: Approve with one click

Log in to your iBanFirst platform to review the payment draft. Everything's already there and properly formatted, ready for you to approve it with a single click.

You maintain complete control and oversight — minus the tedious data entry that was eating up your time.

Your benefits at a glance

The advantages of automating your invoice processing extend far beyond just saving a few minutes here and there. Let's break down the real impact iBanPay can have on your business.

Time savings

No more data entry means your finance team can redirect those hours toward work that actually matters — cash flow analysis, supplier negotiations, financial planning, or simply going home on time.

One of our clients, Isabelle Bert from Surprisez-vous, says:

iBanPay saves me a lot of time. Now, I no longer need to enter each invoice one by one, like I used to.

Fewer errors

Time spent correcting manual errors? They’re gone too!

With iBanPay handling the data extraction and populating the payment fields, your team just needs to verify the details. This reduces the risk of errors to near zero. No more typos. No more transposed numbers. No more accidentally sending €10,000 instead of €1,000. Just reliable, accurate payment drafts ready for your approval.

This doesn't just save you time fixing mistakes — it protects your supplier relationships and your company's reputation.

Complete control and oversight

Some people worry that automation means losing visibility or control. With iBanPay, it's actually the opposite.

You maintain full oversight of every payment. The system creates drafts, but you're still reviewing and approving them. You can see at a glance what's pending, what's been approved, and what's been sent.

As Céline Terrats from Synersy notes:

Paying invoices has never been easier! The email reminders are brilliant for planning my day.

Your team works far more efficiently and the tool does the legwork, but you stay firmly in control.

Getting started with iBanPay

Ready to eliminate invoice processing headaches? iBanFirst users can set up iBanPay in just five simple steps:

- Step 1: Log in to your iBanFirst Client or Company space as Super Admin

- Step 2: Click on Account Settings in the left-hand menu

- Step 3: Activate iBanPay in the Service section by accepting the Terms and Conditions

- Step 4: If needed, authorise additional team members to send invoices via iBanPay by entering their email addresses in the iBanPay section’s account settings

- Step 5: Receive your welcome email containing your personalised iBanPay email address and secure code

That's it! Within minutes, you're ready to hand off the data entry to iBanPay.

Why choose iBanFirst

Yet to open an account with us? To truly transform your invoice payment workflow, you need a reliable, transparent and innovative payment provider.

When you work with iBanFirst, you can:

- Open a multi-currency account in minutes and hold funds across 25+ currencies

- Remove the risk of costly errors and gain better visibility into your payment pipeline with iBanPay — all while maintaining the control and approval workflows

- Share real-time payment tracking links with partners so they see exactly when it was sent, which intermediaries are involved, and when it'll arrive

- Access FX risk management tools, including fixed, flexible, and dynamic forward payment contracts

- Work with human FX experts who understand your unique cross-border needs

Request an account with iBanFirst today.

*Study by iBanFirst, June 2024, 530 users across 10 countries.

Topics