It’s the question on everyone’s lips! What is a global payroll system, and why might you need one?

Let us explain.

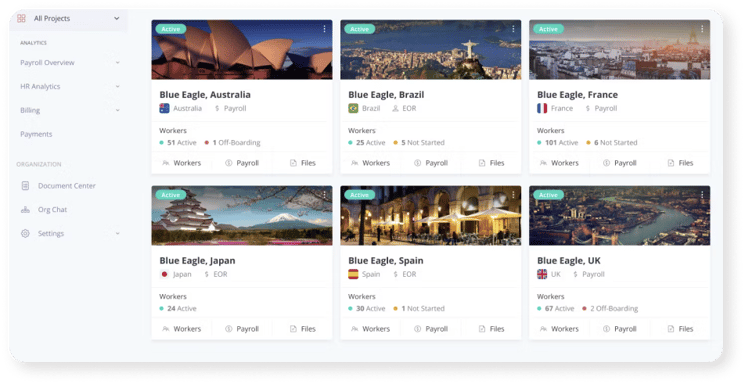

International payroll providers help businesses pay wages to their workforces in multiple countries. The best global payroll providers make it easy to issue payments to a globally distributed workforce, including full-time employees and external contractors.

However, because employment and tax laws vary significantly by country, launching an international payroll service can be a complex, costly and risky endeavour. That's why many businesses partner with a third-party provider to get the job done well — and compliantly.

While each business will ask for a unique set of requirements from their payroll provider, there are a few core features that every service should offer:

- Accurate tax withholding across the jurisdictions where the business operates

- Built-in compliance with applicable tax, labour and employment laws

- Flexible, robust onboarding services that drive long-term success

- Features that match hiring needs, i.e. employees, contractors or both

The following list represents some of the best international payroll providers out there. Each business will have different needs, so these platforms represent the most popular options based on a number of different conditions.

Before you start evaluating your options, be sure to have your set of requirements ready. You can download this as a handy PDF by clicking here.

- How many employees or contractors will you be paying, and how often?

- Which international payroll features are most valuable to your business?

- What degree of compliance support do you need from your international payroll service?

- Do you require other integrated human resources features, such as employee management?

- How do you plan to manage currency exchange risk?

Keep those criteria in mind, and read on for a review of the most popular international payroll providers in 2024.

Papaya Global: International HR management and payroll through one platform

Papaya Global has offered a comprehensive international human resources (HR) and payroll management solution since 2016.

Best for: SMBs to large enterprises.

What it offers: Papaya Global supports hiring, onboarding and payroll in over 160 countries.

Advantages of Papaya Global: Working with Papaya Global means having access to an all-in-one HR and payroll platform. Compliance is built into the experience

If you don’t want to establish local entities in every country where you have employees, you can designate Papaya Global as the employer of record (EOR) for a competitive per-employee rate. The platform also offers a reasonable pricing tier for international contractor payroll.

Disadvantages: Payroll services are outsourced to local providers, which are then facilitated through Papaya. Some users have remarked that vendor turnover can temporarily impact operations.

ADP Global Payroll: Compliance insurance

Founded in 1949, ADP is the most recognised payroll brand worldwide. Its international suite of products, ADP Global Payroll, provides payroll services in over 140 countries.

Best for: SMBs to large enterprises, depending on the chosen solution.

How to qualify for ADP Global Payroll: ADP Global Payroll provides two solutions depending on the service level requirements: ADP Celergo and ADP GlobalView Payroll.

ADP Celergo is best for companies with employees in at least three countries and up to 1,000 employees per country. ADP acquired Celergo in 2018, which had been serving the global human resources market since 2003.

ADP GlobalView Payroll supports multinational businesses operating in up to 42 countries. Businesses require at least 1,000 employees in one country to be eligible for their solutions.

Advantages of ADP Global Payroll: International tax law compliance is a core focus for risk management teams. Partnering with ADP Global Payroll offers some of the highest levels of insurance industry-wide, since they provide local compliance expertise in more than 140 countries.

Disadvantages: ADP provides enterprise-level solutions for international payroll. Smaller businesses and startups may not meet ADP's threshold requirements. And the cost per employee trends higher compared to alternative service providers.

Globalization Partners: Simplified global employee hiring and management

Founded in 2012, Globalization Partners has been a global enterprise SaaS leader for over ten years.

Best for: Large enterprises.

What it offers: Globalization Partners promises a complete, in-country experience for HR administration. That means hiring, onboarding and employee management is handled entirely within their platform.

Advantages of Globalization Partners: The platform enables large enterprise organisations to centralise international hiring efforts within their headquarters. Globalization Partners is set up within 187 countries, which may allow hiring to take place significantly faster compared to the competition.

Disadvantages: Globalization Partners carries a higher price tag than most of the providers reviewed on this list. The costs may prove too high for SMBs.

Rippling: Unified payroll, HR, IT and finance management

While Rippling has been around since 2016, it recently launched a global payroll solution. Combined with a native EOR service, international hiring and payroll are easier than ever through this platform.

Best for: Large enterprises, but also viable for SMBs.

What it offers: Rippling powers international scalability for expanding businesses. What makes it unique? It streamlines hiring, onboarding, HR, IT and corporate card management under one roof. Rippling truly is one of the most comprehensive HR solutions available on the market today.

Advantages of Rippling: With Rippling, businesses can hire using the EOR service across different countries. Their solution enables a near-immediate turnaround to compensate employees and contractors across tax jurisdictions in a single pay run.

Rippling also promotes compliance with legal and company policies through cleverly automated workflows.

Disadvantages: While many of its features are arguably best-in-class, Rippling does not offer fully automated payroll, unlike many of its competitors. This may be inconvenient for businesses looking for a more ‘auto-pilot’ solution.

Remote: Affordable international contractor payroll

If you’re planning to hire a global workforce made up predominantly of contractors, then Remote (2019) could be the payroll solution for you.

Best for: SMBs to small enterprises.

What it offers: Remote's platform helps businesses hire and pay workers in over 178 countries. It ensures compliance with tax and employment laws in each location and streamlines global payroll processing into one unified view.

Advantages of Remote: Remote offers some of the most competitive EOR rates (per-employee and per-contractor) from the services mentioned in this review. It pledges fair and transparent pricing with no hidden fees or surprises.

Flexibility is also a priority. Remote does not hold its customers to a minimum employee commitment.

Disadvantages: If you’re looking for quick access to pricing for global payroll services (for employees and contractors), you should note that Remote is quote-based. (Contractor payroll is $29 per month per user.)

Also, in exchange for its competitive rate, some customer service features may be more limited compared to other providers. Some user reviews note that email support is the only channel available at this time.

Oyster: Breaking down borders for a remote workforce

A relatively new SaaS platform (2019), Oyster provides global payroll and hiring services for full-time and contract employees in over 180 countries.

Best for: Startups and SMBs.

What it offers: Oyster can issue paychecks in over 120 currencies. Tax compliance guidance is available for all 180+ countries, including guardrails for local labour laws. EOR services are available.

Advantages of Oyster: The platform unifies all employee and contractor payroll costs into a single invoice, which simplifies global payroll management. Expense management is also built into the platform.

Oyster has created several useful resources for hiring teams expanding into new countries for the first time. Their international hiring guides and reports provide first-hand insight into cultural norms, salary expectations, benefit requirements and other critical knowledge for fast-growing, globalising businesses.

Disadvantages: If you need to hire, onboard and pay contractors, Oyster may not be the best solution, unless you’re willing to sacrifice features for a lower cost. A pared-down, contractor-only version of the platform is available for a lower monthly rate per user.

Deel: Affordable global payroll platform

Since 2018, Deel has offered global compliance, payroll and HR services for business expansion in 150+ countries.

Best for: Startups and SMBs.

What it offers: Businesses can seamlessly hire employees and contractors alike through the Deel platform or its EOR service. It is one of the more affordable global payroll providers available, which makes it an attractive option for growing businesses.

Advantages of Deel: Automatic payroll and invoicing is a time-saver with Deel. It also lists over seven funds withdrawal methods for contractors and over ten for clients, which helps international workers receive payments via their preferred method.

Deel owns entities in 90 of the 150+ countries where it operates. Many global payroll providers subcontract their in-country products and services. One of their greatest competitive advantages is offering a direct, in-country experience at an affordable rate.

Disadvantages: User reviews on Deel’s customer service are mixed. Some reported excellent experiences with support, while others found it to be their greatest drawback. These reports seemed to vary based on the country where customer service was needed.

Payslip: Streamlined data for seamless global payroll

Payslip (2016) recently expanded its capabilities through investments in enhanced platform functionality.

Best for: SMBs to enterprises.

What it offers: Payslip helps businesses grow and hire quickly in new countries. It provides a consultative approach with its clients during onboarding to enhance how teams plan, implement and report on payroll.

Advantages of Payslip: Standardising global payroll is a complex process, but Payslip tackles this challenge during onboarding to ensure a smooth transition.

Payslip identifies the root cause of global payroll problems as database inputs, which are treated differently in existing internal systems for each country. In order to ensure comprehensive consistency when using the platform, the Payslip team assists clients in categorising and standardising their data, driving uniformity in future platform usage.

Onboarding also includes the creation of advanced automated processes that centralise and distribute payroll to every location using its service.

Payslip features robust reporting for administrators. And employee self-service features are consistent across locations.

Disadvantages: While Payslip lists several customer case studies for review, there are not many online user reviews available, which is surprising given how long they have been in business.

Pricing for Payslip is not available on their website, but they do offer a free platform tour via their website.

Selecting the best payroll and finance tools for your expanding business

Expanding your team and services into other countries can be made easy. By assembling the right technology and services stack, you can expect to reduce administrative overhead, make timely payments, and ensure compliance with local tax and labour laws.

However, many payroll providers fail to mention a crucial aspect when listing their features: managing the costs associated with currency exchange in international payroll.

International payroll involves processing payments for employees located in different countries, often with different currencies. Cross-border payments are subject to unpredictable fluctuations in exchange rates, which can significantly impact your payroll budgets and cash flows. That’s where iBanFirst comes in.

iBanFirst gives businesses real-time access to competitive exchange rates and currency risk management solutions.

As your business grows, keep volatile exchange rate fluctuations from absorbing your hard-earned cash. iBanFirst enables predictable cash flows and payroll budgets by hedging your rates for up to 24 months. Want to learn more? Request to speak with an expert today.